Annual review and forecast of Utah coal - Utah Geological Survey ...

Annual review and forecast of Utah coal - Utah Geological Survey ...

Annual review and forecast of Utah coal - Utah Geological Survey ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

14<br />

<strong>Utah</strong> <strong>Geological</strong> <strong>Survey</strong><br />

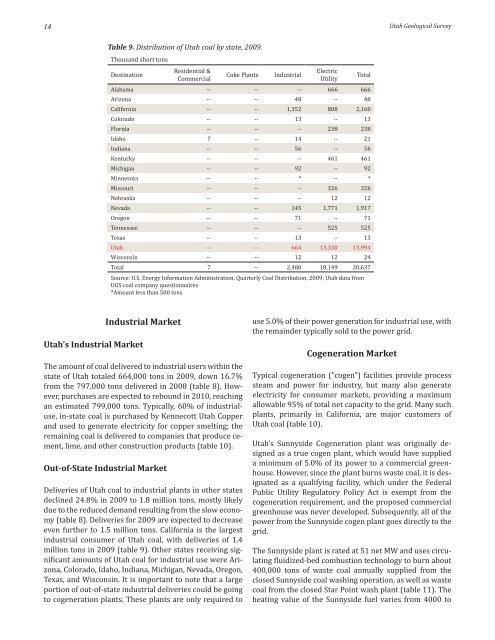

Table 9. Distribution <strong>of</strong> <strong>Utah</strong> <strong>coal</strong> by state, 2009.<br />

Thous<strong>and</strong> short tons<br />

Destination<br />

Residential &<br />

Commercial<br />

Coke Plants<br />

Industrial<br />

Electric<br />

Utility<br />

Total<br />

Alabama -- -- -- 666 666<br />

Arizona -- -- 48 -- 48<br />

California -- -- 1,352 808 2,160<br />

Colorado -- -- 13 -- 13<br />

Florida -- -- -- 238 238<br />

Idaho 7 -- 14 -- 21<br />

Indiana -- -- 56 -- 56<br />

Kentucky -- -- -- 461 461<br />

Michigan -- -- 92 -- 92<br />

Minnesota -- -- * -- *<br />

Missouri -- -- -- 326 326<br />

Nebraska -- -- -- 12 12<br />

Nevada -- -- 145 1,771 1,917<br />

Oregon -- -- 71 -- 71<br />

Tennessee -- -- -- 525 525<br />

Texas -- -- 13 -- 13<br />

<strong>Utah</strong> -- -- 664 13,330 13,994<br />

Wisconsin -- -- 12 12 24<br />

Total 7 -- 2,480 18,149 20,637<br />

Source: U.S. Energy Information Administration, Quarterly Coal Distribution, 2009; <strong>Utah</strong> data from<br />

UGS <strong>coal</strong> company questionnaires<br />

*Amount less than 500 tons<br />

Industrial Market<br />

<strong>Utah</strong>’s Industrial Market<br />

The amount <strong>of</strong> <strong>coal</strong> delivered to industrial users within the<br />

state <strong>of</strong> <strong>Utah</strong> totaled 664,000 tons in 2009, down 16.7%<br />

from the 797,000 tons delivered in 2008 (table 8). However,<br />

purchases are expected to rebound in 2010, reaching<br />

an estimated 799,000 tons. Typically, 60% <strong>of</strong> industrialuse,<br />

in-state <strong>coal</strong> is purchased by Kennecott <strong>Utah</strong> Copper<br />

<strong>and</strong> used to generate electricity for copper smelting; the<br />

remaining <strong>coal</strong> is delivered to companies that produce cement,<br />

lime, <strong>and</strong> other construction products (table 10).<br />

Out-<strong>of</strong>-State Industrial Market<br />

Deliveries <strong>of</strong> <strong>Utah</strong> <strong>coal</strong> to industrial plants in other states<br />

declined 24.8% in 2009 to 1.8 million tons, mostly likely<br />

due to the reduced dem<strong>and</strong> resulting from the slow economy<br />

(table 8). Deliveries for 2009 are expected to decrease<br />

even further to 1.5 million tons. California is the largest<br />

industrial consumer <strong>of</strong> <strong>Utah</strong> <strong>coal</strong>, with deliveries <strong>of</strong> 1.4<br />

million tons in 2009 (table 9). Other states receiving significant<br />

amounts <strong>of</strong> <strong>Utah</strong> <strong>coal</strong> for industrial use were Arizona,<br />

Colorado, Idaho, Indiana, Michigan, Nevada, Oregon,<br />

Texas, <strong>and</strong> Wisconsin. It is important to note that a large<br />

portion <strong>of</strong> out-<strong>of</strong>-state industrial deliveries could be going<br />

to cogeneration plants. These plants are only required to<br />

use 5.0% <strong>of</strong> their power generation for industrial use, with<br />

the remainder typically sold to the power grid.<br />

Cogeneration Market<br />

Typical cogeneration (“cogen”) facilities provide process<br />

steam <strong>and</strong> power for industry, but many also generate<br />

electricity for consumer markets, providing a maximum<br />

allowable 95% <strong>of</strong> total net capacity to the grid. Many such<br />

plants, primarily in California, are major customers <strong>of</strong><br />

<strong>Utah</strong> <strong>coal</strong> (table 10).<br />

<strong>Utah</strong>’s Sunnyside Cogeneration plant was originally designed<br />

as a true cogen plant, which would have supplied<br />

a minimum <strong>of</strong> 5.0% <strong>of</strong> its power to a commercial greenhouse.<br />

However, since the plant burns waste <strong>coal</strong>, it is designated<br />

as a qualifying facility, which under the Federal<br />

Public Utility Regulatory Policy Act is exempt from the<br />

cogeneration requirement, <strong>and</strong> the proposed commercial<br />

greenhouse was never developed. Subsequently, all <strong>of</strong> the<br />

power from the Sunnyside cogen plant goes directly to the<br />

grid.<br />

The Sunnyside plant is rated at 51 net MW <strong>and</strong> uses circulating<br />

fluidized-bed combustion technology to burn about<br />

400,000 tons <strong>of</strong> waste <strong>coal</strong> annually supplied from the<br />

closed Sunnyside <strong>coal</strong> washing operation, as well as waste<br />

<strong>coal</strong> from the closed Star Point wash plant (table 11). The<br />

heating value <strong>of</strong> the Sunnyside fuel varies from 4000 to