CT-1040 Instructions, 2011 Connecticut Resident Income Tax - CT.gov

CT-1040 Instructions, 2011 Connecticut Resident Income Tax - CT.gov

CT-1040 Instructions, 2011 Connecticut Resident Income Tax - CT.gov

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Add all entries in Column C (including the additional amount<br />

from Supplemental Schedule <strong>CT</strong>-<strong>1040</strong>WH) and enter the total<br />

<strong>Connecticut</strong> income tax withheld on Line 18.<br />

Do not send copies of W-2 and 1099 forms. Keep these for<br />

your records. DRS may request them at a later date.<br />

When filing Form <strong>CT</strong>-8379, Nonobligated Spouse Claim,<br />

attach all W-2 and 1099 forms showing <strong>Connecticut</strong> income<br />

tax withheld.<br />

Line 19: All <strong>2011</strong> Estimated <strong>Tax</strong> Payments<br />

Enter the total of all <strong>Connecticut</strong> estimated tax payments,<br />

advance tax payments, and any overpayments of <strong>Connecticut</strong><br />

income tax applied from a prior year. Be sure to include any<br />

<strong>2011</strong> estimated payments made in 2012. Do not include any<br />

refunds received.<br />

Line 20: Payments Made With Form <strong>CT</strong>-<strong>1040</strong> EXT<br />

If you filed Form <strong>CT</strong>-<strong>1040</strong> EXT, Application for Extension<br />

of Time to File, enter the amount you paid with that form.<br />

Line 20a: <strong>Connecticut</strong> Earned <strong>Income</strong> <strong>Tax</strong> Credit<br />

Complete Schedule <strong>CT</strong>-EITC, <strong>Connecticut</strong> Earned <strong>Income</strong><br />

<strong>Tax</strong> Credit, to calculate your earned income tax credit. Enter<br />

the amount from Schedule <strong>CT</strong>-EITC, Line 16.<br />

You must attach a copy of your schedule or the credit will<br />

be disallowed.<br />

Line 21: Total Payments<br />

Add Lines 18, 19, 20, and 20a and enter the total. This<br />

represents the total of all <strong>Connecticut</strong> tax payments made.<br />

4 Overpayment<br />

Line 22: Overpayment<br />

If Line 21 is greater than Line 17, subtract Line 17 from<br />

Line 21 and enter the result. This is your overpayment. To<br />

properly allocate your overpayment, go to Lines 23, 24,<br />

and 25. If Line 21 is less than Line 17, go to Line 26.<br />

If you were required to make estimated income tax payments,<br />

but you did not pay enough tax through withholding, estimated<br />

tax, or both, by any installment due date, your refund may be<br />

reduced by the interest due on the underpayment of estimated<br />

tax. See Form <strong>CT</strong>-2210, Underpayment of Estimated <strong>Income</strong><br />

<strong>Tax</strong> by Individuals, Trusts, and Estates.<br />

Line 23: Amount of Line 22 You Want Applied to<br />

Your 2012 Estimated <strong>Tax</strong><br />

Enter the amount of your <strong>2011</strong> overpayment you want applied<br />

to your 2012 estimated <strong>Connecticut</strong> income tax. It will be<br />

treated as estimated tax paid on April 15, 2012, if your return<br />

is filed on time or if you filed a timely request for extension<br />

and your return is filed within the extension period. Payments<br />

received after April 15, 2012, will be applied as of the date<br />

of receipt. Your request to apply this amount to your 2012<br />

estimated income tax is irrevocable.<br />

Line 24: Total Contributions to Designated Charities<br />

You may make a contribution on this return only if you are<br />

entitled to a refund. Your contribution is limited to your<br />

refund amount. Complete and attach Schedule 5 on Page 4 of<br />

Form <strong>CT</strong>-<strong>1040</strong>. Enter the total contributions as reported on<br />

Schedule 5, Line 70. Your contribution is irrevocable.<br />

You may also make direct contributions by following the<br />

instructions on Page 6.<br />

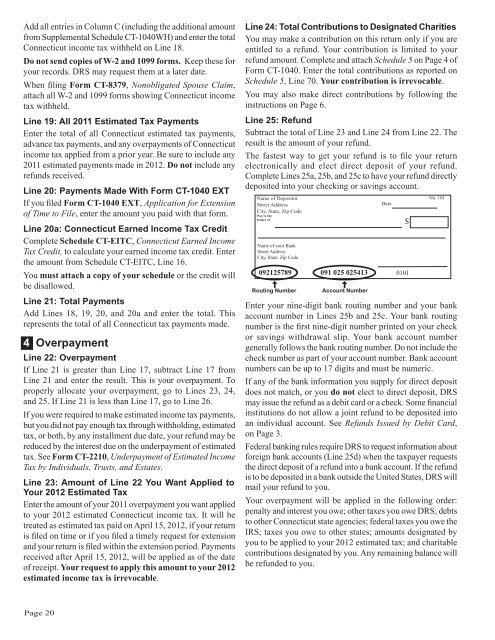

Line 25: Refund<br />

Subtract the total of Line 23 and Line 24 from Line 22. The<br />

result is the amount of your refund.<br />

The fastest way to get your refund is to file your return<br />

electronically and elect direct deposit of your refund.<br />

Complete Lines 25a, 25b, and 25c to have your refund directly<br />

deposited into your checking or savings account.<br />

Name of Depositor<br />

Street Address<br />

City, State, Zip Code<br />

Pay to the<br />

Order of<br />

Name of your Bank<br />

Street Address<br />

City, State, Zip Code<br />

092125789 091 025 025413 0101<br />

<br />

Routing Number<br />

<br />

Account Number<br />

Date<br />

$<br />

No. 101<br />

Enter your nine-digit bank routing number and your bank<br />

account number in Lines 25b and 25c. Your bank routing<br />

number is the first nine-digit number printed on your check<br />

or savings withdrawal slip. Your bank account number<br />

generally follows the bank routing number. Do not include the<br />

check number as part of your account number. Bank account<br />

numbers can be up to 17 digits and must be numeric.<br />

If any of the bank information you supply for direct deposit<br />

does not match, or you do not elect to direct deposit, DRS<br />

may issue the refund as a debit card or a check. Some financial<br />

institutions do not allow a joint refund to be deposited into<br />

an individual account. See Refunds Issued by Debit Card,<br />

on Page 3.<br />

Federal banking rules require DRS to request information about<br />

foreign bank accounts (Line 25d) when the taxpayer requests<br />

the direct deposit of a refund into a bank account. If the refund<br />

is to be deposited in a bank outside the United States, DRS will<br />

mail your refund to you.<br />

Your overpayment will be applied in the following order:<br />

penalty and interest you owe; other taxes you owe DRS; debts<br />

to other <strong>Connecticut</strong> state agencies; federal taxes you owe the<br />

IRS; taxes you owe to other states; amounts designated by<br />

you to be applied to your 2012 estimated tax; and charitable<br />

contributions designated by you. Any remaining balance will<br />

be refunded to you.<br />

Page 20