Annual report 2012-2013 - Aditya Birla Nuvo, Ltd

Annual report 2012-2013 - Aditya Birla Nuvo, Ltd

Annual report 2012-2013 - Aditya Birla Nuvo, Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Aditya</strong> <strong>Birla</strong> <strong>Nuvo</strong> Limited<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

Earnings in the Carbon Black and Insulators<br />

businesses were constrained due to cheaper<br />

imports.<br />

Finance costs related to NBFC business increased<br />

in line with the growth in its lending book. Other<br />

finance costs increased mainly due to higher<br />

working capital employed in the Agri business on<br />

account of increase in subsidy receivable from<br />

the Government coupled with consolidation of<br />

financials of Pantaloons Business acquired with<br />

effect from 1st July, <strong>2012</strong>.<br />

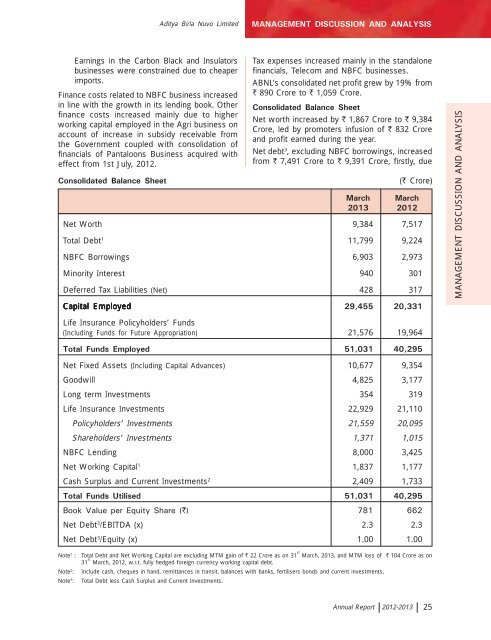

Consolidated Balance Sheet<br />

Tax expenses increased mainly in the standalone<br />

financials, Telecom and NBFC businesses.<br />

ABNL’s consolidated net profit grew by 19% from<br />

` 890 Crore to ` 1,059 Crore.<br />

Consolidated Balance Sheet<br />

Net worth increased by ` 1,867 Crore to ` 9,384<br />

Crore, led by promoters infusion of ` 832 Crore<br />

and profit earned during the year.<br />

Net debt 3 , excluding NBFC borrowings, increased<br />

from ` 7,491 Crore to ` 9,391 Crore, firstly, due<br />

(` Crore)<br />

March March<br />

<strong>2013</strong> <strong>2012</strong><br />

Net Worth 9,384 7,517<br />

Total Debt 1 11,799 9,224<br />

NBFC Borrowings 6,903 2,973<br />

Minority Interest 940 301<br />

Deferred Tax Liabilities (Net) 428 317<br />

Capital Employed 29,455 20,331<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

Life Insurance Policyholders’ Funds<br />

(Including Funds for Future Appropriation) 21,576 19,964<br />

Total Funds Employed 51,031 40,295<br />

Net Fixed Assets (Including Capital Advances) 10,677 9,354<br />

Goodwill 4,825 3,177<br />

Long term Investments 354 319<br />

Life Insurance Investments 22,929 21,110<br />

Policyholders’ Investments 21,559 20,095<br />

Shareholders’ Investments 1,371 1,015<br />

NBFC Lending 8,000 3,425<br />

Net Working Capital 1 1,837 1,177<br />

Cash Surplus and Current Investments 2 2,409 1,733<br />

Total Funds Utilised 51,031 40,295<br />

Book Value per Equity Share (`) 781 662<br />

Net Debt 3 /EBITDA (x) 2.3 2.3<br />

Net Debt 3 /Equity (x) 1.00 1.00<br />

Note 1 :<br />

Note 2 :<br />

Note 3 :<br />

Total Debt and Net Working Capital are excluding MTM gain of ` 22 Crore as on 31 st March, <strong>2013</strong>, and MTM loss of ` 104 Crore as on<br />

31 st March, <strong>2012</strong>, w.r.t. fully hedged foreign currency working capital debt.<br />

Include cash, cheques in hand, remittances in transit, balances with banks, fertilisers bonds and current investments.<br />

Total Debt less Cash Surplus and Current Investments.<br />

<strong>Annual</strong> Report <strong>2012</strong>-<strong>2013</strong> 25