Q6 Full Business Plan - Heathrow Airport

Q6 Full Business Plan - Heathrow Airport

Q6 Full Business Plan - Heathrow Airport

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

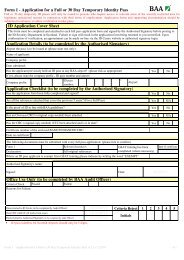

5. Aeronautical charges<br />

Table 5.1 shows the indicative price profile for delivering<br />

the outcomes we describe above. Using the same<br />

methodology as for the Q5 calculation, the value of ‘X’<br />

in <strong>Q6</strong> is 5.9%.<br />

The investments <strong>Heathrow</strong> makes have lives well beyond<br />

<strong>Q6</strong>, and so it is important to look also at the implications<br />

of the <strong>Q6</strong> plans for future quinquennia. We have not<br />

attempted any detailed modelling over this longer term<br />

time horizon, but Table 5.1 gives illustrative projections,<br />

assuming capital expenditure of just over £4.5 billion in<br />

Q7. Although tentative, these projections do illustrate<br />

that real aeronautical charges will fall between <strong>Q6</strong> and<br />

Q7, from an average £24.56/passenger in <strong>Q6</strong> to £23.03/<br />

passenger in Q7. The change in the value of ‘X’ is even<br />

more pronounced from X=5.9% in <strong>Q6</strong> to X=-5.8% in<br />

Q7, due to the ‘over-shooting’ property of the ‘X’<br />

calculation where below/above returns at the beginning<br />

of a quinquennia need to be profiled by above/below<br />

returns at the end of the period.<br />

Alternatively, the price could be adjusted by using an<br />

initial adjustment (known as a P 0<br />

adjustment) to address<br />

the shortfall in passenger numbers in Q5, leaving the<br />

value of ‘X’ to account for <strong>Q6</strong> factors only. Table 5.1 also<br />

shows this alternative price path where an initial<br />

adjustment of 10% is made to prices at the start of <strong>Q6</strong><br />

(roughly the amount needed to adjust for the lower than<br />

anticipated passenger numbers at the start of <strong>Q6</strong>),<br />

followed by a lower level of ‘X’ of 2.6% in subsequent<br />

years. The value of ‘X’ is lower under this profile because<br />

it no longer needs to absorb the impact of the resetting<br />

of the passenger forecast. The price profile for both<br />

these options is shown in Figure 5.2.<br />

<strong>Heathrow</strong> is also considering the potential to realign<br />

regulatory and financial years. This would significantly<br />

enhance transparency between regulatory and statutory<br />

accounts. The implications of this are to reduce the <strong>Q6</strong><br />

value of ‘X’ from 5.9% to 5.4% due to the cash flow<br />

benefit of bringing forward price revisions from April to<br />

January.<br />

In the following sections we describe the major factors<br />

that influence the aeronautical charge level and profile.<br />

Page 40 <strong>Heathrow</strong> <strong>Q6</strong> <strong>Full</strong> <strong>Business</strong> <strong>Plan</strong> - Public version | Chapter 5 © <strong>Heathrow</strong> <strong>Airport</strong> Limited 2013