European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

abc<br />

Global Research<br />

<strong>Stock</strong> <strong>picks</strong><br />

<strong>Q4</strong> <strong>2007</strong>-<strong>Q1</strong> <strong>2008</strong><br />

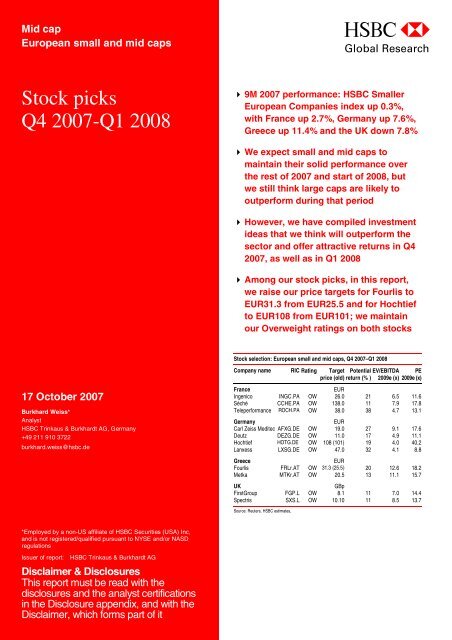

9M <strong>2007</strong> performance: HSBC Smaller<br />

<strong>European</strong> Companies index up 0.3%,<br />

with France up 2.7%, Germany up 7.6%,<br />

Greece up 11.4% <strong>and</strong> the UK down 7.8%<br />

We expect <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong> to<br />

maintain their solid performance over<br />

the rest of <strong>2007</strong> <strong>and</strong> start of <strong>2008</strong>, but<br />

we still think large <strong>caps</strong> are likely to<br />

outperform during that period<br />

However, we have compiled investment<br />

ideas that we think will outperform the<br />

sector <strong>and</strong> offer attractive returns in <strong>Q4</strong><br />

<strong>2007</strong>, as well as in <strong>Q1</strong> <strong>2008</strong><br />

Among our stock <strong>picks</strong>, in this report,<br />

we raise our price targets for <strong>Fourlis</strong> to<br />

EUR31.3 from EUR25.5 <strong>and</strong> for Hochtief<br />

to EUR108 from EUR101; we maintain<br />

our Overweight ratings on both stocks<br />

<strong>Stock</strong> selection: <strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong>, <strong>Q4</strong> <strong>2007</strong>–<strong>Q1</strong> <strong>2008</strong><br />

17 October <strong>2007</strong><br />

Burkhard Weiss*<br />

Analyst<br />

HSBC Trinkaus & Burkhardt AG, Germany<br />

+49 211 910 3722<br />

burkhard.weiss@hsbc.de<br />

Company name RIC Rating Target Potential<br />

price (old) return (% )<br />

EV/EBITDA<br />

2009e (x)<br />

PE<br />

2009e (x)<br />

France<br />

EUR<br />

Ingenico INGC.PA OW 26.0 21 6.5 11.6<br />

Séché CCHE.PA OW 138.0 11 7.9 17.8<br />

Teleperformance ROCH.PA OW 38.0 38 4.7 13.1<br />

Germany<br />

EUR<br />

Carl Zeiss Meditec AFXG.DE OW 19.0 27 9.1 17.6<br />

Deutz DEZG.DE OW 11.0 17 4.9 11.1<br />

Hochtief HOTG.DE OW 108 (101) 19 4.0 40.2<br />

Lanxess LXSG.DE OW 47.0 32 4.1 8.8<br />

Greece<br />

EUR<br />

<strong>Fourlis</strong> FRLr.AT OW 31.3 (25.5) 20 12.6 18.2<br />

Metka MTKr.AT OW 20.5 13 11.1 15.7<br />

UK<br />

GBp<br />

FirstGroup FGP.L OW 8.1 11 7.0 14.4<br />

Spectris SXS.L OW 10.10 11 8.5 13.7<br />

Source: Reuters, HSBC estimates,<br />

*Employed by a non-US affiliate of HSBC Securities (USA) Inc,<br />

<strong>and</strong> is not registered/qualified pursuant to NYSE <strong>and</strong>/or NASD<br />

regulations<br />

Issuer of report: HSBC Trinkaus & Burkhardt AG<br />

Disclaimer & Disclosures<br />

This report must be read with the<br />

disclosures <strong>and</strong> the analyst certifications<br />

in the Disclosure appendix, <strong>and</strong> with the<br />

Disclaimer, which forms part of it

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Contents<br />

<strong>Stock</strong>s can creep higher 3<br />

Regional focus: France 12<br />

Regional focus: Germany 14<br />

Regional focus: Greece 16<br />

Regional focus: UK 18<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong>-cap<br />

stock <strong>picks</strong> for <strong>Q4</strong>/<strong>Q1</strong> 20<br />

Company profiles 23<br />

Carl Zeiss Meditec 24<br />

Deutz 28<br />

FirstGroup 33<br />

<strong>Fourlis</strong> Holdings 37<br />

Hochtief 41<br />

Ingenico 46<br />

Lanxess 51<br />

Metka 55<br />

Séché Environnement 59<br />

Spectris 64<br />

Teleperformance 68<br />

HSBC <strong>European</strong> <strong>small</strong> <strong>and</strong><br />

<strong>mid</strong>-cap coverage universe 73<br />

Notes 78<br />

Disclosure appendix 80<br />

Disclaimer 83<br />

2

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

<strong>Stock</strong>s can creep higher<br />

We expect total returns from stocks to more than offset most<br />

estimates of equity risk over the rest of <strong>2007</strong> <strong>and</strong> into <strong>2008</strong><br />

In our opinion, <strong>European</strong> stocks are pricing in a bigger fall in<br />

profitability than is likely, particularly in the liquidity-strapped <strong>and</strong><br />

ABS-lashed financial arena<br />

Larger <strong>caps</strong> should continue to outperform over the remainder of<br />

<strong>2007</strong>; name of the game: stock picking for <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

Our HSBC Global Equity Strategy views are set out<br />

in more detail in ‘The End of the Beginning’,<br />

published 2 October <strong>2007</strong><br />

The easy stockmarket gains of 2003-06 are long<br />

since behind us. In our view, however, equities<br />

are still conservatively priced, many balance<br />

sheets are under-leveraged <strong>and</strong> ‘riskless’ interest<br />

rates are still low. We have been advocating a<br />

‘long-cycle’ view of the current equity rally – <strong>and</strong><br />

this summer arguably marks not the end of that<br />

cycle, nor the beginning of the end, but perhaps<br />

the end of the beginning...<br />

We think it boils down to whether the surge in<br />

corporate value added a<strong>mid</strong> the golden operating<br />

climate of the last 4-5 years – a surge which, in<br />

our view, has not been priced into stock<br />

valuations – has been driven primarily by cheap<br />

subprime US housing loans. And we doubt it.<br />

So what happened this summer? We did not expect<br />

the ABS story to play out as it did, but as the<br />

liquidity trap sprang <strong>and</strong> it became clear that central<br />

banks were indeed staring into the monetary abyss<br />

so we had to assume that they would do whatever<br />

was necessary to get the system moving again. As<br />

we write, three-month money rates are slowly<br />

returning to earth <strong>and</strong>, believe it or not, the MSCI<br />

All-Countries index is almost exactly where it was<br />

when we posted our Q3 preview, entitled Don’t look<br />

down, on 4 July <strong>2007</strong>.<br />

The risk of recession is, of course, still high. But<br />

there is also a more positive possibility out there,<br />

one we think is being overlooked <strong>and</strong> which we<br />

term the ‘1999 redux’ scenario. The possibility of<br />

such an outcome for us balances the more visible<br />

risk of a ‘nervous recession’ (for more detail, see<br />

Collateral damage, 22 August). We are also<br />

prepared to stick our necks out <strong>and</strong> suggest that the<br />

M&A boom is not yet done: cash-flow yields still<br />

comfortably exceed (slightly) higher credit costs.<br />

The outlook, then, remains one of ‘muddling<br />

through’, in which equity prices continue to creep<br />

higher, supported by continued modest earnings<br />

growth <strong>and</strong> some increase in PE multiples. We<br />

expect a total return on the main US <strong>and</strong> <strong>European</strong><br />

indices of 5-10% through year-end <strong>and</strong> pencil in a<br />

similar return for <strong>2008</strong>e.<br />

Kevin Gardiner*<br />

Head of Global Equity Strategy<br />

HSBC Bank plc (UK)<br />

+44 20 7991 6714<br />

kevin.gardiner@hsbcib.com<br />

3

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Estimated ex-ante US equity risk premium, %<br />

