The Regents - University of California | Office of The President

The Regents - University of California | Office of The President

The Regents - University of California | Office of The President

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

74. In management's comments, Ebbers stated:<br />

I'm also extremely pleased with the results <strong>of</strong> our<br />

heightened focus on cash flow. <strong>The</strong> $600 million<br />

sequential improvement in internally generated cash flow<br />

this quarter is a result <strong>of</strong> good business fundamentals:<br />

solid growth, more stable pricing, efficient cost control<br />

and effective balance sheet management.<br />

Management's Outlook was:<br />

In spite <strong>of</strong> the uncertain global economic environment, at<br />

this point the Company expects full-year 2001<br />

WorldCom group revenue growth <strong>of</strong> between 12 and 15<br />

percent and expects WorldCom group EBITDA to be<br />

between $7.8 and $8.3 billion. WorldCom group's cash<br />

earnings are expected to be between $1.05 and $1.10 per<br />

share for the year.<br />

75. In addition, the Press Release stated that for the three and six-month<br />

periods ended June 30, 2001 and 2000, WorldCom, for comparative purposes,<br />

excluded some non-recurring items.<br />

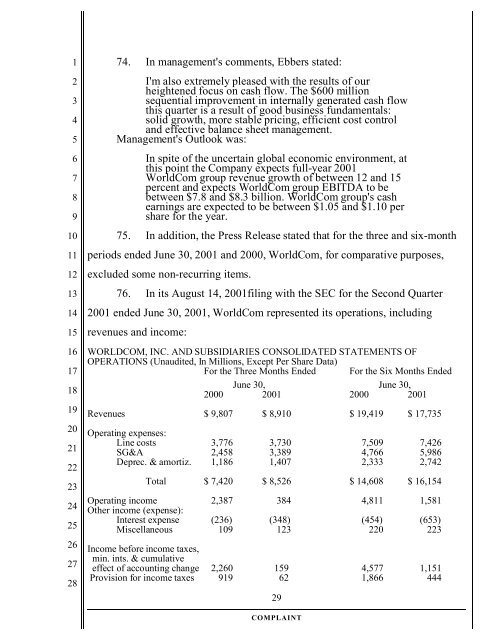

76. In its August 14, 2001filing with the SEC for the Second Quarter<br />

2001 ended June 30, 2001, WorldCom represented its operations, including<br />

revenues and income:<br />

WORLDCOM, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF<br />

OPERATIONS (Unaudited, In Millions, Except Per Share Data)<br />

For the Three Months Ended For the Six Months Ended<br />

June 30, June 30,<br />

2000 2001 2000 2001<br />

Revenues $ 9,807 $ 8,910 $ 19,419 $ 17,735<br />

Operating expenses:<br />

Line costs 3,776 3,730 7,509 7,426<br />

SG&A<br />

Deprec. & amortiz.<br />

2,458<br />

1,186<br />

3,389<br />

1,407<br />

4,766<br />

2,333<br />

5,986<br />

2,742<br />

Total $ 7,420 $ 8,526 $ 14,608 $ 16,154<br />

Operating income 2,387 384 4,811 1,581<br />

Other income (expense):<br />

Interest expense (236) (348) (454) (653)<br />

Miscellaneous 109 123 220 223<br />

Income before income taxes,<br />

min. ints. & cumulative<br />

effect <strong>of</strong> accounting change 2,260<br />

Provision for income taxes 919<br />

159<br />

62<br />

4,577<br />

1,866<br />

1,151<br />

444<br />

29<br />

COMPLAINT