European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

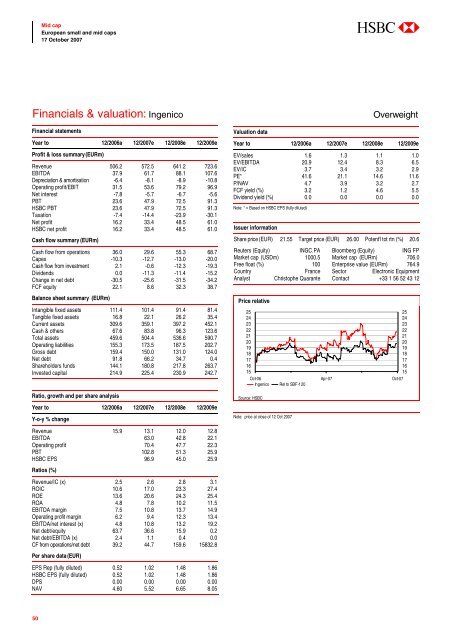

Financials & valuation: Ingenico<br />

Financial statements<br />

Year to 12/2006a 12/<strong>2007</strong>e 12/<strong>2008</strong>e 12/2009e<br />

Profit & loss summary (EURm)<br />

Revenue 506.2 572.5 641.2 723.6<br />

EBITDA 37.9 61.7 88.1 107.6<br />

Depreciation & amortisation -6.4 -8.1 -8.9 -10.8<br />

Operating profit/EBIT 31.5 53.6 79.2 96.9<br />

Net interest -7.8 -5.7 -6.7 -5.6<br />

PBT 23.6 47.9 72.5 91.3<br />

HSBC PBT 23.6 47.9 72.5 91.3<br />

Taxation -7.4 -14.4 -23.9 -30.1<br />

Net profit 16.2 33.4 48.5 61.0<br />

HSBC net profit 16.2 33.4 48.5 61.0<br />

Cash flow summary (EURm)<br />

Cash flow from operations 36.0 29.6 55.3 68.7<br />

Capex -10.3 -12.7 -13.0 -20.0<br />

Cash flow from investment 2.1 -0.6 -12.3 -19.3<br />

Dividends 0.0 -11.3 -11.4 -15.2<br />

Change in net debt -30.5 -25.6 -31.5 -34.2<br />

FCF equity 22.1 8.6 32.3 38.7<br />

Balance sheet summary (EURm)<br />

Intangible fixed assets 111.4 101.4 91.4 81.4<br />

Tangible fixed assets 16.8 22.1 26.2 35.4<br />

Current assets 309.6 359.1 397.2 452.1<br />

Cash & others 67.6 83.8 96.3 123.6<br />

Total assets 459.6 504.4 536.6 590.7<br />

Operating liabilities 155.3 173.5 187.5 202.7<br />

Gross debt 159.4 150.0 131.0 124.0<br />

Net debt 91.8 66.2 34.7 0.4<br />

Shareholders funds 144.1 180.8 217.8 263.7<br />

Invested capital 214.9 225.4 230.9 242.7<br />

Ratio, growth <strong>and</strong> per share analysis<br />

Year to 12/2006a 12/<strong>2007</strong>e 12/<strong>2008</strong>e 12/2009e<br />

Y-o-y % change<br />

Revenue 15.9 13.1 12.0 12.8<br />

EBITDA 63.0 42.8 22.1<br />

Operating profit 70.4 47.7 22.3<br />

PBT 102.8 51.3 25.9<br />

HSBC EPS 96.9 45.0 25.9<br />

Ratios (%)<br />

Revenue/IC (x) 2.5 2.6 2.8 3.1<br />

ROIC 10.6 17.0 23.3 27.4<br />

ROE 13.6 20.6 24.3 25.4<br />

ROA 4.8 7.8 10.2 11.5<br />

EBITDA margin 7.5 10.8 13.7 14.9<br />

Operating profit margin 6.2 9.4 12.3 13.4<br />

EBITDA/net interest (x) 4.8 10.8 13.2 19.2<br />

Net debt/equity 63.7 36.6 15.9 0.2<br />

Net debt/EBITDA (x) 2.4 1.1 0.4 0.0<br />

CF from operations/net debt 39.2 44.7 159.6 15832.8<br />

Per share data (EUR)<br />

EPS Rep (fully diluted) 0.52 1.02 1.48 1.86<br />

HSBC EPS (fully diluted) 0.52 1.02 1.48 1.86<br />

DPS 0.00 0.00 0.00 0.00<br />

NAV 4.60 5.52 6.65 8.05<br />

Valuation data<br />

Overweight<br />

Year to 12/2006a 12/<strong>2007</strong>e 12/<strong>2008</strong>e 12/2009e<br />

EV/sales 1.6 1.3 1.1 1.0<br />

EV/EBITDA 20.9 12.4 8.3 6.5<br />

EV/IC 3.7 3.4 3.2 2.9<br />

PE* 41.6 21.1 14.6 11.6<br />

P/NAV 4.7 3.9 3.2 2.7<br />

FCF yield (%) 3.2 1.2 4.6 5.5<br />

Dividend yield (%) 0.0 0.0 0.0 0.0<br />

Note: * = Based on HSBC EPS (fully diluted)<br />

Issuer information<br />

Share price (EUR) 21.55 Target price (EUR) 26.00 Potent'l tot rtn (%) 20.6<br />

Reuters (Equity) INGC.PA Bloomberg (Equity) ING FP<br />

Market cap (USDm) 1000.5 Market cap (EURm) 706.0<br />

Free float (%) 100 Enterprise value (EURm) 764.9<br />

Country France Sector Electronic Equipment<br />

Analyst Christophe Quarante Contact +33 1 56 52 43 12<br />

Price relative<br />

25<br />

24<br />

23<br />

22<br />

21<br />

20<br />

19<br />

18<br />

17<br />

16<br />

15<br />

Oct-06 Apr-07 Oct-07<br />

Ingenico Rel to SBF-120<br />

Source: HSBC<br />

Note: price at close of 12 Oct <strong>2007</strong><br />

25<br />

24<br />

23<br />

22<br />

21<br />

20<br />

19<br />

18<br />

17<br />

16<br />

15<br />

50