U.S. Income Tax Compliance

U.S. Income Tax Compliance

U.S. Income Tax Compliance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

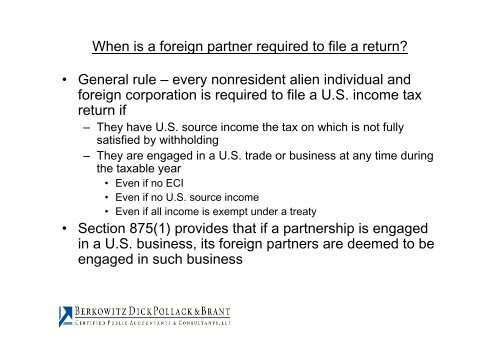

When is a foreign partner required to file a return?<br />

• General rule – every nonresident alien individual and<br />

foreign corporation is required to file a U.S. income tax<br />

return if<br />

– They have U.S. source income the tax on which is not fully<br />

satisfied by withholding<br />

– They are engaged in a U.S. trade or business at any time during<br />

the taxable year<br />

• Even if no ECI<br />

• Even if no U.S. source income<br />

• Even if all income is exempt under a treaty<br />

• Section 875(1) provides that if a partnership is engaged<br />

in a U.S. business, its foreign partners are deemed to be<br />

engaged in such business