Declaration under section 197A(1) of the Income-tax Act ... - Sa-Dhan

Declaration under section 197A(1) of the Income-tax Act ... - Sa-Dhan

Declaration under section 197A(1) of the Income-tax Act ... - Sa-Dhan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

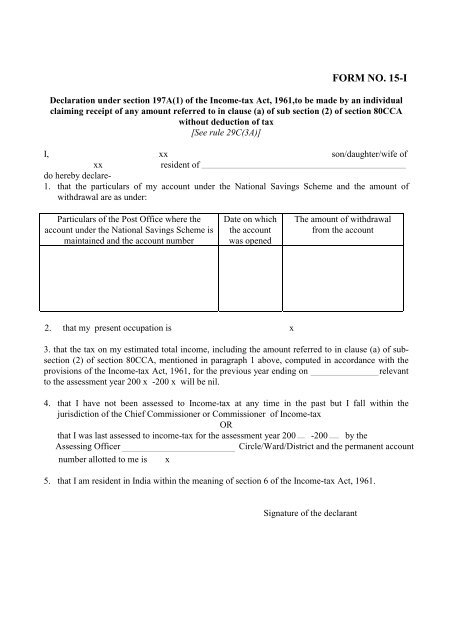

FormNumber 15-I FormSection <strong>197A</strong>(1) FormLaw <strong>Income</strong> Tax & Direct Tax FORM NO. 15-I<br />

FormTitle <strong>Declaration</strong> <strong>under</strong> <strong>section</strong> <strong>197A</strong>(1) <strong>of</strong> <strong>the</strong> <strong>Income</strong>-<strong>tax</strong> <strong>Act</strong>, 1961,to be made by an individual claiming receipt<br />

<strong>Declaration</strong> <strong>under</strong> <strong>section</strong> <strong>197A</strong>(1) <strong>of</strong> <strong>the</strong> <strong>Income</strong>-<strong>tax</strong> <strong>Act</strong>, 1961,to be made by an individual<br />

claiming receipt <strong>of</strong> any amount referred to in clause (a) <strong>of</strong> sub <strong>section</strong> (2) <strong>of</strong> <strong>section</strong> 80CCA<br />

without deduction <strong>of</strong> <strong>tax</strong><br />

[See rule 29C(3A)] FormParent<strong>Act</strong> <strong>Income</strong>Tax <strong>Act</strong>, 1961<br />

<strong>of</strong> any amount referred to in clause (a) <strong>of</strong> sub <strong>section</strong> (2) <strong>of</strong> <strong>section</strong> 80CCA without deduction <strong>of</strong> <strong>tax</strong><br />

I, xx son/daughter/wife <strong>of</strong><br />

xx resident <strong>of</strong> xx<br />

do hereby declare-<br />

1. that <strong>the</strong> particulars <strong>of</strong> my account <strong>under</strong> <strong>the</strong> National <strong>Sa</strong>vings Scheme and <strong>the</strong> amount <strong>of</strong><br />

withdrawal are as <strong>under</strong>:<br />

Particulars <strong>of</strong> <strong>the</strong> Post Office where <strong>the</strong><br />

account <strong>under</strong> <strong>the</strong> National <strong>Sa</strong>vings Scheme is<br />

maintained and <strong>the</strong> account number<br />

Date on which<br />

<strong>the</strong> account<br />

was opened<br />

The amount <strong>of</strong> withdrawal<br />

from <strong>the</strong> account<br />

2. that my present occupation is x<br />

3. that <strong>the</strong> <strong>tax</strong> on my estimated total income, including <strong>the</strong> amount referred to in clause (a) <strong>of</strong> sub<strong>section</strong><br />

(2) <strong>of</strong> <strong>section</strong> 80CCA, mentioned in paragraph 1 above, computed in accordance with <strong>the</strong><br />

provisions <strong>of</strong> <strong>the</strong> <strong>Income</strong>-<strong>tax</strong> <strong>Act</strong>, 1961, for <strong>the</strong> previous year ending on x relevant<br />

to <strong>the</strong> assessment year 200 x -200 x will be nil.<br />

4. that I have not been assessed to <strong>Income</strong>-<strong>tax</strong> at any time in <strong>the</strong> past but I fall within <strong>the</strong><br />

jurisdiction <strong>of</strong> <strong>the</strong> Chief Commissioner or Commissioner <strong>of</strong> <strong>Income</strong>-<strong>tax</strong><br />

OR<br />

that I was last assessed to income-<strong>tax</strong> for <strong>the</strong> assessment year 200 -200 by <strong>the</strong><br />

Assessing Officer x Circle/Ward/District and <strong>the</strong> permanent account<br />

number allotted to me is x<br />

5. that I am resident in India within <strong>the</strong> meaning <strong>of</strong> <strong>section</strong> 6 <strong>of</strong> <strong>the</strong> <strong>Income</strong>-<strong>tax</strong> <strong>Act</strong>, 1961.<br />

Signature <strong>of</strong> <strong>the</strong> declarant

VERIFICATION<br />

I, xx do hereby declare<br />

that to <strong>the</strong> best <strong>of</strong> my knowledge and belief what is stated above is correct, complete and is truly<br />

stated.<br />

Verified today, <strong>the</strong> x day <strong>of</strong> x 200 x<br />

Place<br />

x<br />

Signature <strong>of</strong> <strong>the</strong> declarant<br />

[FOR USE BY THE PERSON TO WHOM THE DECLARATION IS FURNISHED]<br />

1<br />

.<br />

2<br />

.<br />

3<br />

.<br />

Name and address <strong>of</strong> <strong>the</strong> person responsible<br />

for paying <strong>the</strong> amount referred to in clause<br />

(a) <strong>of</strong> sub <strong>section</strong> ( 2) <strong>of</strong> <strong>section</strong> 80 CCA.<br />

Date on which <strong>the</strong> declaration was furnished<br />

by <strong>the</strong> declarant<br />

Amount and date <strong>of</strong> withdrawal from account<br />

number .......... <strong>under</strong> <strong>the</strong> National <strong>Sa</strong>ving<br />

Scheme<br />

xx<br />

x<br />

x<br />

Forward to <strong>the</strong> chief Commissioner or Commissioner <strong>of</strong> <strong>Income</strong> Tax ...............<br />

Place..................<br />

Date.................<br />

Signature <strong>of</strong> <strong>the</strong> person responsible for<br />

paying any amount referred to in clause<br />

(a) <strong>of</strong> sub <strong>section</strong> (2) <strong>of</strong> <strong>section</strong> 80<br />

CCA