Banking Services - DenizBank

Banking Services - DenizBank

Banking Services - DenizBank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Section IV Independent Audit Reports, Financial Statements and Notes<br />

DENİZBANK ANONİM ŞİRKETİ<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

AS OF 31 DECEMBER 2009<br />

(Currency: Thousands of TRY-Turkish Lira)<br />

Convenience Translation of<br />

Consolidated Financial Report<br />

Originally Issued in Turkish, See Note 3.I.2<br />

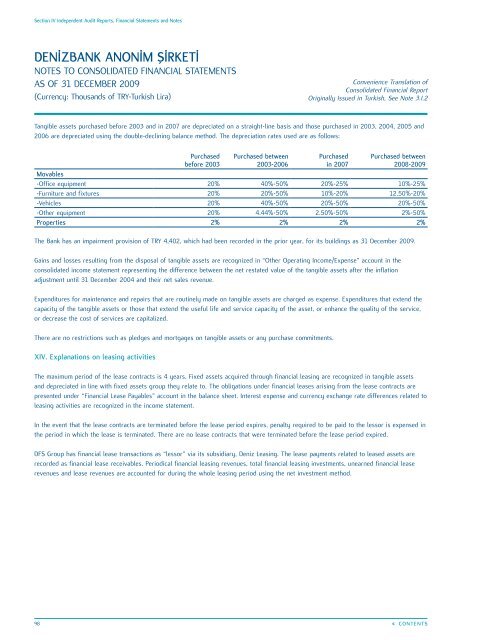

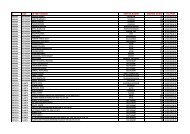

Tangible assets purchased before 2003 and in 2007 are depreciated on a straight-line basis and those purchased in 2003, 2004, 2005 and<br />

2006 are depreciated using the double-declining balance method. The depreciation rates used are as follows:<br />

Purchased<br />

before 2003<br />

Purchased between<br />

2003-2006<br />

Purchased<br />

in 2007<br />

Purchased between<br />

2008-2009<br />

Movables<br />

-Office equipment 20% 40%-50% 20%-25% 10%-25%<br />

-Furniture and fixtures 20% 20%-50% 10%-20% 12.50%-20%<br />

-Vehicles 20% 40%-50% 20%-50% 20%-50%<br />

-Other equipment 20% 4.44%-50% 2.50%-50% 2%-50%<br />

Properties 2% 2% 2% 2%<br />

The Bank has an impairment provision of TRY 4,402, which had been recorded in the prior year, for its buildings as 31 December 2009.<br />

Gains and losses resulting from the disposal of tangible assets are recognized in “Other Operating Income/Expense” account in the<br />

consolidated income statement representing the difference between the net restated value of the tangible assets after the inflation<br />

adjustment until 31 December 2004 and their net sales revenue.<br />

Expenditures for maintenance and repairs that are routinely made on tangible assets are charged as expense. Expenditures that extend the<br />

capacity of the tangible assets or those that extend the useful life and service capacity of the asset, or enhance the quality of the service,<br />

or decrease the cost of services are capitalized.<br />

There are no restrictions such as pledges and mortgages on tangible assets or any purchase commitments.<br />

XIV. Explanations on leasing activities<br />

The maximum period of the lease contracts is 4 years. Fixed assets acquired through financial leasing are recognized in tangible assets<br />

and depreciated in line with fixed assets group they relate to. The obligations under financial leases arising from the lease contracts are<br />

presented under “Financial Lease Payables” account in the balance sheet. Interest expense and currency exchange rate differences related to<br />

leasing activities are recognized in the income statement.<br />

In the event that the lease contracts are terminated before the lease period expires, penalty required to be paid to the lessor is expensed in<br />

the period in which the lease is terminated. There are no lease contracts that were terminated before the lease period expired.<br />

DFS Group has financial lease transactions as “lessor” via its subsidiary, Deniz Leasing. The lease payments related to leased assets are<br />

recorded as financial lease receivables. Periodical financial leasing revenues, total financial leasing investments, unearned financial lease<br />

revenues and lease revenues are accounted for during the whole leasing period using the net investment method.<br />

98<br />

«« CONTENTS