Annual Report 2012 - Raiffeisen Bank Kosovo JSC

Annual Report 2012 - Raiffeisen Bank Kosovo JSC

Annual Report 2012 - Raiffeisen Bank Kosovo JSC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A parent need not present consolidated financial statements if the parent is itself a wholly-owned subsidiary and the<br />

ultimate or any intermediate parent of the parent produces consolidated financial statements available for public use that<br />

comply with International Financial <strong>Report</strong>ing Standards. The <strong>Bank</strong> prepares separate financial statements in accordance<br />

with IFRS. Interests in subsidiaries are accounted for at cost in the separate financial statements.<br />

3.2. Foreign Currencies transactions<br />

Foreign exchange transactions are recorded at the rate ruling at the day of the transaction. Monetary assets and<br />

liabilities denominated in foreign currencies are translated at the rate of exchange ruling at the reporting date.<br />

Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation at year-end<br />

exchange rates of monetary assets and liabilities denominated in foreign currencies are recognized in the profit or loss.<br />

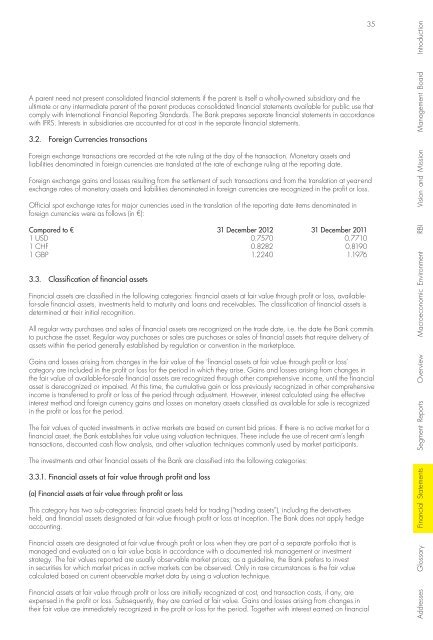

Official spot exchange rates for major currencies used in the translation of the reporting date items denominated in<br />

foreign currencies were as follows (in €):<br />

Compared to € 31 December <strong>2012</strong> 31 December 2011<br />

<br />

1 CHF 0.8282 0.8190<br />

1 GBP 1.2240 1.1976<br />

3.3. Classification of financial assets<br />

Financial assets are classified in the following categories: financial assets at fair value through profit or loss, availablefor-sale<br />

financial assets, investments held to maturity and loans and receivables. The classification of financial assets is<br />

determined at their initial recognition.<br />

All regular way purchases and sales of financial assets are recognized on the trade date, i.e. the date the <strong>Bank</strong> commits<br />

to purchase the asset. Regular way purchases or sales are purchases or sales of financial assets that require delivery of<br />

assets within the period generally established by regulation or convention in the marketplace.<br />

Gains and losses arising from changes in the fair value of the ‘financial assets at fair value through profit or loss’<br />

category are included in the profit or loss for the period in which they arise. Gains and losses arising from changes in<br />

the fair value of available-for-sale financial assets are recognized through other comprehensive income, until the financial<br />

asset is derecognized or impaired. At this time, the cumulative gain or loss previously recognized in other comprehensive<br />

income is transferred to profit or loss of the period through adjustment. However, interest calculated using the effective<br />

interest method and foreign currency gains and losses on monetary assets classified as available for sale is recognized<br />

in the profit or loss for the period.<br />

The fair values of quoted investments in active markets are based on current bid prices. If there is no active market for a<br />

financial asset, the <strong>Bank</strong> establishes fair value using valuation techniques. These include the use of recent arm’s length<br />

transactions, discounted cash flow analysis, and other valuation techniques commonly used by market participants.<br />

The investments and other financial assets of the <strong>Bank</strong> are classified into the following categories:<br />

3.3.1. Financial assets at fair value through profit and loss<br />

(a) Financial assets at fair value through profit or loss<br />

<br />

held, and financial assets designated at fair value through profit or loss at inception. The <strong>Bank</strong> does not apply hedge<br />

accounting.<br />

Financial assets are designated at fair value through profit or loss when they are part of a separate portfolio that is<br />

managed and evaluated on a fair value basis in accordance with a documented risk management or investment<br />

strategy. The fair values reported are usually observable market prices; as a guideline, the <strong>Bank</strong> prefers to invest<br />

in securities for which market prices in active markets can be observed. Only in rare circumstances is the fair value<br />

calculated based on current observable market data by using a valuation technique.<br />

Financial assets at fair value through profit or loss are initially recognized at cost, and transaction costs, if any, are<br />

expensed in the profit or loss. Subsequently, they are carried at fair value. Gains and losses arising from changes in<br />

their fair value are immediately recognized in the profit or loss for the period. Together with interest earned on financial<br />

35<br />

Addresses Glossary Financial Statements Segment <strong>Report</strong>s Overview Macroeconomic Environment RBI Vision and Mission Management Board Introduction