5<br />

4<br />

3<br />

2<br />

1<br />

86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07<br />

US Implied ERP Av erage +1 St. Dev -1 St. Dev<br />

Source: HSBC, Thomson Financial Datastream<br />

At the regional <strong>and</strong> sectoral levels, conviction has<br />

been in short supply over the course of <strong>2007</strong>, as<br />

we thought it might be. This is a reflection of<br />

several issues – M&A <strong>and</strong> infrastructure appeal,<br />

for example – that cut across conventional<br />

cyclical attributes.<br />

If anything, this lack of intra-market conviction<br />

has become even more pronounced as a result of<br />

the ABS <strong>and</strong> liquidity crises. Nonetheless, on a 3-<br />

6 month view, we have cut our cyclical positions<br />

<strong>and</strong> added to a mixture of technology <strong>and</strong> growthoriented<br />

sectors <strong>and</strong> regions, with the weak dollar<br />

making some degree of shift back into the US<br />

more favourable. We have trimmed our<br />

Overweight positions in Europe <strong>and</strong> emerging<br />

markets accordingly, though Europe remains our<br />

favourite among the larger blocs.<br />

One of those cross-market themes that we thought<br />

might make themselves felt in <strong>2007</strong> is size <strong>and</strong>,<br />

indeed, so far, this has been the case. Larger-cap<br />

companies are beginning to claw back some of the<br />

last few years’ underperformance. The turnaround is<br />

now clearly visible in price relative charts in the US<br />

<strong>and</strong> Europe <strong>and</strong> has been for some time in Japan.<br />

US <strong>and</strong> Europe trailing PE/economic value added (EVA) index (ROE/COE)<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07<br />

PE/EVA<br />

Source: HSBC, Thomson Financial Datastream<br />

4

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

We expect large <strong>caps</strong> to continue to outperform.<br />

Larger companies tend to be less dependent on the<br />

vagaries of the business cycle, partly by virtue of<br />

their greater international diversification. They<br />

have stronger balance sheets <strong>and</strong> are likely to be<br />

relatively sheltered from any residual liquidity<br />

pressures. When M&A revives, we suspect its<br />

focus will shift upscale – partly because private<br />

equity may become a little less prominent <strong>and</strong><br />

partly because many of the potential targets in the<br />

<strong>small</strong>/<strong>mid</strong>-cap space have already been snapped<br />

up <strong>and</strong>/or have become too expensive. Recently,<br />

large <strong>caps</strong> have been trading more cheaply than<br />

<strong>small</strong> <strong>and</strong> <strong>mid</strong>-cap companies, both in terms of<br />

PEs <strong>and</strong> dividend yields.<br />

And not all large <strong>caps</strong> look equally attractive.<br />

Most utilities, for example, are large simply by<br />

virtue of their physical assets <strong>and</strong> their earnings<br />

are non-cyclical. However, for us, their earnings<br />

are too defensive, their balance sheets are not the<br />

strongest <strong>and</strong> there has already been a wave of<br />

consolidation in the sector, so we see less<br />

consolidation to look forward to. There are many<br />

<strong>small</strong> technology companies, for example, that we<br />

would buy ahead of larger utilities.<br />

Other things being equal, though, we think investors<br />

will continue to ‘think big’ over the course of the rest<br />

of <strong>2007</strong> <strong>and</strong> into <strong>2008</strong>.<br />

As with other intra-market themes, however, we<br />

do not expect size to prove overwhelmingly<br />

important: we simply expect <strong>small</strong>er-cap indices<br />

to rise less markedly than their large-cap peers.<br />

Some of the post-2000 outperformance by <strong>mid</strong> <strong>and</strong><br />

<strong>small</strong> <strong>caps</strong> has reflected a structural decision by<br />

many money managers to increase their exposure<br />

to what they see as relatively under-researched<br />

<strong>and</strong>, hence (arguably), less efficiently priced<br />

segments of the global market. Smaller <strong>caps</strong> –<br />

together with emerging markets, their regional<br />

equivalents, perhaps – have benefited accordingly.<br />

This shift is unlikely to be reversed any time soon,<br />

in our opinion.<br />

Price relatives: <strong>small</strong> & <strong>mid</strong> cap indices versus large <strong>caps</strong><br />

200<br />

160<br />

120<br />

80<br />

40<br />

97 98 99 00 01 02 03 04 05 06 07<br />

UK US Germany Japan<br />

PE relatives: <strong>small</strong> & <strong>mid</strong> cap indices versus large <strong>caps</strong><br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

97 98 99 00 01 02 03 04 05 06 07<br />

UK US Germany Japan<br />

Source: HSBC, Thomson Financial Datastream<br />

Source: HSBC, Thomson Financial Datastream<br />

5

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

<strong>European</strong> indices: HSBC target prices<br />

Index Country/Type Price 30 Sep 07 Target 31 Dec 07e % potential<br />

CAC 40 France/Large cap 5,717 6200 8.5%<br />

DAX Germany/Large cap 7,862 8500 8.1%<br />

MDAX Germany/Mid cap 10,335 10500 1.6%<br />

FTSE100 UK/Large cap 6,467 7000 8.2%<br />

FTSE 250 UK/Mid cap 11,037 11850 7.4%<br />

Source: JCF, HSBC estimates<br />

Valuation <strong>and</strong> indices targets<br />

Europe remains our Global Equity Strategy<br />

team’s preferred region <strong>and</strong> Germany its preferred<br />

country (Overweight) within it. Europe is<br />

currently benefiting from strong global growth<br />

<strong>and</strong> the relatively cyclical nature of <strong>European</strong><br />

markets means they benefit more from this than<br />

most. This is even more true of Germany, which<br />

benefits strongly from Asian dem<strong>and</strong> for capital<br />

goods <strong>and</strong> which is also seeing the benefits of<br />

structural <strong>and</strong> corporate reforms in the form of<br />

renewed growth.<br />

We also Overweight the UK <strong>and</strong> Underweight<br />

France.<br />

One reason we do not expect <strong>small</strong>/<strong>mid</strong> <strong>caps</strong> to<br />

outperform large <strong>caps</strong> for the first time in many<br />

years is that valuations based on 12-month<br />

forward PEs have become more ambitious, as the<br />

table below indicates. More elevated multiples for<br />

<strong>small</strong>/<strong>mid</strong> <strong>caps</strong> are partly justified, in our view,<br />

because of their higher growth potential, as<br />

reflected by our EPS growth expectations.<br />

Nevertheless, we expect the large-cap indices to<br />

outperform the <strong>small</strong>/<strong>mid</strong>-cap ones.<br />

As a result, we more than ever, believe stock<br />

picking to be the way forward for the next quarter<br />

in order to maximise returns. As every time, there<br />

are still particular stocks, which we expect to have<br />

the potential to significantly st<strong>and</strong> out positively<br />

<strong>and</strong> show extraordinary performances.<br />

We would hereby focus on non-cyclical stocks,<br />

infrastructure plays, stocks with strong Asia<br />

exposure, construction plays. We would avoid if it<br />

is not a really strong story: real estate, financials,<br />

telco's, media. Focus is also on companies with<br />

healthy balance sheet structures <strong>and</strong> strong<br />

cash-flows.<br />

As a conclusion, while the valuation gap between<br />

<strong>small</strong>- <strong>and</strong> <strong>mid</strong>-<strong>caps</strong> <strong>and</strong> large <strong>caps</strong> seems partly<br />

justified by the higher earnings growth, we<br />

believe stock picking to be a paramount success<br />

factor especially for <strong>small</strong>/<strong>mid</strong>-<strong>caps</strong>.<br />

<strong>European</strong> indices: overview<br />

Index Country/Type % Change<br />

3M<br />

% Change<br />

6M<br />

% Change<br />

1Y<br />

Forward<br />

12M PE<br />

Forward<br />

12M P/B<br />

Net div<br />

yield <strong>2008</strong>e<br />

Forward EPS-CAGR<br />

12M ROE <strong>2007</strong>e-09e<br />

CAC 40 France/large cap -5.6% 1.4% 8.8% 12.3 x 1.9 x 3.4% 15.1% 8.3%<br />

CAC 100 France/<strong>mid</strong> cap -5.2% -1.0% 15.8% 16.3 x 1.9 x 2.5% 11.5% 13.9%<br />

DAX Germany/large cap -1.8% 11.0% 27.6% 12.7 x 1.8 x 3.1% 14.2% 13.0%<br />

MDAX Germany/<strong>mid</strong> cap -6.4% 0.0% 19.1% 14.6 x 2.1 x 2.2% 14.1% 16.6%<br />

FTSE100 UK/large cap -5.4% 0.0% 5.7% 12.1 x 2.3 x 3.7% 18.8% 5.1%<br />

FTSE 250 UK/<strong>mid</strong> cap -7.6% -8.5% 7.2% 13.8 x 2.4 x 2.9% 17.5% 9.3%<br />

Source: JCF consensus<br />

6

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Main movers - <strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

HSBC Smaller <strong>European</strong> Companies Index**: top performers 9M 07* HSBC Smaller <strong>European</strong> Companies Index: worst performers 9M 07*<br />

Top 50 companies Country Performance<br />

relative to index<br />

Top 50 companies Country Performance<br />

relative to index<br />

ROTH & RAU AG Germany +419.5 NORTHERN ROCK UK -85.5<br />

MANZ AUTOMATION AG Germany +384.2 VERBIO AG Germany -74.7<br />

ACOTEL GROUP S.P.A Italy +328.9 ASTROC MEDITERRANE Spain -74.2<br />

BETSSON AB Sweden +301.8 BANCA ITALEASE Italy -70.1<br />

MEYER BURGER TECHN Switzerl<strong>and</strong> +291.7 VUELING AIRLINES Spain -66.7<br />

