CERTIFIED - City of Deltona, Florida

CERTIFIED - City of Deltona, Florida

CERTIFIED - City of Deltona, Florida

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Budget Summary - Narrative<br />

<strong>City</strong> <strong>of</strong> <strong>Deltona</strong>, <strong>Florida</strong><br />

PROPERTY TAXES – Continued<br />

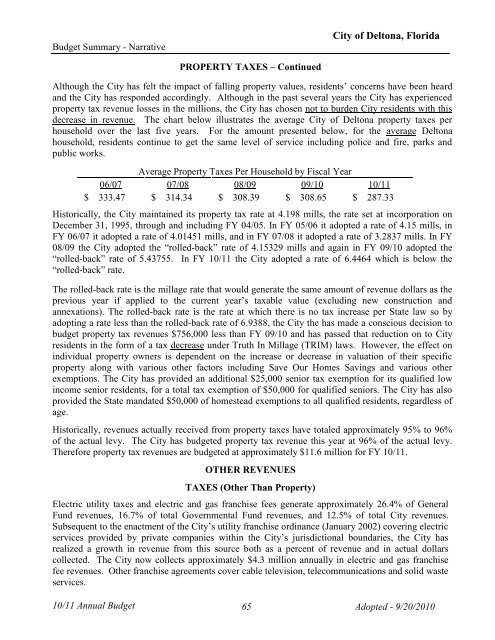

Although the <strong>City</strong> has felt the impact <strong>of</strong> falling property values, residents’ concerns have been heard<br />

and the <strong>City</strong> has responded accordingly. Although in the past several years the <strong>City</strong> has experienced<br />

property tax revenue losses in the millions, the <strong>City</strong> has chosen not to burden <strong>City</strong> residents with this<br />

decrease in revenue. The chart below illustrates the average <strong>City</strong> <strong>of</strong> <strong>Deltona</strong> property taxes per<br />

household over the last five years. For the amount presented below, for the average <strong>Deltona</strong><br />

household, residents continue to get the same level <strong>of</strong> service including police and fire, parks and<br />

public works.<br />

Average Property Taxes Per Household by Fiscal Year<br />

06/07 07/08 08/09 09/10 10/11<br />

$ 333.47 $ 314.34 $ 308.39 $ 308.65 $ 287.33<br />

Historically, the <strong>City</strong> maintained its property tax rate at 4.198 mills, the rate set at incorporation on<br />

December 31, 1995, through and including FY 04/05. In FY 05/06 it adopted a rate <strong>of</strong> 4.15 mills, in<br />

FY 06/07 it adopted a rate <strong>of</strong> 4.01451 mills, and in FY 07/08 it adopted a rate <strong>of</strong> 3.2837 mills. In FY<br />

08/09 the <strong>City</strong> adopted the “rolled-back” rate <strong>of</strong> 4.15329 mills and again in FY 09/10 adopted the<br />

“rolled-back” rate <strong>of</strong> 5.43755. In FY 10/11 the <strong>City</strong> adopted a rate <strong>of</strong> 6.4464 which is below the<br />

“rolled-back” rate.<br />

The rolled-back rate is the millage rate that would generate the same amount <strong>of</strong> revenue dollars as the<br />

previous year if applied to the current year’s taxable value (excluding new construction and<br />

annexations). The rolled-back rate is the rate at which there is no tax increase per State law so by<br />

adopting a rate less than the rolled-back rate <strong>of</strong> 6.9388, the <strong>City</strong> the has made a conscious decision to<br />

budget property tax revenues $756,000 less than FY 09/10 and has passed that reduction on to <strong>City</strong><br />

residents in the form <strong>of</strong> a tax decrease under Truth In Millage (TRIM) laws. However, the effect on<br />

individual property owners is dependent on the increase or decrease in valuation <strong>of</strong> their specific<br />

property along with various other factors including Save Our Homes Savings and various other<br />

exemptions. The <strong>City</strong> has provided an additional $25,000 senior tax exemption for its qualified low<br />

income senior residents, for a total tax exemption <strong>of</strong> $50,000 for qualified seniors. The <strong>City</strong> has also<br />

provided the State mandated $50,000 <strong>of</strong> homestead exemptions to all qualified residents, regardless <strong>of</strong><br />

age.<br />

Historically, revenues actually received from property taxes have totaled approximately 95% to 96%<br />

<strong>of</strong> the actual levy. The <strong>City</strong> has budgeted property tax revenue this year at 96% <strong>of</strong> the actual levy.<br />

Therefore property tax revenues are budgeted at approximately $11.6 million for FY 10/11.<br />

OTHER REVENUES<br />

TAXES (Other Than Property)<br />

Electric utility taxes and electric and gas franchise fees generate approximately 26.4% <strong>of</strong> General<br />

Fund revenues, 16.7% <strong>of</strong> total Governmental Fund revenues, and 12.5% <strong>of</strong> total <strong>City</strong> revenues.<br />

Subsequent to the enactment <strong>of</strong> the <strong>City</strong>’s utility franchise ordinance (January 2002) covering electric<br />

services provided by private companies within the <strong>City</strong>’s jurisdictional boundaries, the <strong>City</strong> has<br />

realized a growth in revenue from this source both as a percent <strong>of</strong> revenue and in actual dollars<br />

collected. The <strong>City</strong> now collects approximately $4.3 million annually in electric and gas franchise<br />

fee revenues. Other franchise agreements cover cable television, telecommunications and solid waste<br />

services.<br />

10/11 Annual Budget<br />

65 Adopted - 9/20/2010