European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Deutz<br />

Strong Q2 top-line momentum <strong>and</strong> substantial EBIT margin<br />

improvement in Compact Engines, despite ongoing production<br />

bottlenecks<br />

We expect stress factors to fully disappear in H2 <strong>2007</strong> <strong>and</strong> a<br />

return to the fore of the structural growth story - driven by OEM<br />

outsourcing<br />

10% premium for far above-average CAGR <strong>2007</strong>-09e of 17%, vs<br />

7% in our German Engineering universe. Overweight rating <strong>and</strong><br />

EUR11.0 target price remain unchanged<br />

Investment summary<br />

Top-line CAGR <strong>2007</strong>-09e of 17%<br />

Q2 <strong>2007</strong> results support our view that margin<br />

pressure, resulting from production bottlenecks is<br />

a temporary issue. We continue to believe that the<br />

structural growth story, which is driven by an<br />

OEM outsourcing trend on the back of steadily<br />

tightening emission thresholds, should again come<br />

to the fore. The recent disposal at an attractive<br />

price of the Power Systems division - which<br />

lacked synergies with the rapidly growing<br />

Compact Engines division - has further sharpened<br />

the company’s short-to-<strong>mid</strong>-term growth profile<br />

<strong>and</strong> also creates the financial scope to sufficiently<br />

exploit the considerable long term growth<br />

potential of compact engines. We now expect a<br />

<strong>2007</strong>-09 CAGR of 17% (10% before), far above<br />

the 4% average of the relevant market, above all<br />

driven by increasing captive production volumes.<br />

Underlying EBIT margin improving<br />

Q2 saw strong momentum in the remaining<br />

Compact Engines division (eg sales +43% y-o-y,<br />

EBIT +26%) <strong>and</strong> a substantial improvement of the<br />

EBIT margin, from 4% in <strong>Q1</strong> <strong>2007</strong> to 6%, despite<br />

ongoing production bottlenecks, which emerged in<br />

<strong>Q4</strong> 2006, due to much stronger-than-expected<br />

dem<strong>and</strong> (Q2 margin >7% if adjusted for the<br />

bottleneck impact).<br />

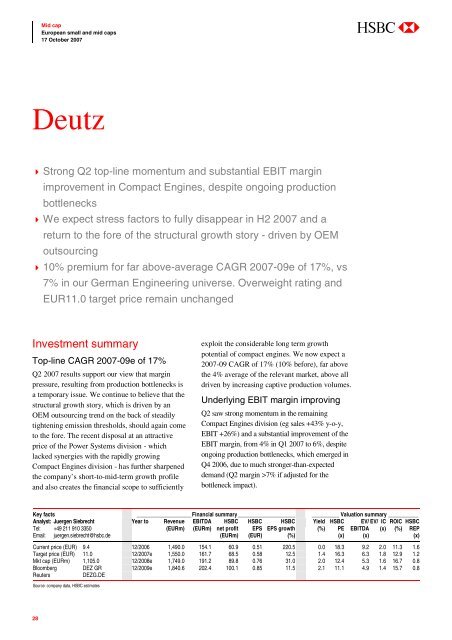

Key facts ____________________Financial summary _____________________ __________ Valuation summary ___________<br />

Analyst: Juergen Siebrecht<br />

Year to Revenue EBITDA HSBC HSBC HSBC Yield HSBC EV/ EV/ IC ROIC HSBC<br />

Tel: +49 211 910 3350<br />

(EURm) (EURm) net profit EPS EPS growth (%) PE EBITDA (x) (%) REP<br />

Email: juergen.siebrecht@hsbc.de<br />

(EURm) (EUR)<br />

(%)<br />

(x) (x)<br />

(x)<br />

Current price (EUR) 9.4 12/2006 1,490.0 154.1 60.9 0.51 220.5 0.0 18.3 9.2 2.0 11.3 1.6<br />

Target price (EUR) 11.0 12/<strong>2007</strong>e 1,550.0 161.7 68.5 0.58 12.5 1.4 16.3 6.3 1.8 12.9 1.2<br />

Mkt cap (EURm) 1,105.0 12/<strong>2008</strong>e 1,749.0 191.2 89.8 0.76 31.0 2.0 12.4 5.3 1.6 16.7 0.8<br />

Bloomberg DEZ GR 12/2009e 1,840.6 202.4 100.1 0.85 11.5 2.1 11.1 4.9 1.4 15.7 0.8<br />

Reuters<br />

DEZG.DE<br />

Source: company data, HSBC estimates<br />

28