FRONTLINE COVER FA 070606 CR2.indd

FRONTLINE COVER FA 070606 CR2.indd

FRONTLINE COVER FA 070606 CR2.indd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

frontline technologies corporation ltd<br />

annual report 2006 67<br />

> notes to the financial statement<br />

for the year ended 31 march 2006<br />

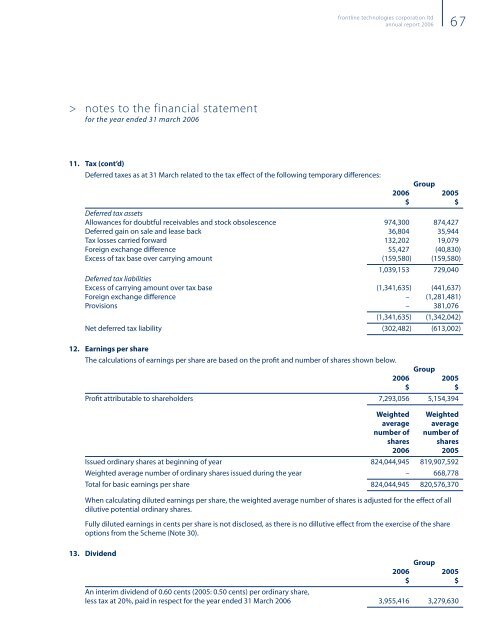

11. Tax (cont’d)<br />

Deferred taxes as at 31 March related to the tax effect of the following temporary differences:<br />

Group<br />

2006 2005<br />

$ $<br />

Deferred tax assets<br />

Allowances for doubtful receivables and stock obsolescence 974,300 874,427<br />

Deferred gain on sale and lease back 36,804 35,944<br />

Tax losses carried forward 132,202 19,079<br />

Foreign exchange difference 55,427 (40,830)<br />

Excess of tax base over carrying amount (159,580) (159,580)<br />

1,039,153 729,040<br />

Deferred tax liabilities<br />

Excess of carrying amount over tax base (1,341,635) (441,637)<br />

Foreign exchange difference – (1,281,481)<br />

Provisions – 381,076<br />

(1,341,635) (1,342,042)<br />

Net deferred tax liability (302,482) (613,002)<br />

12. Earnings per share<br />

The calculations of earnings per share are based on the profit and number of shares shown below.<br />

Group<br />

2006 2005<br />

$ $<br />

Profit attributable to shareholders 7,293,056 5,154,394<br />

Weighted Weighted<br />

average average<br />

number of number of<br />

shares shares<br />

2006 2005<br />

Issued ordinary shares at beginning of year 824,044,945 819,907,592<br />

Weighted average number of ordinary shares issued during the year – 668,778<br />

Total for basic earnings per share 824,044,945 820,576,370<br />

When calculating diluted earnings per share, the weighted average number of shares is adjusted for the effect of all<br />

dilutive potential ordinary shares.<br />

Fully diluted earnings in cents per share is not disclosed, as there is no dillutive effect from the exercise of the share<br />

options from the Scheme (Note 30).<br />

13. Dividend<br />

Group<br />

2006 2005<br />

$ $<br />

An interim dividend of 0.60 cents (2005: 0.50 cents) per ordinary share,<br />

less tax at 20%, paid in respect for the year ended 31 March 2006 3,955,416 3,279,630