SPRIDER SA Greece +241.4 AVIS EUROPE UK -58.0<br />

SOLON AG Germany +232.5 PARAGON GROUP OF COS UK -57.1<br />

TANFIELD UK +199.7 GPC BIOTECH Germany -56.1<br />

GPO SOARES DA COST Portugal +192.4 CENTRAL AFRICAN MI UK -55.5<br />

RECYLEX SA France +190.3 MCINERNEY HLDGS Irel<strong>and</strong> -54.8<br />

CLIMATE EXCHANGE UK +166.7 CAPITAL & REGIONAL UK -54.5<br />

NORDEX AG Germany +148.9 IKB DT INDUSTRIEBK Germany -53.1<br />

RUUKKI GROUP Finl<strong>and</strong> +136.5 INFOGRAMES ENTERTAIN France -53.0<br />

D/S NORDEN Denmark +130.4 PATRIZIA IMMO AG Germany -52.9<br />

VON ROLL BR Switzerl<strong>and</strong> +128.8 DEBENHAMS UK -52.6<br />

INTL FERRO METALS UK +126.0 SOITEC France -51.7<br />

KLOUKINAS-LAPPAS Greece +121.5 WOOLWORTHS GROUP UK -50.5<br />

OMX AB Sweden +117.6 MAPELEY UK -49.3<br />

OUTOTEC OYJ Finl<strong>and</strong> +115.7 MEINL EUROPEAN LAND Austria -49.1<br />

SOLAR MILLENNIUM Germany +114.3 DERICHEBOURG France -48.9<br />

SGL CARBON Germany +112.5 SAVILLS UK -48.5<br />

ANEK LINES Greece +112.2 RAYMARINE UK -48.4<br />

CORIN GROUP UK +108.4 FBD HDGS Irel<strong>and</strong> -47.3<br />

STRABAG Germany +107.4 MINERVA UK -46.7<br />

AIXTRON Germany +102.3 URBAS PROYEC URBAN Spain -46.1<br />

BEGHELLI Italy +101.3 DTZ HOLDINGS UK -46.0<br />

GILDEMEISTER Germany +100.7 REDROW UK -46.0<br />

VIVARTIA SA Greece +100.4 NIBE INDUSTRIER AB B Sweden -45.6<br />

ARQUES INDUSTRIES Germany +100.2 MICRONAS SEMICON REG Switzerl<strong>and</strong> -45.3<br />

ALAPIS S.A. Greece +99.9 BIOPETROL INDUSTRIES Germany -45.3<br />

BLOM Norway +95.9 PHOTO-ME INTL UK -45.0<br />

ROCKWOOL INTL B Denmark +92.4 TT ELECTRONICS UK -44.4<br />

LAVENDON GROUP UK +88.6 NORSKE SKOG Norway -43.5<br />

SCANA INDUSTRIER Norway +87.5 GAGFAH SA Germany -43.2<br />

BEIJER AB G & L 'B' Sweden +85.5 PENDRAGON UK -43.0<br />

UBISOFT ENTERTAIN France +85.3 MICRONIC LASER SYS Sweden -42.7<br />

DUCATI MOTOR HLDG Italy +85.2 BOVIS HOMES GROUP UK -42.4<br />

IRISH CONTINENTAL Irel<strong>and</strong> +83.2 TRANSCOM WRLD 'B'SDR Sweden -42.2<br />

DANIELI N/CV RISP Italy +82.2 TRANSCOM WRLD 'A'SDR Sweden -42.1<br />

CONSTR Y AUX FERRO Spain +80.8 LAVIPHARM Greece -41.7<br />

CARRARO SPA Italy +78.6 ADV DIGITAL BROAD Switzerl<strong>and</strong> -41.3<br />

TECNICAS REUNIDAS Spain +75.8 HOGG ROBINSON GRP UK -41.3<br />

NOKIAN RENKAAT OYJ Finl<strong>and</strong> +75.0 H & R WASAG Germany -40.6<br />

KEMIRA GROWHOW OYJ Finl<strong>and</strong> +74.9 ETAM DEVELOPPEMENT France -40.6<br />

SEVAN MARINE Norway +74.2 USG PEOPLE NV Netherl<strong>and</strong>s -40.3<br />

SENIOR UK +73.7 BUONGIORNO SPA Italy -40.0<br />

ODIM ASA Norway +72.2 BRIXTON UK -40.0<br />

EXPERT EILAG Norway +71.1 TECHNIKI OLYMPIAKI Greece -39.8<br />

IASO SA Greece +70.2 SONDAGSAVISEN Denmark -39.8<br />

SCHOELLER BLECKMAN Austria +69.9 SHAFTESBURY UK -39.7<br />

Source: HSBC; * (02.01.<strong>2007</strong> – 28.09.<strong>2007</strong>), **Bloomberg Index RIC: JCSCEURO Index<br />

7

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

HSBC <strong>European</strong> Smaller <strong>European</strong> Companies Index: top 30 companies with highest dividend yield for <strong>2007</strong>e<br />

Company Country Share price (as of 30 September <strong>2007</strong>) (EUR) Dividend yield <strong>2007</strong>e<br />

Baader Wertpapierh<strong>and</strong>elsbank AG Germany 4.4 12.1%<br />

Acta Holding ASA Norway 3.2 11.5%<br />

Woolworths Group Great-Britain 0.3 10.0%<br />

Drax Group PLC Great-Britain 8.7 9.7%<br />

ABG Sundal Collier ASA Norway 1.9 9.5%<br />

Lloyd Fonds AG Germany 16.3 9.5%<br />

Mapeley Ltd. Great-Britain 30.2 9.5%<br />

Norske Skogindustrier ASA Norway 7.5 9.3%<br />

HCI Capital AG Germany 15.2 9.0%<br />

Axfood Ab Sweden 23.6 8.3%<br />

Cairo Communication SpA Italy 37.0 8.1%<br />

Chesnara Plc Great-Britain 2.5 8.1%<br />

Paragon Group Of Cies Great-Britain 4.3 8.0%<br />

MPC AG Germany 59.9 8.0%<br />

Vastned Offices Industrial Netherl<strong>and</strong>s 22.2 7.9%<br />

Bradford And Bingley Great-Britain 4.3 7.7%<br />

HQ AB Sweden 19.2 7.6%<br />

KappAhl Holding AB Sweden 7.4 7.5%<br />

Maurel Et Prom France 15.0 7.5%<br />

Deep Sea Supply ASA Norway 3.1 7.4%<br />

DAB Bank AG Germany 6.3 7.4%<br />

AWD Holding AG Germany 23.4 7.4%<br />

Sparebank 1 SR-Bank Norway 21.4 7.3%<br />

Pendragon Great-Britain 0.9 7.3%<br />

Electrocomponents Great-Britain 3.6 7.2%<br />

Note: * dividend <strong>2007</strong>e to be paid out in <strong>2008</strong><br />

Source: HSBC<br />

<strong>2007</strong>e dividend yield plays<br />

As many funds require a constant stream of cash<br />

flow without having to liquidate parts of their<br />

holdings, dividend yield is still a key decider<br />

when it comes to stock investment. Another<br />

element of investing in stocks with a high<br />

dividend yield is the ‘bird-in-the-h<strong>and</strong>’ theory,<br />

which dubs stocks with high yields preferable to<br />

those with lower yields (all else being equal).<br />

Note, though, that there are hardly any<br />

technology companies in our top 30. This is no<br />

surprise, however, as we expect companies with<br />

high growth potential to retain <strong>and</strong> reinvest<br />

profits rather than pay them out.<br />

From this perspective, German Baader<br />

Wertpapierh<strong>and</strong>els AG <strong>and</strong> Norwegian Acta<br />

Holding ASA appear to be the most attractive<br />

<strong>small</strong>- or <strong>mid</strong>-cap dividend stocks, with more<br />

than a 10% dividend yield (payable in <strong>2008</strong>e).<br />

In general, financial <strong>and</strong> financial-related stocks<br />

dominate our top 30 dividend yield list, not only<br />

because of their relatively low capital<br />

requirements, allowing them to pay out a large<br />

portion of their earnings, even in growth<br />

periods, but also because they suffered strongly<br />

during the recent market turmoil.<br />

8

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

HSBC <strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong>-cap conferences in <strong>2007</strong>-08<br />

HSBC’s newly bolstered <strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong>-cap product will be represented at a number of<br />

interesting <strong>small</strong> <strong>and</strong> <strong>mid</strong>-cap conferences to be held in <strong>Q4</strong> <strong>2007</strong> <strong>and</strong> H1 <strong>2008</strong>:<br />

06 November <strong>2007</strong>, Paris, Hotel de Crillon - HSBC Leisure Conference<br />

28 November <strong>2007</strong>, London, Great Eastern Hotel - HSBC Small/Mid-Cap Healthcare Conference<br />

29 November <strong>2007</strong>, Paris, Hotel de Crillon - HSBC <strong>European</strong> Aerospace Conference<br />

28-29 January <strong>2008</strong>, Frankfurt, Hilton Hotel - HSBC Small <strong>and</strong> Mid-cap SRI Conference:<br />

