Q6 Full Business Plan - Heathrow Airport

Q6 Full Business Plan - Heathrow Airport

Q6 Full Business Plan - Heathrow Airport

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5. Aeronautical charges<br />

5.1.1. Capital investment<br />

Capital investment at <strong>Heathrow</strong>, financed by shareholder<br />

equity and issuing of debt, is repaid through the building<br />

block model by depreciation charges to repay the<br />

original capital investment, and a return on the RAB (or<br />

the cost of capital) to compensate for the financing costs<br />

taking account of the risk of investment.<br />

<strong>Heathrow</strong> has invested heavily over recent years to<br />

enhance passenger experience and deliver efficiencies for<br />

the airlines. Individual investments over Q5 have<br />

included:<br />

• Enhancing the passenger experience by replacing T2<br />

with a new terminal;<br />

• Improving baggage performance and airline<br />

efficiencies by delivering a new baggage system for T3;<br />

• Improving pier service by delivering T5C.<br />

For <strong>Q6</strong> this investment will become embedded in the<br />

RAB, and will be reflected in the building block<br />

calculations through the return on RAB and depreciation<br />

charges.<br />

<strong>Heathrow</strong> will continue to invest over <strong>Q6</strong> – our plan is<br />

based on £3 billion of investment 9 which will impact the<br />

return on RAB, depreciation and operational costs in <strong>Q6</strong><br />

and beyond. The broad composition of the capital plan is<br />

shown in Table 5.2.<br />

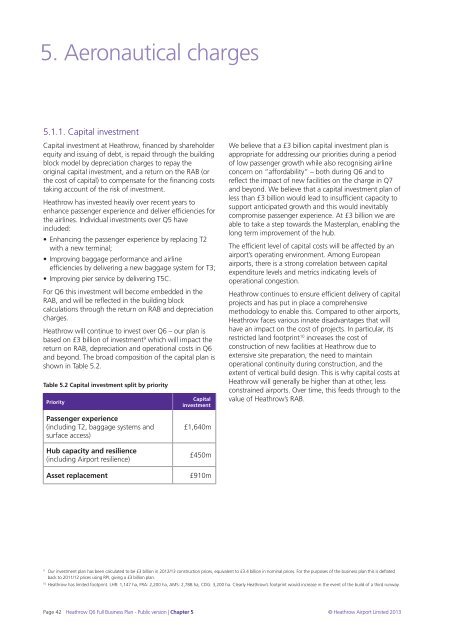

Table 5.2 Capital investment split by priority<br />

Priority<br />

Capital<br />

investment<br />

We believe that a £3 billion capital investment plan is<br />

appropriate for addressing our priorities during a period<br />

of low passenger growth while also recognising airline<br />

concern on “affordability” – both during <strong>Q6</strong> and to<br />

reflect the impact of new facilities on the charge in Q7<br />

and beyond. We believe that a capital investment plan of<br />

less than £3 billion would lead to insufficient capacity to<br />

support anticipated growth and this would inevitably<br />

compromise passenger experience. At £3 billion we are<br />

able to take a step towards the Masterplan, enabling the<br />

long term improvement of the hub.<br />

The efficient level of capital costs will be affected by an<br />

airport’s operating environment. Among European<br />

airports, there is a strong correlation between capital<br />

expenditure levels and metrics indicating levels of<br />

operational congestion.<br />

<strong>Heathrow</strong> continues to ensure efficient delivery of capital<br />

projects and has put in place a comprehensive<br />

methodology to enable this. Compared to other airports,<br />

<strong>Heathrow</strong> faces various innate disadvantages that will<br />

have an impact on the cost of projects. In particular, its<br />

restricted land footprint 10 increases the cost of<br />

construction of new facilities at <strong>Heathrow</strong> due to<br />

extensive site preparation, the need to maintain<br />

operational continuity during construction, and the<br />

extent of vertical build design. This is why capital costs at<br />

<strong>Heathrow</strong> will generally be higher than at other, less<br />

constrained airports. Over time, this feeds through to the<br />

value of <strong>Heathrow</strong>’s RAB.<br />

Passenger experience<br />

(including T2, baggage systems and<br />

surface access)<br />

Hub capacity and resilience<br />

(including <strong>Airport</strong> resilience)<br />

£1,640m<br />

£450m<br />

Asset replacement £910m<br />

9<br />

Our investment plan has been calculated to be £3 billion in 2012/13 construction prices, equivalent to £3.4 billion in nominal prices. For the purposes of the business plan this is deflated<br />

back to 2011/12 prices using RPI, giving a £3 billion plan.<br />

10<br />

<strong>Heathrow</strong> has limited footprint. LHR: 1,147 ha, FRA: 2,200 ha, AMS: 2,788 ha, CDG: 3,200 ha. Clearly <strong>Heathrow</strong>’s footprint would increase in the event of the build of a third runway.<br />

Page 42 <strong>Heathrow</strong> <strong>Q6</strong> <strong>Full</strong> <strong>Business</strong> <strong>Plan</strong> - Public version | Chapter 5 © <strong>Heathrow</strong> <strong>Airport</strong> Limited 2013