Annual Report 2012 - Raiffeisen Bank Kosovo JSC

Annual Report 2012 - Raiffeisen Bank Kosovo JSC

Annual Report 2012 - Raiffeisen Bank Kosovo JSC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

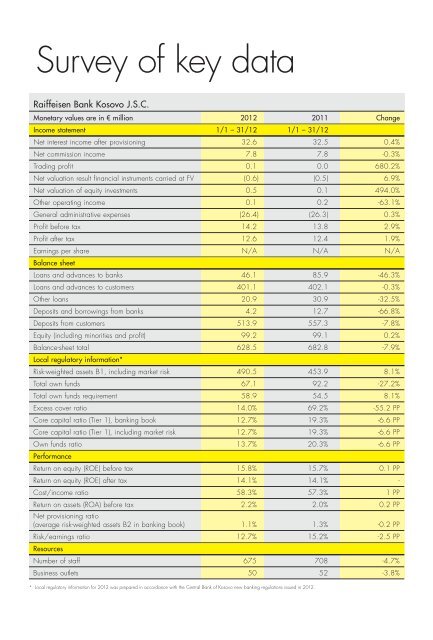

Survey of key data<br />

<strong>Raiffeisen</strong> <strong>Bank</strong> <strong>Kosovo</strong> J.S.C.<br />

Monetary values are in € million <strong>2012</strong> 2011 Change<br />

Income statement 1/1 – 31/12 1/1 – 31/12<br />

Net interest income after provisioning 32.6 32.5 0.4%<br />

Net commission income 7.8 7.8 -0.3%<br />

Trading profit 0.1 0.0 680.2%<br />

Net valuation result financial instruments carried at FV (0.6) (0.5) 6.9%<br />

Net valuation of equity investments 0.5 0.1 494.0%<br />

Other operating income 0.1 0.2 -63.1%<br />

General administrative expenses (26.4) (26.3) 0.3%<br />

Profit before tax 14.2 13.8 2.9%<br />

Profit after tax 12.6 12.4 1.9%<br />

Earnings per share N/A N/A N/A<br />

Balance sheet<br />

Loans and advances to banks 46.1 85.9 -46.3%<br />

Loans and advances to customers 401.1 402.1 -0.3%<br />

Other loans 20.9 30.9 -32.5%<br />

Deposits and borrowings from banks 4.2 12.7 -66.8%<br />

Deposits from customers 513.9 557.3 -7.8%<br />

Equity (including minorities and profit) 99.2 99.1 0.2%<br />

Balance-sheet total 628.5 682.8 -7.9%<br />

Local regulatory information*<br />

Risk-weighted assets B1, including market risk 490.5 453.9 8.1%<br />

Total own funds 67.1 92.2 -27.2%<br />

Total own funds requirement 58.9 54.5 8.1%<br />

Excess cover ratio 14.0% 69.2% -55.2 PP<br />

Core capital ratio (Tier 1), banking book 12.7% 19.3% -6.6 PP<br />

Core capital ratio (Tier 1), including market risk 12.7% 19.3% -6.6 PP<br />

Own funds ratio 13.7% 20.3% -6.6 PP<br />

Performance<br />

Return on equity (ROE) before tax 15.8% 15.7% 0.1 PP<br />

Return on equity (ROE) after tax 14.1% 14.1% -<br />

Cost/income ratio 58.3% 57.3% 1 PP<br />

Return on assets (ROA) before tax 2.2% 2.0% 0.2 PP<br />

Net provisioning ratio<br />

(average risk-weighted assets B2 in banking book) 1.1% 1.3% -0.2 PP<br />

Risk/earnings ratio 12.7% 15.2% -2.5 PP<br />

Resources<br />

Number of staff 675 708 -4.7%<br />

Business outlets 50 52 -3.8%<br />

* Local regulatory information for <strong>2012</strong> was prepared in accordance with the Central <strong>Bank</strong> of <strong>Kosovo</strong> new banking regulations issued in <strong>2012</strong>.