‘Responsible growth – investments for the future’<br />

27-28 February <strong>2008</strong>, Frankfurt, Hilton Hotel - HSBC <strong>European</strong> Real Estate (TREC)<br />

08-09 April <strong>2008</strong>, Paris, HSBC Office – HSBC French Small <strong>and</strong> Mid-Cap Conference<br />

At our first HSBC Leisure Seminar on 6 November <strong>2007</strong> in Paris, we will present 12 selected <strong>European</strong><br />

<strong>small</strong> <strong>and</strong> <strong>mid</strong>-cap companies that we consider to be among the leaders in the leisure sector.<br />

Source: HSBC<br />

9

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

At our HSBC Small <strong>and</strong> Mid-cap Healthcare Conference on 28 November <strong>2007</strong> in London, we will<br />

present 14 selected German <strong>and</strong> <strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong>-cap companies that we view as being among the<br />

leaders in their particular sectors.<br />

HSBC Small/Mid-Cap Healthcare Conference<br />

- save the date -<br />

London - 28 November <strong>2007</strong><br />

Great Eastern Hotel, Liverpool Street, London EC2M 7QN<br />

HSBC is pleased to announce that it will conduct a HSBC Healthcare Conference<br />

with leading German <strong>and</strong> selected <strong>European</strong> Small/Mid Cap stocks (companies see page 2) in London.<br />

Please SAVE THE DATE in your diary, a formal invitation will be sent to you shortly, accompanied<br />

by a detailed schedule.<br />

We will offer 1-1 meetings <strong>and</strong> <strong>small</strong> group meetings with the management of the attending<br />

companies <strong>and</strong> present a captivating key note speaker, who will be giving a sector related lunch speech.<br />

Anke Ohm<br />

Event Management – Institutional Clients<br />

Telephone: +49 (2 11) 9 10 25 44<br />

Fax: +49 (2 11) 32 61 19<br />

E-mail: anke.ohm@hsbc.de<br />

Source: HSBC<br />

HSBC Small/Mid-Cap Healthcare Conference<br />

LIST OF ATTENDING COMPANIES*:<br />

Germany:<br />

Curanum, Nursing, EUR203m<br />

Celesio, Wholesale/Pharmacies, EUR8.3bn<br />

Fresenius Medical Care, Medical Systems/Services, EUR11bn<br />

QIAGEN, Medtech/Diagnosis, EUR2.3bn<br />

Carl Zeiss Meditec, Medtech, EUR1.1bn<br />

Drägerwerk, Medtech, EUR866m<br />

Sartorius, Medtech, EUR743m<br />

STRATEC Biomedical, Medtech, EUR243m<br />

PULSION Medical Systems, Medtech, EUR51m<br />

CompuGROUP, Healthcare Equipment, EUR651m<br />

Greece:<br />

Lavipharm, Wholesale, EUR175m<br />

Switzerl<strong>and</strong>:<br />

Sonova (formerly Phonak), Hearing Systems, EUR4.5bn<br />

Nobel Biocare, Implants, EUR5.2bn<br />

UK:<br />

Vectura, Pharmaceuticals, EUR320m<br />

* Companies listed by Sector <strong>and</strong> Market Capitalization<br />

Source: HSBC<br />

10

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

At our third HSBC Small <strong>and</strong> Mid-Cap SRI Conference on 28-29 January <strong>2008</strong> in Frankfurt, we will<br />

present 35 German <strong>and</strong> <strong>European</strong> <strong>small</strong>- <strong>and</strong> <strong>mid</strong>-cap companies that we believe to be among those<br />

companies leading the way in combining economic growth <strong>and</strong> shareholder value creation with a socially<br />

responsible business model <strong>and</strong> approach.<br />

3. HSBC Small / Mid Cap SRI-Conference<br />

- Responsible Growth – Investments for the Future -<br />

Please SAVE THE DATE in your diary!<br />

Frankfurt Main, 28 - 29 January <strong>2008</strong><br />

HSBC Trinkaus & Burkhardt cordially invites you to its<br />

Small / Mid Cap Socially Responsible Investment Conference.<br />

We will present Small / Mid cap companies, who are among those leading the way<br />

in combining economic growth <strong>and</strong> shareholder value creation with socially<br />

responsible business models <strong>and</strong> attitudes. (Please see planned participants page 2)<br />

Venue:<br />

Hilton Frankfurt<br />

Hochstrasse 4<br />

60313 Frankfurt<br />

Anke Ohm<br />

Event Management / Inst. Clients<br />

Telephone: +49 (2 11) 9 10 25 44<br />

Fax: +49 (2 11) 9 10 26 34<br />

E-mail:<br />

anke.ohm@hsbctrinkaus.de<br />

Source: HSBC<br />

PARTICIPATING COMPANIES<br />

(PRELIMINARY LIST)<br />

<strong>European</strong> companies (28 January, <strong>2008</strong>) German companies (29 January, <strong>2008</strong>)<br />

Abengoa<br />

Suzlon<br />

Agor<br />

Pfeiffer Vaccum<br />

Andritz<br />

Tomra<br />

Biogas Nord<br />

Phönix Sonnenstrom<br />

BDI<br />

Vectrix<br />

Biopetrol Industries<br />

Q-Cells<br />

BWT<br />

Veolia<br />

Centrosolar<br />

Rational<br />

Christ Water<br />

Vestas<br />

Centrotec<br />

REpower Systems<br />

Clipper Windpower<br />

Conergy<br />

Roth & Rau<br />

Energies Nouvelles / EdF<br />

CropEnergies<br />

Schmack Biogas<br />

Gamesa<br />

Deutz<br />

SGL Carbon<br />

Kingspan<br />

Envitec Biogas<br />

Smart Fuel Cells<br />

Lassila & Tikanoja<br />

Elring Klinger<br />

Solar Millenium<br />

MayrMelnhof<br />

EOP Biodiesel<br />

SolarWorld<br />

Meyer Burger Technology<br />

ErSol<br />

Solon<br />

NIBE<br />

Interseroh<br />

Steico<br />

Uralita<br />

K+S<br />

Techem<br />

PV Crystalox Solar<br />

Krones<br />

Verbio<br />

REC<br />

KWS Saat<br />

Wacker Chemie<br />

Rockwool<br />

Manz Automation<br />

Washtec<br />

Schulthess<br />

MAX Automation<br />

Seche Environnement<br />

MVV Energie<br />

Shanks<br />

Nordex<br />

SIG<br />

Petrotec<br />

Source: HSBC<br />

11

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Regional focus: France<br />

Growth gap between France <strong>and</strong> the Eurozone set to diminish<br />

France should hold up, in our opinion, thanks to the rebound in<br />

the automotive <strong>and</strong> aerospace industries<br />

Sarkozy’s fiscal plan should increase disposable income by<br />

€ € 13.7bn <strong>and</strong> benefit major firms in sectors employing large<br />

numbers of unskilled workers<br />

The macroeconomic view<br />

Weak industrial production was one of the main<br />

items that dragged down French economic growth<br />

last year, notably in the automotive sector. The<br />

situation has been improving since the beginning<br />

of <strong>2007</strong>, however, with the introduction of new<br />

car models in France. Furthermore, deliveries of<br />

the Airbus A380, the first of which is expected in<br />

October, should bolster exports. As a result of this<br />

counter-cyclical trend, along with favourable<br />

fiscal measures, we expect the French economy to<br />

exp<strong>and</strong> 1.8% in both <strong>2007</strong> <strong>and</strong> <strong>2008</strong>, despite what<br />

is likely to be slowing growth in the Eurozone.<br />

Tax breaks to prop up household<br />

spending<br />

The French economy is still being fuelled by<br />

consumer spending. Measures have been<br />

proposed to exempt overtime hours from income<br />

tax <strong>and</strong> social security levies, as well as to limit<br />

the tax burden, ie, income tax, wealth tax, local<br />

taxes, <strong>and</strong> social charges to a combined total of<br />

50% of income. According to our calculations,<br />

this should add 1.1 percentage point, or<br />

EUR13.7bn, to gross disposable income in <strong>2008</strong>.<br />

We expect such tax breaks, effective 1 October<br />

<strong>2007</strong>, to buoy consumer spending <strong>and</strong> offset any<br />

increase in the unemployment rate. The other<br />

facet of the tax package, which makes interest on<br />

new home loans deductible from income tax,<br />

should bolster the residential property market <strong>and</strong><br />

is tantamount to a 34bp decrease in interest rates.<br />

The labour-market reforms planned for <strong>2008</strong><br />

could limit the anticipated rise in the<br />

unemployment rate to 8.9%, from 8.6% currently.<br />

Growth should prove resistant to the<br />

impact of tighter monetary policy<br />

We expect household spending to be only slightly<br />

impacted by the tighter money supply, which we<br />

believe should be partially offset by the planned<br />

tax cuts. The expected slump in the housing<br />

market is likely to be delayed until tighter<br />

monetary policy pushes up interest rates on home<br />

loans by 34bp. Furthermore, a potential short term<br />

interest rate increase due to the financial turmoil<br />

will have little impact on households that have<br />

already borrowed. Debt-funded business<br />

investment could slow with a tightening of<br />

monetary policy. However, the French<br />

government has said it will seek to enact<br />

corporate tax reforms in <strong>2008</strong>, to complement the<br />

lowering of on-payroll costs.<br />

Pierre Bosset<br />

Head of Equity Research, France<br />

HSBC Bank plc<br />

+33 1 56 52 43 10<br />

pierre.bosset@hsbc.fr<br />

Mathilde Lemoine<br />

Economist<br />

HSBC France<br />

+33 1 40 70 32 66<br />

mathilde.lemoine@hsbc.fr<br />

12

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Main movers – French <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

