Foundation Annual Report 2008/09 - State Library of New South ...

Foundation Annual Report 2008/09 - State Library of New South ...

Foundation Annual Report 2008/09 - State Library of New South ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

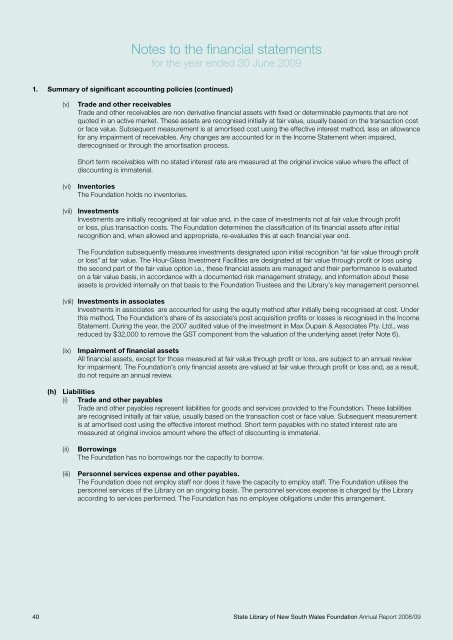

notes to the financial statements<br />

for the year ended 30 June 20<strong>09</strong><br />

1. Summary <strong>of</strong> significant accounting policies (continued)<br />

(v)<br />

Trade and other receivables<br />

trade and other receivables are non derivative financial assets with fixed or determinable payments that are not<br />

quoted in an active market. these assets are recognised initially at fair value, usually based on the transaction cost<br />

or face value. Subsequent measurement is at amortised cost using the effective interest method, less an allowance<br />

for any impairment <strong>of</strong> receivables. any changes are accounted for in the income <strong>State</strong>ment when impaired,<br />

derecognised or through the amortisation process.<br />

Short term receivables with no stated interest rate are measured at the original invoice value where the effect <strong>of</strong><br />

discounting is immaterial.<br />

(vi) Inventories<br />

the <strong>Foundation</strong> holds no inventories.<br />

(vii) Investments<br />

investments are initially recognised at fair value and, in the case <strong>of</strong> investments not at fair value through pr<strong>of</strong>it<br />

or loss, plus transaction costs. the <strong>Foundation</strong> determines the classification <strong>of</strong> its financial assets after initial<br />

recognition and, when allowed and appropriate, re-evaluates this at each financial year end.<br />

the <strong>Foundation</strong> subsequently measures investments designated upon initial recognition “at fair value through pr<strong>of</strong>it<br />

or loss” at fair value. the Hour-Glass investment Facilities are designated at fair value through pr<strong>of</strong>it or loss using<br />

the second part <strong>of</strong> the fair value option i.e., these financial assets are managed and their performance is evaluated<br />

on a fair value basis, in accordance with a documented risk management strategy, and information about these<br />

assets is provided internally on that basis to the <strong>Foundation</strong> trustees and the <strong>Library</strong>’s key management personnel.<br />

(viii) Investments in associates<br />

investments in associates are accounted for using the equity method after initially being recognised at cost. under<br />

this method, the <strong>Foundation</strong>’s share <strong>of</strong> its associate’s post acquisition pr<strong>of</strong>its or losses is recognised in the income<br />

<strong>State</strong>ment. during the year, the 2007 audited value <strong>of</strong> the investment in Max dupain & associates Pty. Ltd., was<br />

reduced by $32,000 to remove the GSt component from the valuation <strong>of</strong> the underlying asset (refer note 6).<br />

(ix) Impairment <strong>of</strong> financial assets<br />

all financial assets, except for those measured at fair value through pr<strong>of</strong>it or loss, are subject to an annual review<br />

for impairment. the <strong>Foundation</strong>’s only financial assets are valued at fair value through pr<strong>of</strong>it or loss and, as a result,<br />

do not require an annual review.<br />

(h) Liabilities<br />

(i) Trade and other payables<br />

trade and other payables represent liabilities for goods and services provided to the <strong>Foundation</strong>. these liabilities<br />

are recognised initially at fair value, usually based on the transaction cost or face value. Subsequent measurement<br />

is at amortised cost using the effective interest method. Short term payables with no stated interest rate are<br />

measured at original invoice amount where the effect <strong>of</strong> discounting is immaterial.<br />

(ii)<br />

(iii)<br />

Borrowings<br />

the <strong>Foundation</strong> has no borrowings nor the capacity to borrow.<br />

Personnel services expense and other payables.<br />

the <strong>Foundation</strong> does not employ staff nor does it have the capacity to employ staff. the <strong>Foundation</strong> utilises the<br />

personnel services <strong>of</strong> the <strong>Library</strong> on an ongoing basis. the personnel services expense is charged by the <strong>Library</strong><br />

according to services performed. the <strong>Foundation</strong> has no employee obligations under this arrangement.<br />

40<br />

<strong>State</strong> <strong>Library</strong> <strong>of</strong> <strong>New</strong> <strong>South</strong> Wales <strong>Foundation</strong> annual <strong>Report</strong> <strong>2008</strong>/<strong>09</strong>