Volume I - Finance - Government of Newfoundland and Labrador

Volume I - Finance - Government of Newfoundland and Labrador

Volume I - Finance - Government of Newfoundland and Labrador

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

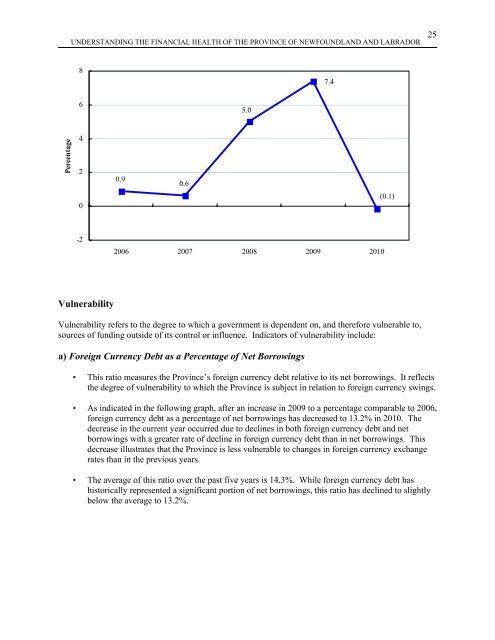

UNDERSTANDING THE FINANCIAL HEALTH OF THE PROVINCE OF NEWFOUNDLAND AND LABRADOR 25<br />

8<br />

7.4<br />

6<br />

5.0<br />

Percentage<br />

4<br />

2<br />

0.9<br />

0.6<br />

0<br />

(0.1)<br />

-2<br />

2006 2007 2008 2009 2010<br />

Vulnerability<br />

Vulnerability refers to the degree to which a government is dependent on, <strong>and</strong> therefore vulnerable to,<br />

sources <strong>of</strong> funding outside <strong>of</strong> its control or influence. Indicators <strong>of</strong> vulnerability include:<br />

a) Foreign Currency Debt as a Percentage <strong>of</strong> Net Borrowings<br />

• This ratio measures the Province’s foreign currency debt relative to its net borrowings. It reflects<br />

the degree <strong>of</strong> vulnerability to which the Province is subject in relation to foreign currency swings.<br />

• As indicated in the following graph, after an increase in 2009 to a percentage comparable to 2006,<br />

foreign currency debt as a percentage <strong>of</strong> net borrowings has decreased to 13.2% in 2010. The<br />

decrease in the current year occurred due to declines in both foreign currency debt <strong>and</strong> net<br />

borrowings with a greater rate <strong>of</strong> decline in foreign currency debt than in net borrowings. This<br />

decrease illustrates that the Province is less vulnerable to changes in foreign currency exchange<br />

rates than in the previous years.<br />

• The average <strong>of</strong> this ratio over the past five years is 14.3%. While foreign currency debt has<br />

historically represented a significant portion <strong>of</strong> net borrowings, this ratio has declined to slightly<br />

below the average to 13.2%.