U.S. Income Tax Compliance

U.S. Income Tax Compliance

U.S. Income Tax Compliance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

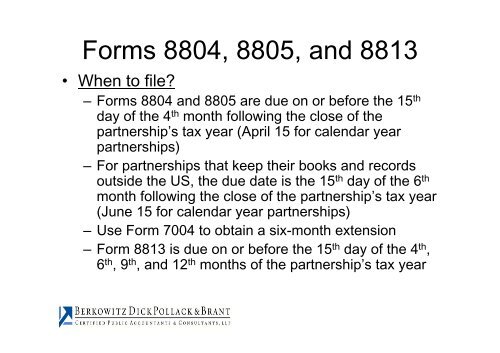

Forms 8804, 8805, and 8813<br />

• When to file?<br />

– Forms 8804 and 8805 are due on or before the 15 th<br />

day of the 4 th month following the close of the<br />

partnership’s tax year (April 15 for calendar year<br />

partnerships)<br />

– For partnerships that keep their books and records<br />

outside the US, the due date is the 15 th day of the 6 th<br />

month following the close of the partnership’s tax year<br />

(June 15 for calendar year partnerships)<br />

– Use Form 7004 to obtain a six-month extension<br />

– Form 8813 is due on or before the 15 th day of the 4 th ,<br />

6 th , 9 th , and 12 th months of the partnership’s tax year