European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

We expect large <strong>caps</strong> to continue to outperform.<br />

Larger companies tend to be less dependent on the<br />

vagaries of the business cycle, partly by virtue of<br />

their greater international diversification. They<br />

have stronger balance sheets <strong>and</strong> are likely to be<br />

relatively sheltered from any residual liquidity<br />

pressures. When M&A revives, we suspect its<br />

focus will shift upscale – partly because private<br />

equity may become a little less prominent <strong>and</strong><br />

partly because many of the potential targets in the<br />

<strong>small</strong>/<strong>mid</strong>-cap space have already been snapped<br />

up <strong>and</strong>/or have become too expensive. Recently,<br />

large <strong>caps</strong> have been trading more cheaply than<br />

<strong>small</strong> <strong>and</strong> <strong>mid</strong>-cap companies, both in terms of<br />

PEs <strong>and</strong> dividend yields.<br />

And not all large <strong>caps</strong> look equally attractive.<br />

Most utilities, for example, are large simply by<br />

virtue of their physical assets <strong>and</strong> their earnings<br />

are non-cyclical. However, for us, their earnings<br />

are too defensive, their balance sheets are not the<br />

strongest <strong>and</strong> there has already been a wave of<br />

consolidation in the sector, so we see less<br />

consolidation to look forward to. There are many<br />

<strong>small</strong> technology companies, for example, that we<br />

would buy ahead of larger utilities.<br />

Other things being equal, though, we think investors<br />

will continue to ‘think big’ over the course of the rest<br />

of <strong>2007</strong> <strong>and</strong> into <strong>2008</strong>.<br />

As with other intra-market themes, however, we<br />

do not expect size to prove overwhelmingly<br />

important: we simply expect <strong>small</strong>er-cap indices<br />

to rise less markedly than their large-cap peers.<br />

Some of the post-2000 outperformance by <strong>mid</strong> <strong>and</strong><br />

<strong>small</strong> <strong>caps</strong> has reflected a structural decision by<br />

many money managers to increase their exposure<br />

to what they see as relatively under-researched<br />

<strong>and</strong>, hence (arguably), less efficiently priced<br />

segments of the global market. Smaller <strong>caps</strong> –<br />

together with emerging markets, their regional<br />

equivalents, perhaps – have benefited accordingly.<br />

This shift is unlikely to be reversed any time soon,<br />

in our opinion.<br />

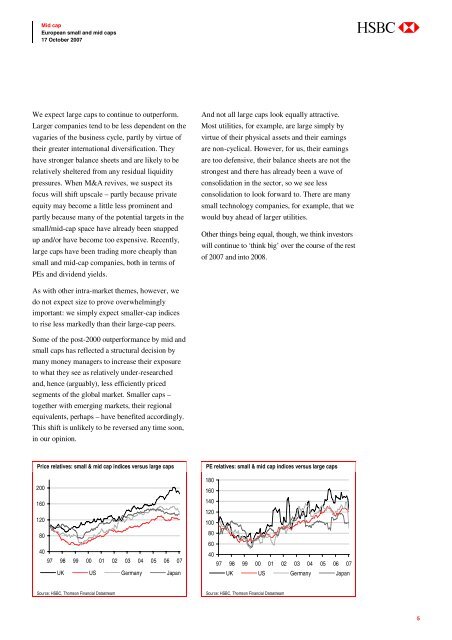

Price relatives: <strong>small</strong> & <strong>mid</strong> cap indices versus large <strong>caps</strong><br />

200<br />

160<br />

120<br />

80<br />

40<br />

97 98 99 00 01 02 03 04 05 06 07<br />

UK US Germany Japan<br />

PE relatives: <strong>small</strong> & <strong>mid</strong> cap indices versus large <strong>caps</strong><br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

97 98 99 00 01 02 03 04 05 06 07<br />

UK US Germany Japan<br />

Source: HSBC, Thomson Financial Datastream<br />

Source: HSBC, Thomson Financial Datastream<br />

5