Banking Services - DenizBank

Banking Services - DenizBank

Banking Services - DenizBank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

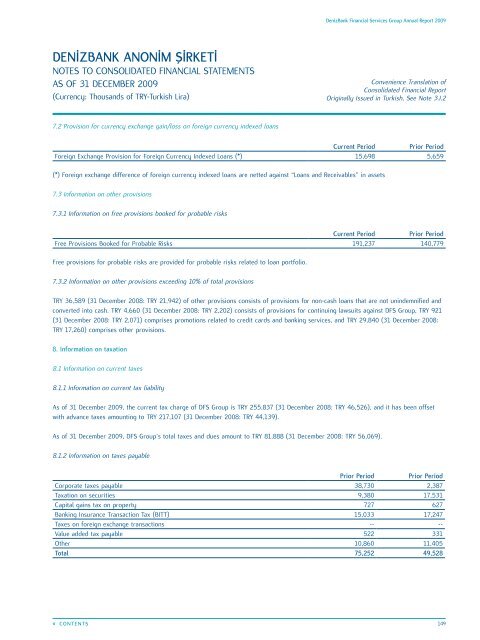

<strong>DenizBank</strong> Financial <strong>Services</strong> Group Annual Report 2009<br />

DENİZBANK ANONİM ŞİRKETİ<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

AS OF 31 DECEMBER 2009<br />

(Currency: Thousands of TRY-Turkish Lira)<br />

Convenience Translation of<br />

Consolidated Financial Report<br />

Originally Issued in Turkish, See Note 3.I.2<br />

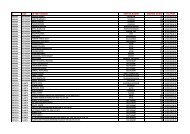

7.2 Provision for currency exchange gain/loss on foreign currency indexed loans<br />

Current Period Prior Period<br />

Foreign Exchange Provision for Foreign Currency Indexed Loans (*) 15,698 5,659<br />

(*) Foreign exchange difference of foreign currency indexed loans are netted against “Loans and Receivables” in assets<br />

7.3 Information on other provisions<br />

7.3.1 Information on free provisions booked for probable risks<br />

Current Period Prior Period<br />

Free Provisions Booked for Probable Risks 191,237 140,779<br />

Free provisions for probable risks are provided for probable risks related to loan portfolio.<br />

7.3.2 Information on other provisions exceeding 10% of total provisions<br />

TRY 36,589 (31 December 2008: TRY 21,942) of other provisions consists of provisions for non-cash loans that are not unindemnified and<br />

converted into cash. TRY 4,660 (31 December 2008: TRY 2,202) consists of provisions for continuing lawsuits against DFS Group, TRY 921<br />

(31 December 2008: TRY 2,071) comprises promotions related to credit cards and banking services, and TRY 29,840 (31 December 2008:<br />

TRY 17,260) comprises other provisions.<br />

8. Information on taxation<br />

8.1 Information on current taxes<br />

8.1.1 Information on current tax liability<br />

As of 31 December 2009, the current tax charge of DFS Group is TRY 255,837 (31 December 2008: TRY 46,526), and it has been offset<br />

with advance taxes amounting to TRY 217,107 (31 December 2008: TRY 44,139).<br />

As of 31 December 2009, DFS Group’s total taxes and dues amount to TRY 81,888 (31 December 2008: TRY 56,069).<br />

8.1.2 Information on taxes payable<br />

Prior Period Prior Period<br />

Corporate taxes payable 38,730 2,387<br />

Taxation on securities 9,380 17,531<br />

Capital gains tax on property 727 627<br />

<strong>Banking</strong> Insurance Transaction Tax (BITT) 15,033 17,247<br />

Taxes on foreign exchange transactions -- --<br />

Value added tax payable 522 331<br />

Other 10,860 11,405<br />

Total 75,252 49,528<br />

«« CONTENTS<br />

149