Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The Company’s Results were affected by what happened at the level of Indirect Results. In this area, the<br />

Company’s Equity Holders booked a loss of €113.9 million at the end of the first semester of <strong>2009</strong>, whereas they<br />

had booked a loss of €7.7 million in the same period of 2008.<br />

The market value of the investment properties continues to be affected by the negative climate in the properties’<br />

markets of most of the developed countries where the Company operates. This context led to an upwards shift of<br />

the capitalization yields applied in the valuations carried out on assets in those countries, this increase implying a<br />

reduction in the value of the corresponding property.<br />

Balance Sheet<br />

The <strong>Consolidated</strong> Balance Sheet continues to show a solid financial position. The total assets amounted to<br />

€4,129 million at the end of June <strong>2009</strong>; the decrease in Investment Properties is fully explained by the devaluation<br />

of the investment properties in Europe. As for the Brazilian portfolio, it benefited from the opening of Manauara<br />

and a favourable FX effect between December 2008 and June <strong>2009</strong>.<br />

The Bank Debt amount remains at a similar level to 2008 year end. The Asset Gearing (measured as net<br />

indebtedness less cash and equivalents, as a percentage of total assets excluding cash and equivalents)<br />

increased from 45.4% to 47.5%, a level still below the target of 50%.<br />

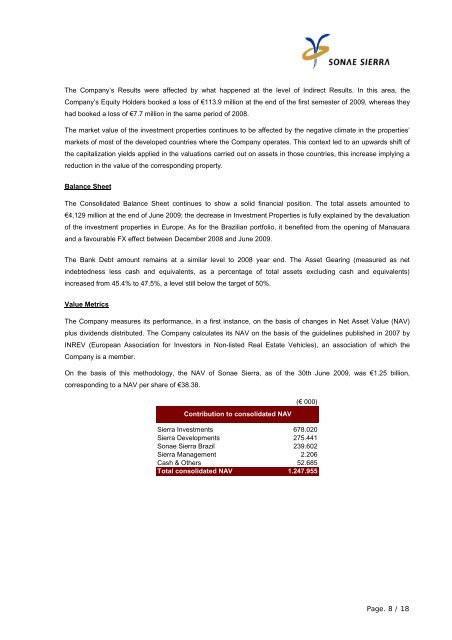

Value Metrics<br />

The Company measures its performance, in a first instance, on the basis of changes in Net Asset Value (NAV)<br />

plus dividends distributed. The Company calculates its NAV on the basis of the guidelines published in 2007 by<br />

INREV (European Association for Investors in Non-listed Real Estate Vehicles), an association of which the<br />

Company is a member.<br />

On the basis of this methodology, the NAV of <strong>Sonae</strong> <strong>Sierra</strong>, as of the 30th June <strong>2009</strong>, was €1.25 billion,<br />

corresponding to a NAV per share of €38.38.<br />

Contribution to consolidated NAV<br />

(€ 000)<br />

<strong>Sierra</strong> Investments 678.020<br />

<strong>Sierra</strong> Developments 275.441<br />

<strong>Sonae</strong> <strong>Sierra</strong> Brazil 239.602<br />

<strong>Sierra</strong> Management 2.206<br />

Cash & Others 52.685<br />

Total consolidated NAV 1.247.955<br />

Page. 8 / 18