Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

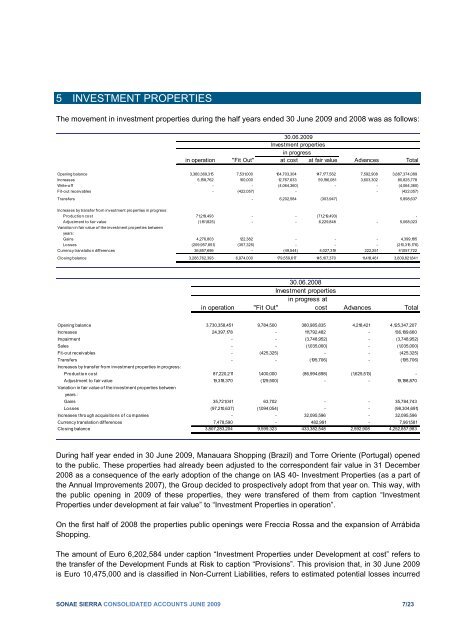

5 INVESTMENT PROPERTIES<br />

The movement in investment properties during the half years ended 30 June <strong>2009</strong> and 2008 was as follows:<br />

30.06.<strong>2009</strong><br />

Investment properties<br />

in progress<br />

in operation "Fit Out" at cost at fair value Advances Total<br />

Opening balance 3,360,369,315 7,531,000 164,703,304 147,177,562 7,592,908 3,687,374,089<br />

Increases 5,158,762 100,000 12,767,633 59,196,081 3,603,302 80,825,778<br />

Write-o ff - - (4,064,360) - - (4,064,360)<br />

Fit-out receivables - (422,057) - - (422,057)<br />

Transfers - 6,202,584 (303,947) 5,898,637<br />

Increases by transfer from investment properties in progress:<br />

Production cost 71,219,493 - - (71,219,493) -<br />

Adjustment to fair value (1,161,825) - - 6,229,848 - 5,068,023<br />

Variation in fair value of the investment properties between<br />

years:<br />

Gains 4,276,803 122,382 - - - 4,399,185<br />

Losses (209,957,851) (357,325) - - - (210,315,176)<br />

Currency translation differences 36,857,696 - (49,544) 4,027,319 222,251 41,057,722<br />

Closing balance 3,266,762,393 6,974,000 179,559,617 145,107,370 11,418,461 3,609,821,841<br />

in operation<br />

30.06.2008<br />

Investment properties<br />

in progress at<br />

"Fit Out"<br />

cost Advances Total<br />

Opening balance 3,730,358,451 9,784,500 380,985,835 4,218,421 4,125,347,207<br />

Increases 24,397,178 - 111,792,482 - 136,189,660<br />

Impairment - - (3,748,952) - (3,748,952)<br />

Sales - - (1,035,000) - (1,035,000)<br />

Fit-out receivables - (425,325) - - (425,325)<br />

Transfers - - (195,706) - (195,706)<br />

Increases by transfer from investment properties in progress:<br />

Production cost 87,220,211 1,400,000 (86,994,698) (1,625,513) -<br />

Adjustment to fair value 19,318,370 (129,500) - - 19,188,870<br />

Variation in fair value of the investment properties between<br />

years :<br />

Gains 35,721,041 63,702 - - 35,784,743<br />

Losses (97,210,637) (1,094,054) - - (98,304,691)<br />

Increases through acquisitions of companies - - 32,095,596 - 32,095,596<br />

Currency translation differences 7,478,590 - 482,991 - 7,961,581<br />

Closing balance 3,807,283,204 9,599,323 433,382,548 2,592,908 4,252,857,983<br />

During half year ended in 30 June <strong>2009</strong>, Manauara Shopping (Brazil) and Torre Oriente (Portugal) opened<br />

to the public. These properties had already been adjusted to the correspondent fair value in 31 December<br />

2008 as a consequence of the early adoption of the change on IAS 40- Investment Properties (as a part of<br />

the Annual Improvements 2007), the Group decided to prospectively adopt from that year on. This way, with<br />

the public opening in <strong>2009</strong> of these properties, they were transfered of them from caption “Investment<br />

Properties under development at fair value” to “Investment Properties in operation”.<br />

On the first half of 2008 the properties public openings were Freccia Rossa and the expansion of Arrábida<br />

Shopping.<br />

The amount of Euro 6,202,584 under caption “Investment Properties under Development at cost” refers to<br />

the transfer of the Development Funds at Risk to caption “Provisions”. This provision that, in 30 June <strong>2009</strong><br />

is Euro 10,475,000 and is classified in Non-Current Liabilities, refers to estimated potential losses incurred<br />

SONAE SIERRA CONSOLIDATED ACCOUNTS JUNE <strong>2009</strong> 7/23