HSBC Smaller <strong>European</strong> Comp index (France) – top performers*<br />

HSBC Smaller <strong>European</strong> Comp index (France) – worst performers*<br />

Top 10 companies Performance relative to index Top 10 companies Performance relative to index<br />

RECYLEX SA +190.3 INFOGRAMES ENTERTAIN -53.0<br />

UBISOFT ENTERTAIN +85.3 SOITEC -51.7<br />

AUDIKA +66.0 DERICHEBOURG -48.9<br />

SELOGER PROMESSES +65.3 ETAM DEVELOPPEMENT -40.6<br />

STALLERGENES +64.9 SPIR COMMUNICATION -35.8<br />

WAVECOM +55.3 NRJ GROUP -33.9<br />

VILMORIN CL & CIE +51.2 ARCHOS -33.8<br />

BUSINESS&DECISION +50.9 LACIE SA -32.8<br />

THEOLIA +50.6 AVENIR TELECOM -31.8<br />

COMPLETEL EUROPE N +48.6 ASSYSTEM -29.4<br />

Source: HSBC, *(02.01.<strong>2007</strong> – 28.09.<strong>2007</strong>) Source: HSBC, *(02.01.<strong>2007</strong> – 28.09.<strong>2007</strong>)<br />

HSBC Smaller <strong>European</strong> Companies index (all) versus HSBC<br />

Smaller <strong>European</strong> Companies index (France)<br />

CAC40 index versus CAC100 index <strong>and</strong> CAC 90 index (top<br />

190 French <strong>small</strong> <strong>and</strong> <strong>mid</strong>-cap stocks)<br />

114<br />

111<br />

108<br />

105<br />

102<br />

99<br />

96<br />

Jan-07 Mar-07 May -07 Jul-07 Sep-07<br />

HSBC Smaller <strong>European</strong> Companies HSBC Smaller <strong>European</strong> Companies (FRA)<br />

110<br />

105<br />

100<br />

95<br />

90<br />

Jan-07 Mar-07 May -07 Jul-07 Sep-07<br />

CAC 40 CAC 100 CAC 90<br />

Source: HSBC<br />

Source: Datastream<br />

HSBC Smaller <strong>European</strong> Companies Index (FR) – lowest PE<br />

HSBC Smaller <strong>European</strong> Companies Index (FR) – Highest <strong>2007</strong>e<br />

dividend yield (payable in <strong>2008</strong>)<br />

Top 10 companies Forward 12-month PE Top 10 companies Forward 12-month net dividend yield<br />

SCOR SA 7.7 x Maurel Et Prom 7.5%<br />

Rhodia SA 8.1 x Kaufman & Broad SA 5.5%<br />

Nexity 8.2 x Tour Eiffel 5.4%<br />

Montupet Sa 8.3 x M6 Metropole Television 5.3%<br />

Ims Int Met Serv 8.5 x Spir Communication SA 5.2%<br />

LACIE SA 9.0 x LACIE SA 4.9%<br />

Recylex SA 9.2 x SCOR SA 4.6%<br />

Groupe Crit SA 9.8 x Avenir Telecom 4.5%<br />

Steria (Groupe) 10.0 x Smtpc 4.4%<br />

Kaufman & Broad SA 10.1 x Montupet Sa 4.3%<br />

Source: HSBC, JCF<br />

Source: HSBC, JCF<br />

13

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Regional focus: Germany<br />

Robust German GDP growth expected on the back of healthy<br />

balance sheets<br />

Small <strong>and</strong> <strong>mid</strong> <strong>caps</strong> set to be potential beneficiaries of German<br />

corporate tax reform in <strong>2008</strong>e<br />

Falling unemployment rate should provide a boost to consumption<br />

Macroeconomic view<br />

Leading indicators for Germany suggest that the<br />

economic momentum being witnessed in <strong>2007</strong><br />

may be sustainable, as the outlook remains robust,<br />

with HSBC GDP growth forecasts now for an<br />

expansion of perhaps 3% y-o-y in <strong>2007</strong> <strong>and</strong> 2.2%<br />

in <strong>2008</strong>. Furthermore, private consumption,<br />

temporarily constrained by the VAT increase in<br />

January <strong>2007</strong>, is expected to regain strength in<br />

<strong>2008</strong> (1.5% y-o-y growth in <strong>2008</strong>e versus a 0.1%<br />

decline in <strong>2007</strong>e, we estimate). In addition,<br />

Germany’s exceptional credit discipline (solid<br />

balance sheets at German companies, <strong>and</strong> high<br />

household savings rate) gives the economy a<br />

comfortable buffer from potential liquidity<br />

crunches or increasing credit spreads.<br />

Corporate tax reform<br />

By <strong>2008</strong>, the tax burden on German companies<br />

should have been reduced to below 30% (from<br />

39% currently) in a bid to improve the country’s<br />

international competitiveness <strong>and</strong> make it more<br />

attractive to investors. The reduction in the total<br />

tax burden will stem largely from a planned<br />

reduction in corporate income tax from 25% to<br />

15%. This should result in higher reported net<br />

income <strong>and</strong>, hence, higher EPS. However, not all<br />

companies will benefit to the same extent from the<br />

reduction in income tax. As German companies<br />

that generate most of their revenues in Germany<br />

are set to benefit more than companies with a large<br />

proportion of revenues from abroad, we expect<br />

<strong>small</strong> <strong>and</strong> <strong>mid</strong>-cap firms to benefit more than, say,<br />

German blue chips (many of which generate most<br />

of their sales abroad).<br />

Declining unemployment rate<br />

Germany’s unemployment rate is falling, reaching<br />

a new low of 8.8% in September <strong>2007</strong>, down from<br />

10.1% just a year before. This <strong>and</strong> a corresponding<br />

drop in the savings rate (according to our<br />

economists) should support a more significant<br />

recovery in consumer spending than has<br />

materialised to date.<br />

We believe that this falling-savings-rate effect<br />

will start showing in H2 <strong>2007</strong>, but much more so<br />

in <strong>2008</strong>. This view is supported by the HDE, the<br />

umbrella association of German retailers. While<br />

the HDE sees little consumption recovery so far, it<br />

says momentum is improving. For H2, the HDE<br />

expects nominal market growth of 1.5% y-o-y,<br />

though it says its guidance could prove overly<br />

cautious if economic developments remain robust.<br />

Key contact for German stocks::<br />

Thomas Teetz<br />

Head of Equity Research,<br />

Germany<br />

HSBC Trinkaus & Burkhardt AG<br />

+49 211 910 2353<br />

thomas.teetz@hsbc.de<br />

Burkhard Weiss<br />

Product Coordinator S/M Cap<br />

Research<br />

HSBC Trinkaus & Burkhardt AG<br />

+49 211 910 3722<br />

burkhard.weiss@hsbc.de<br />

14

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Main movers – German <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

HSBC Smaller <strong>European</strong> Companies Index (GER) – top performers*<br />

HSBC Smaller <strong>European</strong> Companies Index (GER) – worst performers*<br />

Top 10 companies Performance relative to index Top 10 companies Performance relative to index<br />

ROTH & RAU AG +419.5 VERBIO AG -74.7<br />

MANZ AUTOMATION AG +384.2 GPC BIOTECH -56.1<br />

SOLON AG +232.5 IKB DT INDUSTRIEBK -53.1<br />

NORDEX AG +148.9 PATRIZIA IMMO AG -52.9<br />

SOLAR MILLENNIUM +114.3 BIOPETROL INDUSTRIES -45.3<br />

SGL CARBON +112.5 GAGFAH SA -43.2<br />

STRABAG +107.4 H & R WASAG -40.6<br />

AIXTRON +102.3 DEUTSCHE WOHNEN (BR) -38.5<br />

GILDEMEISTER +100.7 MLP AG -38.5<br />

ARQUES INDUSTRIES +100.2 BOEWE SYSTEC -35.3<br />

Source: HSBC, (02.01.<strong>2007</strong> – 28.09.<strong>2007</strong>) Source: HSBC, (02.01.<strong>2007</strong> – 28.09.<strong>2007</strong>)<br />

