Banking Services - DenizBank

Banking Services - DenizBank

Banking Services - DenizBank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Section I Introduction<br />

<strong>Banking</strong> <strong>Services</strong><br />

Retail <strong>Banking</strong> Group<br />

The Retail <strong>Banking</strong> Department increased the number<br />

of active customers by offering its customers the<br />

Group’s entire retail product portfolio.<br />

Retail <strong>Banking</strong><br />

The Retail <strong>Banking</strong> Department offers its<br />

customers all of the Group’s retail products<br />

with the highest quality standards at every<br />

point of contact between the customers<br />

and the Bank. Thanks to this approach,<br />

<strong>DenizBank</strong> registered an 17% increase in<br />

the number of her retail banking customers<br />

in 2009.<br />

In 2009, <strong>DenizBank</strong> achieved a 23% growth<br />

in the number of “active” customers who<br />

prefer the Bank for their daily banking<br />

needs and general purpose loans, as well<br />

as in the number of general purpose loans<br />

made to these customers.<br />

Retail <strong>Banking</strong> Products and<br />

Performances<br />

Deposits<br />

<strong>DenizBank</strong> offers a range of products to<br />

her customers to invest their savings based<br />

on their preferred level of risk and needs.<br />

The Bank’s customer deposit volume grew<br />

by 16% in 2009.<br />

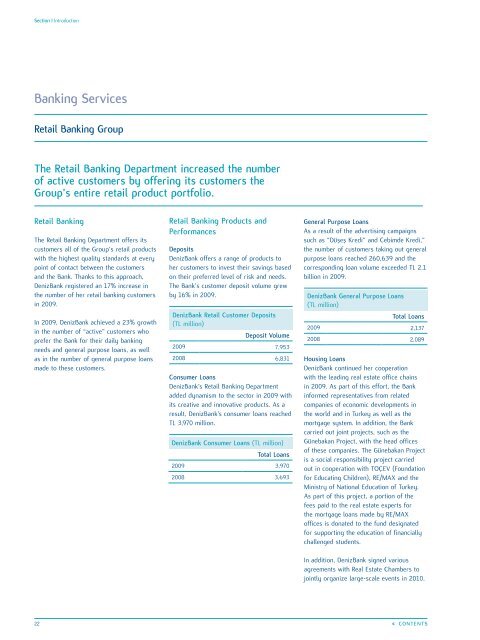

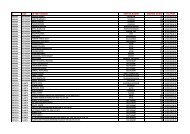

<strong>DenizBank</strong> Retail Customer Deposits<br />

(TL million)<br />

Deposit Volume<br />

2009 7,953<br />

2008 6,831<br />

Consumer Loans<br />

<strong>DenizBank</strong>’s Retail <strong>Banking</strong> Department<br />

added dynamism to the sector in 2009 with<br />

its creative and innovative products. As a<br />

result, <strong>DenizBank</strong>’s consumer loans reached<br />

TL 3,970 million.<br />

<strong>DenizBank</strong> Consumer Loans (TL million)<br />

Total Loans<br />

2009 3,970<br />

2008 3,693<br />

General Purpose Loans<br />

As a result of the advertising campaigns<br />

such as “Düşeş Kredi” and Cebimde Kredi,”<br />

the number of customers taking out general<br />

purpose loans reached 260,639 and the<br />

corresponding loan volume exceeded TL 2.1<br />

billion in 2009.<br />

<strong>DenizBank</strong> General Purpose Loans<br />

(TL million)<br />

Total Loans<br />

2009 2,137<br />

2008 2,089<br />

Housing Loans<br />

<strong>DenizBank</strong> continued her cooperation<br />

with the leading real estate office chains<br />

in 2009. As part of this effort, the Bank<br />

informed representatives from related<br />

companies of economic developments in<br />

the world and in Turkey as well as the<br />

mortgage system. In addition, the Bank<br />

carried out joint projects, such as the<br />

Günebakan Project, with the head offices<br />

of these companies. The Günebakan Project<br />

is a social responsibility project carried<br />

out in cooperation with TOÇEV (Foundation<br />

for Educating Children), RE/MAX and the<br />

Ministry of National Education of Turkey.<br />

As part of this project, a portion of the<br />

fees paid to the real estate experts for<br />

the mortgage loans made by RE/MAX<br />

offices is donated to the fund designated<br />

for supporting the education of financially<br />

challenged students.<br />

In addition, <strong>DenizBank</strong> signed various<br />

agreements with Real Estate Chambers to<br />

jointly organize large-scale events in 2010.<br />

22<br />

«« CONTENTS