East Belfast Sectoral Study - Northern Ireland Housing Executive

East Belfast Sectoral Study - Northern Ireland Housing Executive

East Belfast Sectoral Study - Northern Ireland Housing Executive

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

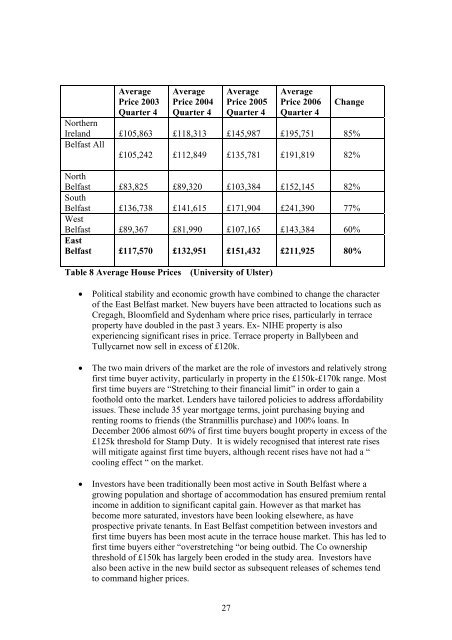

Average<br />

Price 2003<br />

Quarter 4<br />

Average<br />

Price 2004<br />

Quarter 4<br />

Average<br />

Price 2005<br />

Quarter 4<br />

Average<br />

Price 2006<br />

Quarter 4<br />

Change<br />

<strong>Northern</strong><br />

<strong>Ireland</strong> £105,863 £118,313 £145,987 £195,751 85%<br />

<strong>Belfast</strong> All<br />

£105,242 £112,849 £135,781 £191,819 82%<br />

North<br />

<strong>Belfast</strong> £83,825 £89,320 £103,384 £152,145 82%<br />

South<br />

<strong>Belfast</strong> £136,738 £141,615 £171,904 £241,390 77%<br />

West<br />

<strong>Belfast</strong> £89,367 £81,990 £107,165 £143,384 60%<br />

<strong>East</strong><br />

<strong>Belfast</strong> £117,570 £132,951 £151,432 £211,925 80%<br />

Table 8 Average House Prices (University of Ulster)<br />

• Political stability and economic growth have combined to change the character<br />

of the <strong>East</strong> <strong>Belfast</strong> market. New buyers have been attracted to locations such as<br />

Cregagh, Bloomfield and Sydenham where price rises, particularly in terrace<br />

property have doubled in the past 3 years. Ex- NIHE property is also<br />

experiencing significant rises in price. Terrace property in Ballybeen and<br />

Tullycarnet now sell in excess of £120k.<br />

• The two main drivers of the market are the role of investors and relatively strong<br />

first time buyer activity, particularly in property in the £150k-£170k range. Most<br />

first time buyers are “Stretching to their financial limit” in order to gain a<br />

foothold onto the market. Lenders have tailored policies to address affordability<br />

issues. These include 35 year mortgage terms, joint purchasing buying and<br />

renting rooms to friends (the Stranmillis purchase) and 100% loans. In<br />

December 2006 almost 60% of first time buyers bought property in excess of the<br />

£125k threshold for Stamp Duty. It is widely recognised that interest rate rises<br />

will mitigate against first time buyers, although recent rises have not had a “<br />

cooling effect “ on the market.<br />

• Investors have been traditionally been most active in South <strong>Belfast</strong> where a<br />

growing population and shortage of accommodation has ensured premium rental<br />

income in addition to significant capital gain. However as that market has<br />

become more saturated, investors have been looking elsewhere, as have<br />

prospective private tenants. In <strong>East</strong> <strong>Belfast</strong> competition between investors and<br />

first time buyers has been most acute in the terrace house market. This has led to<br />

first time buyers either “overstretching “or being outbid. The Co ownership<br />

threshold of £150k has largely been eroded in the study area. Investors have<br />

also been active in the new build sector as subsequent releases of schemes tend<br />

to command higher prices.<br />

27