THE ECHO - Ferrostaal

THE ECHO - Ferrostaal

THE ECHO - Ferrostaal

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

30 <strong>THE</strong> <strong>ECHO</strong> August 2007<br />

31<br />

ProjECtS<br />

Products and Markets<br />

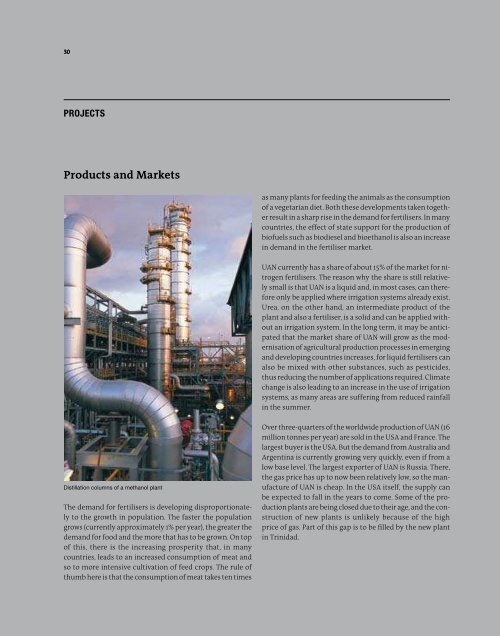

Distillation columns of a methanol plant<br />

The demand for fertilisers is developing disproportionately<br />

to the growth in population. The faster the population<br />

grows (currently approximately 1% per year), the greater the<br />

demand for food and the more that has to be grown. On top<br />

of this, there is the increasing prosperity that, in many<br />

countries, leads to an increased consumption of meat and<br />

so to more intensive cultivation of feed crops. The rule of<br />

thumb here is that the consumption of meat takes ten times<br />

as many plants for feeding the animals as the consumption<br />

of a vegetarian diet. Both these developments taken together<br />

result in a sharp rise in the demand for fertilisers. In many<br />

countries, the effect of state support for the production of<br />

biofuels such as biodiesel and bioethanol is also an increase<br />

in demand in the fertiliser market.<br />

UAN currently has a share of about 15% of the market for nitrogen<br />

fertilisers. The reason why the share is still relatively<br />

small is that UAN is a liquid and, in most cases, can therefore<br />

only be applied where irrigation systems already exist.<br />

Urea, on the other hand, an intermediate product of the<br />

plant and also a fertiliser, is a solid and can be applied without<br />

an irrigation system. In the long term, it may be anticipated<br />

that the market share of UAN will grow as the modernisation<br />

of agricultural production processes in emerging<br />

and developing countries increases, for liquid fertilisers can<br />

also be mixed with other substances, such as pesticides,<br />

thus reducing the number of applications required. Climate<br />

change is also leading to an increase in the use of irrigation<br />

systems, as many areas are suffering from reduced rainfall<br />

in the summer.<br />

Over three-quarters of the worldwide production of UAN (16<br />

million tonnes per year) are sold in the USA and France. The<br />

largest buyer is the USA. But the demand from Australia and<br />

Argentina is currently growing very quickly, even if from a<br />

low base level. The largest exporter of UAN is Russia. There,<br />

the gas price has up to now been relatively low, so the manufacture<br />

of UAN is cheap. In the USA itself, the supply can<br />

be expected to fall in the years to come. Some of the production<br />

plants are being closed due to their age, and the construction<br />

of new plants is unlikely because of the high<br />

price of gas. Part of this gap is to be filled by the new plant<br />

in Trinidad.<br />

ProjECtS<br />

Versatile in use<br />

Melamine resins are resistant to UV light, fire, water, impact<br />

and scratches and are therefore suitable for a wide range of<br />

surface finishes. Melamine resins are important for the<br />

wood and furniture industry. In the production of laminate<br />

flooring, for example, the actual floor surface is melamine<br />

resin. It is also frequently used in the wood industry as an<br />

adhesive. Melamine resins also have high electrical resistance,<br />

so they are used as insulating elements in the electrical<br />

industry. The textile industry also makes use of resins to<br />

make textiles resistant to water and creasing. In the automobile<br />

industry, the resistance of melamine to water, scratches<br />

and impacts is valued, especially in the paints sector.<br />

Melamine is used for surface finishing.<br />

The demand for melamine is currently a little over a million<br />

tonnes per year and is rising, on average, at an annual<br />

rate of about six per cent. Against this background, the demand<br />

is expected to double by the year 2020. The plant in<br />

Trinidad is intended to serve both the US American and the<br />

European markets. For the US market, melamine from<br />

Trinidad is attractive because US production plants have<br />

had to be closed because of the high price of natural gas.<br />

The low manufacturing costs in Trinidad also make the<br />

product interesting for the European market. Neither does<br />

the construction of new melamine plants in China (some<br />

on the basis of a licence from Eurotecnica), the United Arab<br />

Emirates or Qatar make much difference here. While the<br />

gas prices are also low there, export from Asia or the Near<br />

East is less attractive because of the high transport costs.