European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

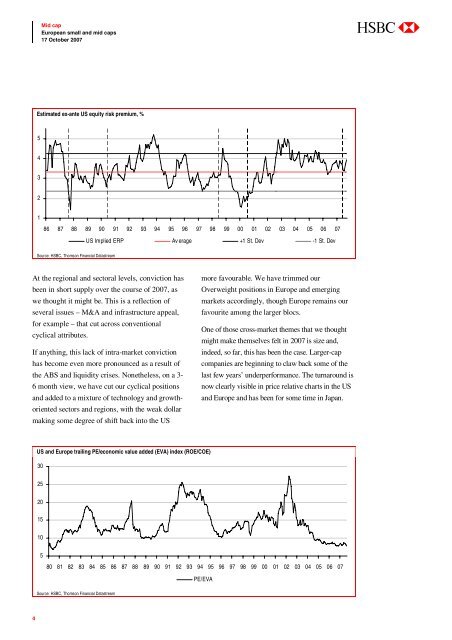

Estimated ex-ante US equity risk premium, %<br />

5<br />

4<br />

3<br />

2<br />

1<br />

86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07<br />

US Implied ERP Av erage +1 St. Dev -1 St. Dev<br />

Source: HSBC, Thomson Financial Datastream<br />

At the regional <strong>and</strong> sectoral levels, conviction has<br />

been in short supply over the course of <strong>2007</strong>, as<br />

we thought it might be. This is a reflection of<br />

several issues – M&A <strong>and</strong> infrastructure appeal,<br />

for example – that cut across conventional<br />

cyclical attributes.<br />

If anything, this lack of intra-market conviction<br />

has become even more pronounced as a result of<br />

the ABS <strong>and</strong> liquidity crises. Nonetheless, on a 3-<br />

6 month view, we have cut our cyclical positions<br />

<strong>and</strong> added to a mixture of technology <strong>and</strong> growthoriented<br />

sectors <strong>and</strong> regions, with the weak dollar<br />

making some degree of shift back into the US<br />

more favourable. We have trimmed our<br />

Overweight positions in Europe <strong>and</strong> emerging<br />

markets accordingly, though Europe remains our<br />

favourite among the larger blocs.<br />

One of those cross-market themes that we thought<br />

might make themselves felt in <strong>2007</strong> is size <strong>and</strong>,<br />

indeed, so far, this has been the case. Larger-cap<br />

companies are beginning to claw back some of the<br />

last few years’ underperformance. The turnaround is<br />

now clearly visible in price relative charts in the US<br />

<strong>and</strong> Europe <strong>and</strong> has been for some time in Japan.<br />

US <strong>and</strong> Europe trailing PE/economic value added (EVA) index (ROE/COE)<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07<br />

PE/EVA<br />

Source: HSBC, Thomson Financial Datastream<br />

4