European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

Spectris<br />

Market-leading niche supplier of testing <strong>and</strong> inspection equipment<br />

Robust dem<strong>and</strong> backdrop <strong>and</strong> restructuring should drive strong<br />

near-term EPS growth<br />

Rising CFROI <strong>and</strong> low cost of capital lead to 1,010p target price,<br />

reiterate Overweight rating<br />

Investment summary<br />

Spectris is a niche producer of testing <strong>and</strong><br />

inspection equipment, serving a broad range of<br />

end-markets <strong>and</strong> selling directly to a largely bluechip<br />

customer base. The group typically invests<br />

around 7% of sales in R&D <strong>and</strong> develops whollyowned<br />

intellectual property in order to<br />

differentiate itself on product excellence rather<br />

than price. Although the aftermarket represents a<br />

modest proportion of total sales (c25%), unlike<br />

many of its competitors Spectris is reluctant to<br />

sacrifice product margin in search of more stable<br />

service revenues.<br />

Market backdrop is especially robust<br />

The group is currently benefiting from a strong<br />

industrial backdrop in emerging economies,<br />

combined with buoyant market conditions in<br />

Continental Europe. Together, these areas account<br />

for nearly two-thirds of group sales. Medium-term<br />

dem<strong>and</strong> is underpinned by positive drivers for<br />

testing <strong>and</strong> inspection, supported by environmental<br />

regulation on emissions, noise, waste, <strong>and</strong> health<br />

<strong>and</strong> safety, for which trends are increasingly<br />

migrating towards developing markets.<br />

Furthermore, despite the group’s market exposure<br />

being fairly diverse, we estimate that process<br />

industries account for c50% of sales – this is an<br />

area where we forecast a 13% increase in capital<br />

investment over the next two years.<br />

Margins reaching respectable levels<br />

Historically, Spectris’ margins have been<br />

uninspiring, but management’s efforts have<br />

recently focused on enhancing profitability<br />

through recent restructuring initiatives <strong>and</strong><br />

disposals. As a result, we believe the group is now<br />

on course to meet <strong>mid</strong>-teens margin targets in FY<br />

<strong>2007</strong> (from 12.2% in FY 2006), despite<br />

substantial currency headwinds.<br />

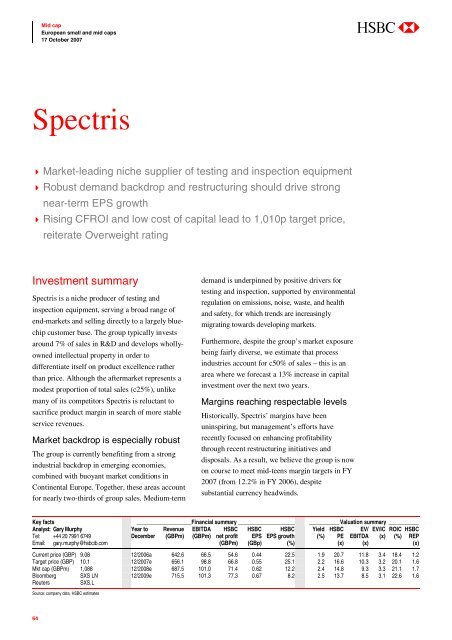

Key facts ____________________Financial summary _____________________ ___________ Valuation summary ___________<br />

Analyst: Gary Murphy<br />

Year to Revenue EBITDA HSBC HSBC HSBC Yield HSBC EV/ EV/IC ROIC HSBC<br />

Tel: +44 20 7991 6749<br />

December (GBPm) (GBPm) net profit EPS EPS growth (%) PE EBITDA (x) (%) REP<br />

Email: gary.murphy@hsbcib.com<br />

(GBPm) (GBp) (%)<br />

(x) (x)<br />

(x)<br />

Current price (GBP) 9.08 12/2006a 642.6 66.5 54.6 0.44 22.5 1.9 20.7 11.8 3.4 18.4 1.2<br />

Target price (GBP) 10.1 12/<strong>2007</strong>e 656.1 98.8 66.8 0.55 25.1 2.2 16.6 10.3 3.2 20.1 1.6<br />

Mkt cap (GBPm) 1,088 12/<strong>2008</strong>e 687.5 101.0 71.4 0.62 12.2 2.4 14.8 9.3 3.3 21.1 1.7<br />

Bloomberg SXS LN 12/2009e 715.5 101.3 77.3 0.67 8.2 2.5 13.7 8.5 3.1 22.6 1.6<br />

Reuters<br />

SXS.L<br />

Source: company data, HSBC estimates<br />

64