Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

Consolidated Financial Statements 1st Semester 2009 - Sonae Sierra

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PROSPECTS<br />

The current situation of the economies and of markets is having a clear impact on the Group’s activity.<br />

At operating level, the shopping centres held by the Group continue to deliver a positive and sustained<br />

performance, certainly better than one would expect in the depressive context that Economies show today. And,<br />

on the other hand, the first signs of recovery at macro-economic level should help to maintain and consolidate<br />

today’s levels of performance.<br />

But the financing and investment markets are equally important for the Group. Today’s depressed situation of the<br />

financing markets makes more difficult the decision to commit to the development of new shopping centres. In this<br />

area, the Group will maintain its prudent approach of only making new commitments once the respective sources<br />

of finance are assured.<br />

The property investment markets, on the other hand, continue with low levels of liquidity and with prices at<br />

historically low levels. This has an immediate impact on the valuation of the shopping centres held by the Group,<br />

and a corresponding effect in its Indirect Result. The evolution of these markets is obviously important for the<br />

active management of the properties under management by the Group and also for the process of capital<br />

recycling that sustains the Group’s growth. On this front, the Group believes that there could be positive<br />

developments in the near future, namely in terms of growth in liquidity and volume of transactions.<br />

BUSINESS ACTIVITIES<br />

SIERRA INVESTMENTS<br />

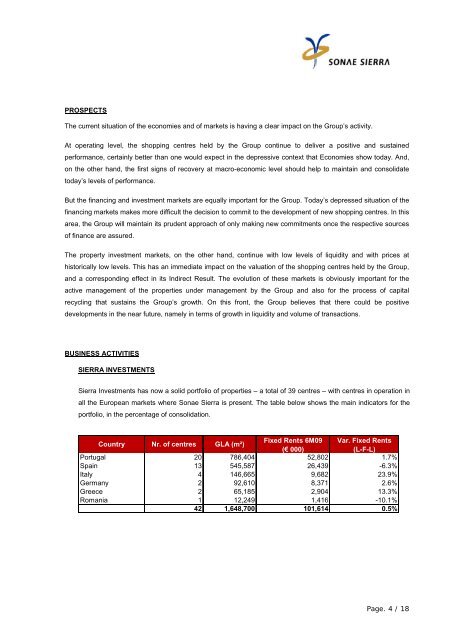

<strong>Sierra</strong> Investments has now a solid portfolio of properties – a total of 39 centres – with centres in operation in<br />

all the European markets where <strong>Sonae</strong> <strong>Sierra</strong> is present. The table below shows the main indicators for the<br />

portfolio, in the percentage of consolidation.<br />

Country Nr. of centres GLA (m²)<br />

Fixed Rents 6M09 Var. Fixed Rents<br />

(€ 000)<br />

(L-F-L)<br />

Portugal 20 786,404 52,802 1.7%<br />

Spain 13 545,587 26,439 -6.3%<br />

Italy 4 146,665 9,682 23.9%<br />

Germany 2 92,610 8,371 2.6%<br />

Greece 2 65,185 2,904 13.3%<br />

Romania 1 12,249 1,416 -10.1%<br />

42 1,648,700 101,614 0.5%<br />

Page. 4 / 18