The Regents - University of California | Office of The President

The Regents - University of California | Office of The President

The Regents - University of California | Office of The President

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

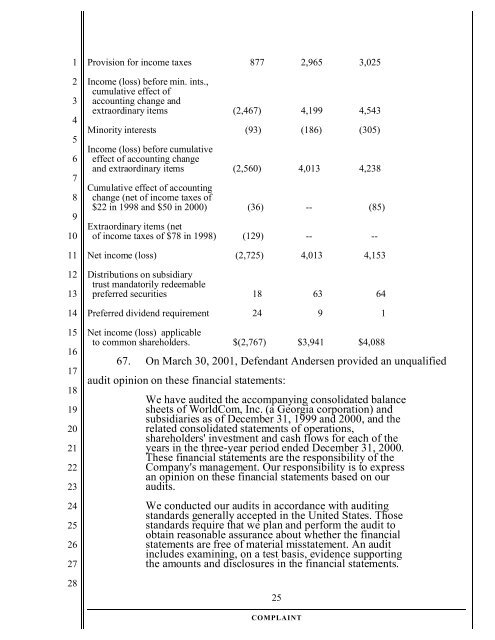

Provision for income taxes 877 2,965 3,025<br />

Income (loss) before min. ints.,<br />

cumulative effect <strong>of</strong><br />

accounting change and<br />

extraordinary items (2,467) 4,199 4,543<br />

Minority interests (93) (186) (305)<br />

Income (loss) before cumulative<br />

effect <strong>of</strong> accounting change<br />

and extraordinary items (2,560) 4,013 4,238<br />

Cumulative effect <strong>of</strong> accounting<br />

change (net <strong>of</strong> income taxes <strong>of</strong><br />

$22 in 1998 and $50 in 2000) (36) -- (85)<br />

Extraordinary items (net<br />

<strong>of</strong> income taxes <strong>of</strong> $78 in 1998) (129) -- --<br />

Net income (loss) (2,725) 4,013 4,153<br />

Distributions on subsidiary<br />

trust mandatorily redeemable<br />

preferred securities 18 63 64<br />

Preferred dividend requirement 24 9 1<br />

Net income (loss) applicable<br />

to common shareholders. $(2,767) $3,941 $4,088<br />

67. On March 30, 2001, Defendant Andersen provided an unqualified<br />

audit opinion on these financial statements:<br />

We have audited the accompanying consolidated balance<br />

sheets <strong>of</strong> WorldCom, Inc. (a Georgia corporation) and<br />

subsidiaries as <strong>of</strong> December 31, 1999 and 2000, and the<br />

related consolidated statements <strong>of</strong> operations,<br />

shareholders' investment and cash flows for each <strong>of</strong> the<br />

years in the three-year period ended December 31, 2000.<br />

<strong>The</strong>se financial statements are the responsibility <strong>of</strong> the<br />

Company's management. Our responsibility is to express<br />

an opinion on these financial statements based on our<br />

audits.<br />

We conducted our audits in accordance with auditing<br />

standards generally accepted in the United States. Those<br />

standards require that we plan and perform the audit to<br />

obtain reasonable assurance about whether the financial<br />

statements are free <strong>of</strong> material misstatement. An audit<br />

includes examining, on a test basis, evidence supporting<br />

the amounts and disclosures in the financial statements.<br />

25<br />

COMPLAINT