HSBC Smaller <strong>European</strong> Companies Index (all) versus HSBC<br />

Smaller <strong>European</strong> Companies Index (Germany)<br />

124<br />

DAX versus MidCap market index (Top 100 German <strong>small</strong><br />

<strong>and</strong> <strong>mid</strong>-cap stocks)<br />

125<br />

119<br />

120<br />

114<br />

115<br />

109<br />

104<br />

99<br />

94<br />

Jan-07 Mar-07 May -07 Jul-07 Sep-07<br />

110<br />

105<br />

100<br />

95<br />

Jan-07 Mar-07 May -07 Jul-07 Sep-07<br />

HSBC Smaller <strong>European</strong> Companies HSBC Smaller <strong>European</strong> Companies (GER )<br />

DAX 30<br />

MidCap market index<br />

Source: HSBC<br />

Source: Datastream<br />

HSBC Smaller <strong>European</strong> Companies Index (GER) – lowest PE<br />

Top 10 companies<br />

Forward 12-month<br />

PE<br />

HSBC Smaller <strong>European</strong> Companies Index (GER) – highest <strong>2007</strong>e<br />

dividend yield (payable in <strong>2008</strong>)<br />

Top 10 companies<br />

Forward 12-month net<br />

dividend yield<br />

ARQUES Industries AG 5.3 x Baader Wertpapierh<strong>and</strong>elsbank AG 12.1%<br />

Vivacon AG 6.1 x Lloyd Fonds AG 9.5%<br />

Baader Wertpapierh<strong>and</strong>elsbank AG 6.1 x HCI Capital AG 9.0%<br />

Indus Holding AG 7.7 x MPC (Munchmeyer Petersen Ca 8.0%<br />

Colonia Real Estate AG 7.9 x DAB Bank AG 7.3%<br />

WMF AG 8.9 x AWD Holding AG 7.4%<br />

Dyckerhoff AG 9.0 x WMF AG 6.8%<br />

Lloyd Fonds AG 9.0 x Telegate AG 6.6%<br />

HCI Capital AG 9.3 x MLP AG 5.8%<br />

Grammer AG 9.4 x ProSiebenSat.1 Media AG 5.6%<br />

Source: HSBC, JCF<br />

Source: HSBC, JCF<br />

15

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Regional focus: Greece<br />

Medium-term macroeconomic environment remains benign, with<br />

high real economic growth providing a boost to corporate profitability<br />

Liberalisation of the energy market is attracting investment from<br />

domestic <strong>and</strong> foreign players<br />

Greek companies’ exposure to central <strong>and</strong> southeastern Europe is<br />

growing rapidly<br />

Macroeconomic view<br />

The medium-term outlook for the Greek economy<br />

remains favourable, in our view. We expect real<br />

GDP growth of 4.1% in <strong>2007</strong> <strong>and</strong> 3.9% in <strong>2008</strong>,<br />

well above the EU 13 average (2.6% <strong>and</strong> 1.9% in<br />

<strong>2007</strong>e <strong>and</strong> <strong>2008</strong>e according to HSBC estimates).<br />

Economic growth should be underpinned, we<br />

believe, by (a) healthy private consumption (a<br />

function of robust real wage growth, employment<br />

gains <strong>and</strong> positive wealth effects on rising equity<br />

<strong>and</strong> real-estate markets), (b) a favourable policy<br />

mix, supported by accommodating monetary<br />

conditions, persisting rapid credit expansion to<br />

households <strong>and</strong> tax reform gains <strong>and</strong> (c) robust<br />

investment spending on continued inflows of EU<br />

funds, strong residential construction <strong>and</strong> a sharp<br />

pick-up in corporate investment (driven by low<br />

real lending rates, special incentives <strong>and</strong> increased<br />

private-sector participation in infrastructure<br />

spending through public-private partnerships).<br />

Energy market liberalisation<br />

Electricity dem<strong>and</strong> in Greece has grown by nearly<br />

50% over the past decade <strong>and</strong> is forecasted by<br />

HTSO (Hellenic Transmission system operator) to<br />

exp<strong>and</strong> by 3% pa through 2012 (<strong>and</strong> by 2.5%<br />

annually thereafter). Furthermore, electricity<br />

reserve margins remain very tight, while the<br />

country’s rich RES (renewable energy source)<br />

potential is largely unexploited. The benign sector<br />

outlook, coupled with the full liberalisation of the<br />

electricity market (as of July <strong>2007</strong>) <strong>and</strong> special<br />

incentives provided under the RES law, have<br />

attracted considerable investment from both<br />

Greek <strong>and</strong> large foreign groups. With the<br />

exception of Terna (TERr.AT), all other domestic<br />

players have formed strategic partnerships with<br />

large <strong>European</strong> utilities.<br />

Growing exposure to C&SEE<br />

The Greek corporate sector is committing more<br />

<strong>and</strong> more capital to exp<strong>and</strong>ing across central <strong>and</strong><br />

southeastern Europe, placing special emphasis on<br />

its neighbouring Balkan economies <strong>and</strong>, most<br />

recently, Turkey. Although domestic operations<br />

should remain the chief driver of corporate<br />

earnings for the majority of Greek <strong>small</strong> <strong>and</strong> <strong>mid</strong><br />

<strong>caps</strong>, increasing exposure to central <strong>and</strong><br />

southeastern Europe is a longer-duration theme,<br />

which, in our view, is certain to feature more <strong>and</strong><br />

more on investors’ radar screens going forward.<br />

By our estimates, c20% of our Greek <strong>small</strong> <strong>and</strong><br />

<strong>mid</strong>-cap universe’s earnings will come from this<br />

region in <strong>2008</strong>e.<br />

Key contact for Greece stocks:<br />

Joanna Telioudi<br />

Head of Equity Research, Greece<br />

HSBC Pantelakis Securities<br />

+30 210 696 5209<br />

joanna.telioudi@hsbc.gr<br />

16

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Main movers – Greece <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

HSBC Smaller <strong>European</strong> Comp index (Greece) – Top performers*<br />

HSBC Smaller <strong>European</strong> Comp index (Greece) – Worst performers*<br />

Top 10 companies Performance relative to index Top 10 companies Performance relative to index<br />

SPRIDER SA +241.4 LAVIPHARM -41.7<br />

KLOUKINAS-LAPPAS +121.5 TECHNIKI OLYMPIAKI -39.8<br />

ANEK LINES +112.2 GENIKI BANK SA -34.4<br />

VIVARTIA SA +100.4 ASPIS BANK -30.0<br />

ALAPIS S.A. +99.9 MARFIN EGNATIA BK -22.3<br />

IASO SA +70.2 HELLENIC DUTY FREE -22.1<br />

METKA +69.7 BABIS VOVOS SA -18.3<br />

HELLENIC EXCH SA HLD +63.9 ALUM CO OF GREECE -15.7<br />

FOURLIS +62.2 TITAN CEMENT PREF -14.9<br />

SIDENOR METAL PROC +61.5 GREEK POSTAL SAVIN -14.7<br />

Source: HSBC, *(02.01.<strong>2007</strong> – 28.09.<strong>2007</strong>) Source: HSBC, * (02.01.<strong>2007</strong> – 28.09.<strong>2007</strong>)<br />

HSBC Smaller <strong>European</strong> Companies Index (all) versus HSBC<br />

Smaller <strong>European</strong> Companies Index (Greece)<br />

115<br />

110<br />

105<br />

100<br />

95<br />

Jan-07 Mar-07 May -07 Jul-07 Sep-07<br />

HSBC Smaller <strong>European</strong> Companies<br />

HSBC Smaller <strong>European</strong> Companies (GRE)<br />

FTSE/ATHEX 20 (Greece blue-chip Index) versus FTSE/ATHEX<br />

40 <strong>and</strong> FTSE/ATHEX 140 (Top Greek <strong>small</strong> & <strong>mid</strong>-cap stocks)<br />

135<br />

130<br />

125<br />

120<br />

115<br />

110<br />

105<br />

100<br />

95<br />

Jan-07 Mar-07 May -07 Jul-07 Sep-07<br />

ATHEX 20 ATHEX 40 ATHEX 140<br />

Source: HSBC<br />

Source: Datastream<br />

HSBC Smaller <strong>European</strong> Comp index (GRE) – lowest PE<br />

Top 10 companies<br />

12-month forward<br />

PE<br />

HSBC Smaller <strong>European</strong> Comp index (GRE) – highest <strong>2007</strong>e<br />

