U.S. Income Tax Compliance

U.S. Income Tax Compliance

U.S. Income Tax Compliance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

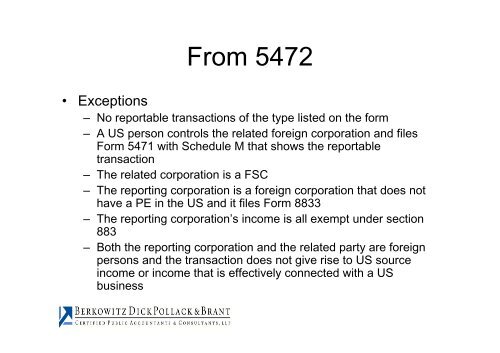

From 5472<br />

• Exceptions<br />

– No reportable transactions of the type listed on the form<br />

– A US person controls the related foreign corporation and files<br />

Form 5471 with Schedule M that shows the reportable<br />

transaction<br />

– The related corporation is a FSC<br />

– The reporting corporation is a foreign corporation that does not<br />

have a PE in the US and it files Form 8833<br />

– The reporting corporation’s income is all exempt under section<br />

883<br />

– Both the reporting corporation and the related party are foreign<br />

persons and the transaction does not give rise to US source<br />

income or income that is effectively connected with a US<br />

business