U.S. Income Tax Compliance

U.S. Income Tax Compliance

U.S. Income Tax Compliance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

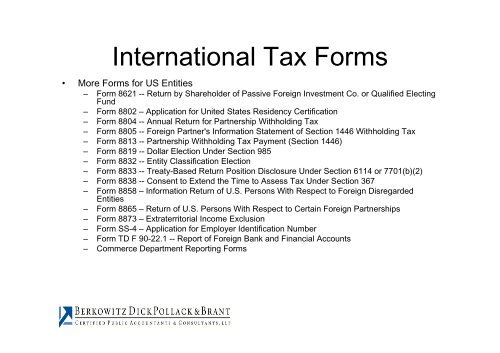

International <strong>Tax</strong> Forms<br />

• More Forms for US Entities<br />

– Form 8621 -- Return by Shareholder of Passive Foreign Investment Co. or Qualified Electing<br />

Fund<br />

– Form 8802 – Application for United States Residency Certification<br />

– Form 8804 -- Annual Return for Partnership Withholding <strong>Tax</strong><br />

– Form 8805 -- Foreign Partner's Information Statement of Section 1446 Withholding <strong>Tax</strong><br />

– Form 8813 -- Partnership Withholding <strong>Tax</strong> Payment (Section 1446)<br />

– Form 8819 -- Dollar Election Under Section 985<br />

– Form 8832 -- Entity Classification Election<br />

– Form 8833 -- Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b)(2)<br />

– Form 8838 -- Consent to Extend the Time to Assess <strong>Tax</strong> Under Section 367<br />

– Form 8858 – Information Return of U.S. Persons With Respect to Foreign Disregarded<br />

Entities<br />

– Form 8865 – Return of U.S. Persons With Respect to Certain Foreign Partnerships<br />

– Form 8873 – Extraterritorial <strong>Income</strong> Exclusion<br />

– Form SS-4 – Application for Employer Identification Number<br />

– Form TD F 90-22.1 -- Report of Foreign Bank and Financial Accounts<br />

– Commerce Department Reporting Forms