dividend yield (payable in <strong>2008</strong>)<br />

Top 10 companies<br />

12-month forward net<br />

dividend yield<br />

Technical Olympic SA 3.8 x Motor Oil Hellas Corinth 6.8%<br />

Sidenor 8.5 x Hellenic Duty Free Shops SA 5.8%<br />

Aluminium Co Of Greece 8.6 x Heracles General Cement 5.8%<br />

I.Kloukinas-I.Lappas 8.7 x Aluminium Co Of Greece 5.6%<br />

Lamda Development SA 9.1 x Autohellas Hertz 5.0%<br />

Titan Cement 10.7 x Greek Postal Savings Bank SA 4.7%<br />

Autohellas Hertz 11.0 x Metka SA 4.3%<br />

Folli Follie SA 11.4 x Hellenic Petroleum Sa 3.8%<br />

Blue Star Maritime 11.5 x I.Kloukinas-I.Lappas 3.8%<br />

Babis Vovos Int 11.7 x Agricultural Bk Greece 3.6%<br />

Source: HSBC, JCF<br />

Source: HSBC, JCF<br />

17

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Regional focus: UK<br />

Substantial deterioration in consumer spending (HSBC expects<br />

consumer spending growth of only 0.8% in <strong>2008</strong>e)<br />

Rising inflation in non-discretionary household spending<br />

categories magnifies pressure on discretionary spending<br />

Housing to go from spending enabler to spending disabler<br />

Macroeconomic view<br />

HSBC recently lowered its estimate for UK<br />

consumer spending growth in <strong>2008</strong>e to only 0.8%<br />

<strong>and</strong> we do not expect an interest-rate cut until<br />

February <strong>2008</strong>. We have looked at the housing<br />

market’s grip on UK consumers, who have<br />

become too used to steady house-price inflation,<br />

which they have used as a proxy for saving. We<br />

believe that house-price declines will unnerve<br />

consumers’ propensity to spend. As for the<br />

pressures on household budgets, the<br />

incontrovertible conclusion is that inflation is<br />

rising on the non-discretionary side of household<br />

spending, which means even more pressure on the<br />

discretionary element, which fuels this sector.<br />

Food prices will be a particular pressure point.<br />

UK retailers head for troubled waters<br />

Equally worrying is the raft of cost pressures<br />

facing retailers <strong>and</strong> the possibility of adverse<br />

currency movements for a change. Retailers that<br />

have enjoyed (<strong>and</strong> continue to promise) gross<br />

margin expansion will be gasping for breath -<br />

clothing retailers are most exposed here, but gross<br />

margin optimism is also central to earnings<br />

growth expectations at, say, WH Smith (SMWH<br />

LN) <strong>and</strong> Home Retail (HOME LN). Therefore, we<br />

have recently cut our sales growth expectations<br />

for <strong>2008</strong>e for most of our UK retailing universe.<br />

Index view for UK market<br />

We held firm on our 7000 end-year FTSE 100<br />

index target throughout the July-August turmoil<br />

<strong>and</strong>, after the subsequent 700-point bounce, we<br />

see no reason to change it now. The reasons why<br />

we remain positive are also unchanged. Corporate<br />

profitability is as attractive as ever. The interestrate<br />

cycle appears to have peaked (certainly if rate<br />

expectations are any guide). And valuations,<br />

inexpensive even before the recent correction, in<br />

our view, look even more compelling now.<br />

Elsewhere, M&A activity may be down, but we<br />

think it’s far from out (trade buyers, petrodollarfinanced<br />

buyers <strong>and</strong> Asian FX reserve-financed<br />

buyers look likely c<strong>and</strong>idates to stimulate a reacceleration<br />

in activity going forward). In<br />

addition, pension funding levels, an ongoing<br />

concern for many, but not for us, are now moving<br />

sharply back into surplus. Within the broader UK<br />

market, we continue to prefer large <strong>caps</strong> over <strong>mid</strong><br />

<strong>and</strong> <strong>small</strong> <strong>caps</strong>. The large-cap theme appears to be<br />

gathering momentum. Since the start of the<br />

second quarter of this year, the FTSE 100 has<br />

outperformed the 250 by 7.5%.<br />

Key contact for UK stocks:<br />

David May<br />

Head of Equity Research, EMEA<br />

HSBC Bank plc<br />

+44 (0) 02079916781<br />

david.may@hsbcib.com<br />

Kevin Gardiner<br />

Head of Global Equity Strategy<br />

HSBC Bank plc (UK)<br />

+44 20 7991 6714<br />

kevin.gardiner@hsbcib.com<br />

18

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Main movers – UK <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

HSBC Smaller <strong>European</strong> Comp index (UK) – top performers*<br />

HSBC Smaller <strong>European</strong> Comp Index (UK) – worst performers*<br />

Top 10 companies Performance relative to index Top 10 companies Performance relative to index<br />

TANFIELD 199.7 NORTHERN ROCK -84.5<br />

CLIMATE EXCHANGE 166.7 AVIS EUROPE -58.0<br />

INTL FERRO METALS 126.0 PARAGON GROUP OF COS -57.1<br />

CORIN GROUP 108.3 CENTRAL AFRICAN MI -55.5<br />

LAVENDON GROUP 88.6 CAPITAL & REGIONAL -54.5<br />

SENIOR 73.7 DEBENHAMS -52.6<br />

AUTONOMY CORP 69.0 WOOLWORTHS GROUP -50.5<br />

AMEC 67.8 MAPELEY -49.3<br />

IMPERIAL ENERGY CO 66.4 SAVILLS -48.5<br />

GAME GROUP 61.4 RAYMARINE -48.4<br />

Source: HSBC, * (02.01.<strong>2007</strong> – 28.09.<strong>2007</strong>) Source: HSBC, * (02.01.<strong>2007</strong> – 28.09.<strong>2007</strong>)<br />

HSBC Smaller <strong>European</strong> Companies Index (all) versus HSBC<br />

Smaller <strong>European</strong> Companies Index (UK)<br />

FTSE100 versus FTSE350 (top 350 UK stocks)<br />

130<br />

110<br />

105<br />

100<br />

95<br />

90<br />

J an-07 Mar-07 M ay -07 Jul-07 Sep-07<br />

HSBC Smaller <strong>European</strong> Companies HSBC Sm aller <strong>European</strong> Companies (UK)<br />

125<br />

120<br />

115<br />

110<br />

105<br />

100<br />

95<br />

90<br />

Jan-07 Mar-07 May -07 Jul-07 Sep-07<br />

FTSE 100 FTSE 350<br />

Source: HSBC<br />

Source: Datastream<br />

HSBC Smaller <strong>European</strong> Companies Index (UK) – lowest PE<br />

HSBC Smaller <strong>European</strong> Companies Index (UK) – highest <strong>2007</strong>e<br />

dividend yield (payable in <strong>2008</strong>)<br />

Top 10 companies 12-month forward PE Top 10 companies 12-month forward net dividend yield<br />

RAB Capital Plc 8.4 x Woolworths Group 10.0%<br />

Johnson Service Group 8.5 x Drax Group PLC 9.7%<br />

Smiths News Plc 8.5 x Mapeley Ltd. 9.5%<br />

Pendragon 8.6 x Chesnara Plc 8.1%<br />

Brit Insurance Holdings 8.6 x Paragon Group Of Cies 8.0%<br />

Sports Direct International Plc 8.8 x Bradford And Bingley 7.7%<br />

Lupus Capital 8.8 x Pendragon 7.3%<br />

TT Electronics 8.9 x Electrocomponents 7.2%<br />

Johnston Press 9.0 x Provident Financial 7.1%<br />

SThree Plc 9.3 x Debenhams Plc 6.9%<br />

Source: HSBC, JCF<br />

Source: HSBC, JCF<br />

19

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong>cap<br />

stock <strong>picks</strong> for <strong>Q4</strong>/<strong>Q1</strong><br />

Best ideas from our French<br />

universe<br />

Ingenico is one of the world’s leading providers of<br />

payment solutions. The company has built up its<br />

position by adopting an aggressive, but carefully<br />

targeted acquisition policy. In the years to come,<br />

the company should benefit by upgrading its<br />

installed networks to EMV (Europay-Mastercard-<br />

Visa st<strong>and</strong>ard) <strong>and</strong> the rollout of electronic<br />

payment projects in emerging markets. Moreover,<br />

Ingenico has announced that negotiations to acquire<br />

Sagem Monetel (Safran group) are in their<br />

advanced stages. We see this as a strong potential<br />

driver of further margin improvement <strong>and</strong> value<br />

creation. Hence, we maintain our Overweight<br />

rating <strong>and</strong> DCF-based target price of EUR26,<br />

implying potential return of 21%.<br />

Séché Environnement is the third-largest player<br />

in waste management in France, far behind Suez<br />

<strong>and</strong> Véolia Environnement. Because of its <strong>small</strong>er<br />

size <strong>and</strong> more pure-play positioning, the company<br />

has been able to maintain sustained organic<br />

growth for the last 10 years (6-8% on average). Its<br />

recent acquisition of 33% of water management<br />

company Saur underpins the group’s aim to<br />

become a multi-services company. With this<br />

transaction, Séché should become the third-largest<br />

multi-utility player in France. We expect Séché to<br />

continue to benefit from a increasingly favourable<br />

regulatory environment <strong>and</strong> its ability to boost<br />

treatment capacity at a steady pace. We rate the<br />

stock Overweight, with a DCF-based target price<br />

of EUR138, implying 11% potential return.<br />

Teleperformance is a leading player in the<br />

outsourced call-centre market, ranked No.2 in the<br />

world after Convergys (United States). The group<br />

has increased its market share (3.2% calculated on<br />

2006 sales) with average organic growth of 9.5%<br />

pa over the past six years versus only 7.0% for the<br />

market. The company’s strong organic growth is<br />

combined with an active external growth policy,<br />

aimed at improving the group's geographic grid<br />

<strong>and</strong> presence in countries targeted for strategic<br />

expansion (the US, the UK, France <strong>and</strong><br />

Germany). After the capital increase in November<br />

2006 (EUR260m) <strong>and</strong> external growth, paid for in<br />

cash, the resulting financial leverage on the<br />

balance sheet is the main value driver for the<br />

company, in our view. Our DCF-based target<br />

price of EUR38 implies a potential return of 38%<br />

<strong>and</strong> justifies our Overweight rating.<br />

Best ideas from our German<br />

universe<br />

Carl Zeiss Meditec is a supplier of medical<br />

devices <strong>and</strong> services in the ophthalmology <strong>and</strong><br />

