Working papers published by IMAD ISSN: 1318-1920 ... - UMAR

Working papers published by IMAD ISSN: 1318-1920 ... - UMAR

Working papers published by IMAD ISSN: 1318-1920 ... - UMAR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

An analysis of past and future GDP growth in Slovenia<br />

Growth in GDP and inputs in the past<br />

<strong>Working</strong> paper 3/2004<br />

<strong>IMAD</strong><br />

27<br />

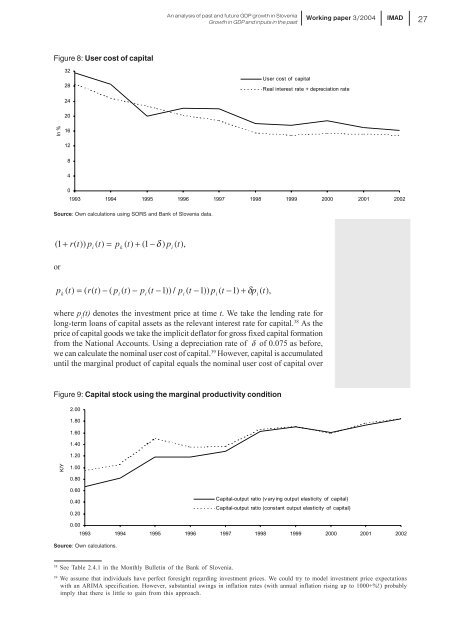

Figure 8: User cost of capital<br />

32<br />

28<br />

User cost of capital<br />

Real interest rate + depreciation rate<br />

24<br />

20<br />

In %<br />

16<br />

12<br />

8<br />

4<br />

0<br />

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002<br />

Source: Own calculations using SORS and Bank of Slovenia data.<br />

( 1+<br />

r(<br />

t))<br />

p ( t)<br />

= p ( t)<br />

+ (1 − δ ) p ( t),<br />

or<br />

i<br />

k<br />

p ( t)<br />

= ( r(<br />

t)<br />

− ( p ( t)<br />

− p ( t −1)) / p ( t −1))<br />

p ( t −1)<br />

+ δp<br />

( t),<br />

k<br />

i<br />

i<br />

i<br />

i<br />

where p i<br />

(t) denotes the investment price at time t. We take the lending rate for<br />

long-term loans of capital assets as the relevant interest rate for capital. 38 As the<br />

price of capital goods we take the implicit deflator for gross fixed capital formation<br />

from the National Accounts. Using a depreciation rate of ä of 0.075 as before,<br />

we can calculate the nominal user cost of capital. 39 However, capital is accumulated<br />

until the marginal product of capital equals the nominal user cost of capital over<br />

i<br />

i<br />

Figure 9: Capital stock using the marginal productivity condition<br />

2.00<br />

1.80<br />

1.60<br />

1.40<br />

1.20<br />

K/Y<br />

1.00<br />

0.80<br />

0.60<br />

0.40<br />

0.20<br />

Capital-output ratio (v ary ing output elasticity of capital)<br />

Capital-output ratio (constant output elasticity of capital)<br />

0.00<br />

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002<br />

Source: Own calculations.<br />

38<br />

See Table 2.4.1 in the Monthly Bulletin of the Bank of Slovenia.<br />

39<br />

We assume that individuals have perfect foresight regarding investment prices. We could try to model investment price expectations<br />

with an ARIMA specification. However, substantial swings in inflation rates (with annual inflation rising up to 1000+%!) probably<br />

imply that there is little to gain from this approach.