Annual report 2012-2013 - Aditya Birla Nuvo, Ltd

Annual report 2012-2013 - Aditya Birla Nuvo, Ltd

Annual report 2012-2013 - Aditya Birla Nuvo, Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Aditya</strong> <strong>Birla</strong> <strong>Nuvo</strong> Limited<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

Consolidated Revenue of ABNL grew year-onyear<br />

by 17% to ` 25,490 Crore supported by the<br />

top-line growth across the businesses. This is<br />

despite the fact that Life Insurance witnessed<br />

challenging sector environment.<br />

During the year, private sector’s total new<br />

business premium de-grew y-o-y by 4%.<br />

Growth was impacted by uncertain equity<br />

markets and high interest rates coupled with<br />

regulatory changes. <strong>Birla</strong> Sun Life Insurance<br />

(BSLI) <strong>report</strong>ed a lower de-growth at 2% and<br />

maintained its 5 th rank among private sector<br />

players. Its market share improved from 7.8%<br />

to 8%. BSLI’s revenue de-grew year-on-year<br />

by 11% to ` 5,037 Crore.<br />

Revenue of other financial services surged<br />

by 79% to ` 1,258 Crore led by the NBFC<br />

business. The revenue of NBFC business<br />

more than doubled to ` 713 Crore in line<br />

with growth in its lending book.<br />

Combined revenue of Fashion & Lifestyle<br />

business rose by 50% to ` 4,930 Crore.<br />

Madura Fashion & Lifestyle continued to<br />

outperform the industry. Driven by stores<br />

expansion and like-to-like stores sales growth,<br />

its revenue grew by 15% to reach<br />

` 2,500 Crore. Pantaloons Fashion & Retail<br />

<strong>Ltd</strong>. <strong>report</strong>ed revenue of ` 1,285 Crore.<br />

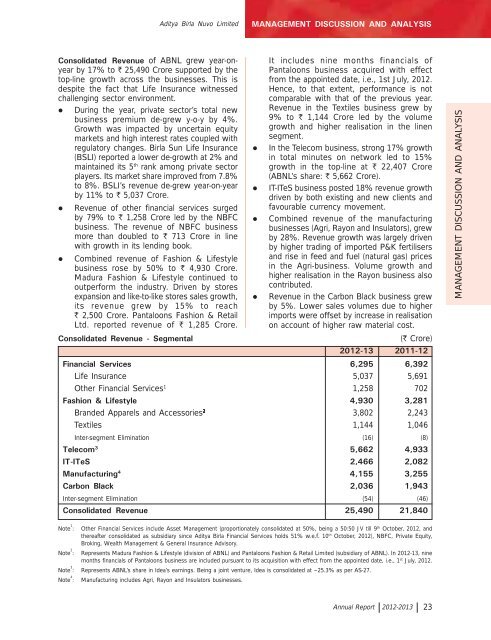

Consolidated Revenue - Segmental<br />

<br />

<br />

<br />

<br />

It includes nine months financials of<br />

Pantaloons business acquired with effect<br />

from the appointed date, i.e., 1st July, <strong>2012</strong>.<br />

Hence, to that extent, performance is not<br />

comparable with that of the previous year.<br />

Revenue in the Textiles business grew by<br />

9% to ` 1,144 Crore led by the volume<br />

growth and higher realisation in the linen<br />

segment.<br />

In the Telecom business, strong 17% growth<br />

in total minutes on network led to 15%<br />

growth in the top-line at ` 22,407 Crore<br />

(ABNL’s share: ` 5,662 Crore).<br />

IT-ITeS business posted 18% revenue growth<br />

driven by both existing and new clients and<br />

favourable currency movement.<br />

Combined revenue of the manufacturing<br />

businesses (Agri, Rayon and Insulators), grew<br />

by 28%. Revenue growth was largely driven<br />

by higher trading of imported P&K fertilisers<br />

and rise in feed and fuel (natural gas) prices<br />

in the Agri-business. Volume growth and<br />

higher realisation in the Rayon business also<br />

contributed.<br />

Revenue in the Carbon Black business grew<br />

by 5%. Lower sales volumes due to higher<br />

imports were offset by increase in realisation<br />

on account of higher raw material cost.<br />

(` Crore)<br />

<strong>2012</strong>-13 2011-12<br />

Financial Services 6,295 6,392<br />

Life Insurance 5,037 5,691<br />

Other Financial Services 1 1,258 702<br />

Fashion & Lifestyle 4,930 3,281<br />

Branded Apparels and Accessories 2 3,802 2,243<br />

Textiles 1,144 1,046<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

Inter-segment Elimination (16) (8)<br />

Telecom 3 5,662 4,933<br />

IT-ITeS 2,466 2,082<br />

Manufacturing 4 4,155 3,255<br />

Carbon Black 2,036 1,943<br />

Inter-segment Elimination (54) (46)<br />

Consolidated Revenue 25,490 21,840<br />

Note 1 :<br />

Note 2 :<br />

Note 3 :<br />

Note 4 :<br />

Other Financial Services include Asset Management (proportionately consolidated at 50%, being a 50:50 JV till 9 th October, <strong>2012</strong>, and<br />

thereafter consolidated as subsidiary since <strong>Aditya</strong> <strong>Birla</strong> Financial Services holds 51% w.e.f. 10 th October, <strong>2012</strong>), NBFC, Private Equity,<br />

Broking, Wealth Management & General Insurance Advisory.<br />

Represents Madura Fashion & Lifestyle (division of ABNL) and Pantaloons Fashion & Retail Limited (subsidiary of ABNL). In <strong>2012</strong>-13, nine<br />

months financials of Pantaloons business are included pursuant to its acquisition with effect from the appointed date, i.e., 1 st July, <strong>2012</strong>.<br />

Represents ABNL’s share in Idea’s earnings. Being a joint venture, Idea is consolidated at ~25.3% as per AS-27.<br />

Manufacturing includes Agri, Rayon and Insulators businesses.<br />

<strong>Annual</strong> Report <strong>2012</strong>-<strong>2013</strong> 23