neuro/ENT-surgery business. With the recent<br />

acquisitions of Carl Zeiss Surgical, IOL Tech <strong>and</strong><br />

AcriTech, Carl Zeiss Meditec has widened its<br />

product portfolio in these areas. We see the high<br />

proportion of R&D expenses <strong>and</strong> the further<br />

development of the group’s sales network as<br />

supportive to the company’s further growth.<br />

20

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Based on our DCF model, we derive a target price<br />

of EUR19 <strong>and</strong> rate the stock Overweight,<br />

implying 27% potential return.<br />

Deutz is an independent manufacturer of diesel<br />

<strong>and</strong> gas engines, with a highly recognised br<strong>and</strong><br />

image. Following several years of restructuring,<br />

with a successful turnaround in 2002 <strong>and</strong> the<br />

recent disposal of the power systems division, the<br />

focus is now on the expansion of its compact<br />

engines division. We expect Deutz to outperform<br />

the market in terms of growth rates until 2009e<br />

driven by rising captive production volumes. Our<br />

DCF-based target price of EUR11 implies<br />

potential return of about 17% on a 12-month<br />

horizon. As our Neutral b<strong>and</strong> for non-volatile<br />

German stocks is 3.9-13.9%, we have an<br />

Overweight rating on the stock.<br />

Hochtief is a Germany-based construction service<br />

company, with a wide global offering: planning,<br />

financing, building <strong>and</strong> operating facilities. With its<br />

recent acquisition of aurelis (real-estate subsidiary<br />

of Deutsche Bahn), Hochtief gained access to a<br />

broad strategic platform from which it should gain<br />

access to project development <strong>and</strong> assetmanagement<br />

know-how. Moreover, we view<br />

Hochtief as being well positioned to benefit from<br />

the increasing market dem<strong>and</strong> for complex<br />

infrastructure <strong>and</strong> building projects, not only in<br />

emerging regions but also in developed countries<br />

(PPP, facilities management, project development).<br />

Our sum-of-the-parts valuation yields a fair value<br />

of EUR108 (up from EUR101 previously),<br />

implying potential return of 19% from the current<br />

share price. We rate the stock Overweight.<br />

Lanxess is a Germany-based global chemicals<br />

company with a broad portfolio of basic to fine<br />

chemicals <strong>and</strong> is among Europe’s major producers<br />

of chemical <strong>and</strong> polymer products. Lanxess has<br />

been transformed in record time from a merely<br />

profitable restructuring case into a ‘normal’<br />

specialty chemicals group, which is now on a<br />

profitability par with its <strong>European</strong> peers.<br />

However, the market still assigns a significant<br />

discount to Lanxess, of more than 20% based on<br />

<strong>2008</strong>-09e PE <strong>and</strong> EV/EBITDA multiples. As we<br />

do not see this discount as justified, we reiterate<br />

our Overweight rating on the stock, as well as our<br />

target price of EUR47, which implies a potential<br />

return of c32%.<br />

Best ideas from our Greek<br />

universe<br />

<strong>Fourlis</strong> Holdings is a holding company<br />

consisting of three main divisions: IKEA home<br />

furniture, Intersport sportswear retail <strong>and</strong> the<br />

wholesaling of electrical goods, with powerful<br />

br<strong>and</strong>s like Samsung <strong>and</strong> GE. The exclusive <strong>and</strong><br />

lucrative long-term IKEA franchise for Greece,<br />

Cyprus <strong>and</strong> Bulgaria is the company’s key asset.<br />

Moreover, <strong>Fourlis</strong> Holdings st<strong>and</strong>s to gain from<br />

the positive momentum of the exclusive Intersport<br />

franchise, which we believe is well placed to<br />

become one of the largest sportswear apparel<br />

retail chains in southeast Europe. We expect EPS<br />

CAGR of 42% for 2006-09e, primarily driven by<br />

new IKEA store rollouts. Based on our sum-ofthe-parts<br />

valuation, we reiterate our Overweight<br />

rating on the stock <strong>and</strong> raise our target price to<br />

EUR31.3 (from EUR25.5), implying 20%<br />

potential return.<br />

Metka is the leading electromechanical <strong>and</strong> metal<br />

construction company in Greece, actively engaged<br />

in the energy, defence <strong>and</strong> infrastructure sectors.<br />

Because of its excellent track record <strong>and</strong> expertise<br />

in energy projects, we are confident that Metka will<br />

be a major beneficiary of the upcoming<br />

liberalisation of the domestic energy market. In<br />

addition, cooperation agreements with Endesa,<br />

Helllenic Technodomiki <strong>and</strong> Alstom should provide<br />

a steady flow of business, in our view. We rate the<br />

stock Overweight, with a DCF-based target price of<br />

EUR20.5, implying 13% potential return.<br />

21

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Best ideas from our UK<br />

universe<br />

First Group is the UK’s largest bus operator<br />

(fourth-largest in London), with approximately<br />

9,000 buses, carrying 2.9m passengers every day. It<br />

is also the UK’s largest passenger rail franchise<br />

operator, with four franchises, one open access<br />

service <strong>and</strong> GB Railfreight. In North America, the<br />

combined First Student <strong>and</strong> Laidlaw business is c5x<br />

the size of its nearest competitor. As management<br />

recently confirmed the Laidlaw acquisition, our<br />

attention now turns to the integration process. We<br />

believe that there is still upside potential to<br />

synergies guidance. In our view, the market is still<br />

underestimating the value of Laidlaw <strong>and</strong> we<br />

remain Overweight, with an 810p target price based<br />

on our DCF sum-of-the-parts valuation, implying<br />

11% potential return.<br />

Spectris is involved in the development <strong>and</strong><br />

manufacture of a range of precision testing <strong>and</strong><br />

inspection instrumentation <strong>and</strong> control equipment<br />

which assists customers in improving the<br />

efficiency, quality <strong>and</strong> cost effectiveness of their<br />

production process. It is currently benefiting from<br />

a strong industrial backdrop in emerging<br />

economies, combined with buoyant market<br />

conditions in Europe; together these areas account<br />

for nearly two-thirds of group sales. In our view,<br />

Spectris shares remain inexpensive, trading on<br />

14.3x <strong>2008</strong>e EPS. This is a 5% valuation premium<br />

to its UK sector peers, but a 30% discount to its<br />

major US peer group. Our 1010p target price<br />

stems from our market-assessed cost of capitalbased<br />

valuation methodology. This implies<br />

potential return of 11% from the current share<br />

price, <strong>and</strong> our rating is Overweight.<br />

22

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Company profiles<br />

23

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Carl Zeiss Meditec<br />

Leading position in the medical devices <strong>and</strong> service market for<br />

ophthalmology <strong>and</strong> neuro/ENT surgery<br />

Recent AcriTec acquisition to strengthen IOL business<br />

Promising product launches should reanimate organic growth; TP<br />

EUR19, Overweight<br />

Investment summary<br />

Based in Germany, Carl Zeiss Meditech (CZM) is<br />

a globally operating specialist of integrated<br />

medical solutions. After recent acquisitions, it<br />

now focuses on four main divisions: in the<br />

ophthalmology field it has diagnosis <strong>and</strong> laser <strong>and</strong><br />

intraocular lenses (IOL) divisions; the other two<br />

divisions are neuro/ear, nose <strong>and</strong> throat (ENT)<br />

surgery <strong>and</strong> services. Regarding the nature of the<br />

addressed symptoms <strong>and</strong> diseases, demographic<br />

trends signal growing dem<strong>and</strong> for their respective<br />

treatments (eg, by the age of 80, c50% of all<br />

Americans suffer from cataracts, the most<br />

common cause of blindness).<br />

The company is operating in a very dynamic market.<br />

Owing to constantly improving technologies,<br />

diseases that were long inoperable can now be<br />

addressed <strong>and</strong> treated, generating strong growth<br />

opportunities. We expect the completed acquisitions<br />

of IOLtech, Carl Zeiss Surgical <strong>and</strong>, most recently,<br />

Acri.Tec will enable CZM to provide an enhanced<br />

product portfolio to clients. Moreover, we think the<br />

Acri.Tec acquisition should allow CZM to generate<br />

synergies at the cost <strong>and</strong> revenue levels.<br />

FY2006/9M <strong>2007</strong> results…<br />

The 9M figures (FY 2006/07) were strong, but<br />

slightly disappointed our bullish expectations. Sales<br />

were up 45.6% y-o-y (c52% excluding exchange<br />

rate effects) to EUR417.6m, mainly driven by the<br />

recent acquisitions. EBIT increased by 39% to<br />