U.S. Income Tax Compliance

U.S. Income Tax Compliance

U.S. Income Tax Compliance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

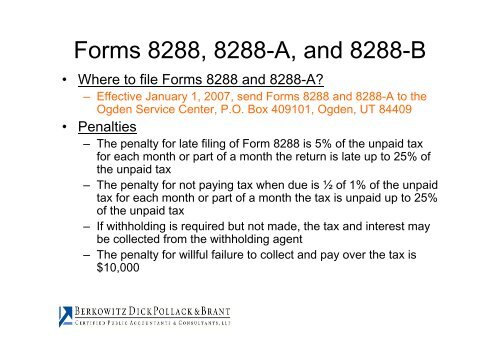

Forms 8288, 8288-A, and 8288-B<br />

• Where to file Forms 8288 and 8288-A?<br />

– Effective January 1, 2007, send Forms 8288 and 8288-A to the<br />

Ogden Service Center, P.O. Box 409101, Ogden, UT 84409<br />

• Penalties<br />

– The penalty for late filing of Form 8288 is 5% of the unpaid tax<br />

for each month or part of a month the return is late up to 25% of<br />

the unpaid tax<br />

– The penalty for not paying tax when due is ½ of 1% of the unpaid<br />

tax for each month or part of a month the tax is unpaid up to 25%<br />

of the unpaid tax<br />

– If withholding is required but not made, the tax and interest may<br />

be collected from the withholding agent<br />

– The penalty for willful failure to collect and pay over the tax is<br />

$10,000