U.S. Income Tax Compliance

U.S. Income Tax Compliance

U.S. Income Tax Compliance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

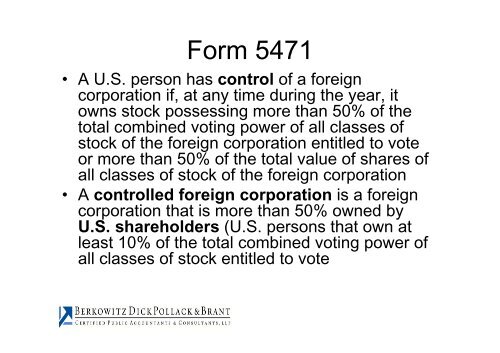

Form 5471<br />

• A U.S. person has control of a foreign<br />

corporation if, at any time during the year, it<br />

owns stock possessing more than 50% of the<br />

total combined voting power of all classes of<br />

stock of the foreign corporation entitled to vote<br />

or more than 50% of the total value of shares of<br />

all classes of stock of the foreign corporation<br />

• A controlled foreign corporation is a foreign<br />

corporation that is more than 50% owned by<br />

U.S. shareholders (U.S. persons that own at<br />

least 10% of the total combined voting power of<br />

all classes of stock entitled to vote