Banking Services - DenizBank

Banking Services - DenizBank

Banking Services - DenizBank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

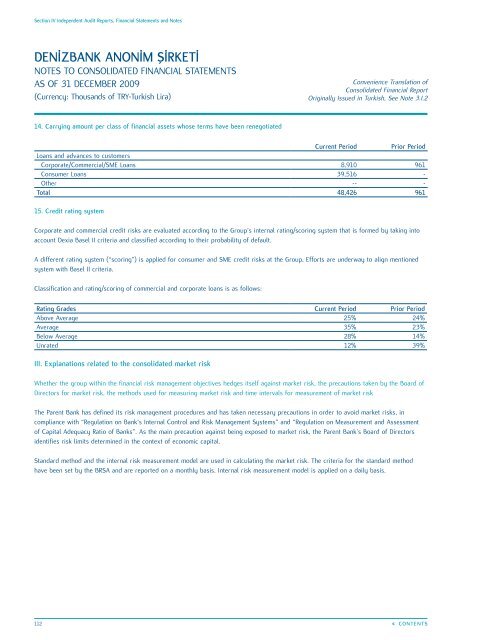

Section IV Independent Audit Reports, Financial Statements and Notes<br />

DENİZBANK ANONİM ŞİRKETİ<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

AS OF 31 DECEMBER 2009<br />

(Currency: Thousands of TRY-Turkish Lira)<br />

Convenience Translation of<br />

Consolidated Financial Report<br />

Originally Issued in Turkish, See Note 3.I.2<br />

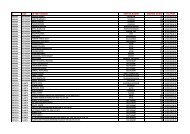

14. Carrying amount per class of financial assets whose terms have been renegotiated<br />

Current Period Prior Period<br />

Loans and advances to customers<br />

Corporate/Commercial/SME Loans 8,910 961<br />

Consumer Loans 39,516 -<br />

Other -- -<br />

Total 48,426 961<br />

15. Credit rating system<br />

Corporate and commercial credit risks are evaluated according to the Group’s internal rating/scoring system that is formed by taking into<br />

account Dexia Basel II criteria and classified according to their probability of default.<br />

A different rating system (“scoring”) is applied for consumer and SME credit risks at the Group. Efforts are underway to align mentioned<br />

system with Basel II criteria.<br />

Classification and rating/scoring of commercial and corporate loans is as follows:<br />

Rating Grades Current Period Prior Period<br />

Above Average 25% 24%<br />

Average 35% 23%<br />

Below Average 28% 14%<br />

Unrated 12% 39%<br />

III. Explanations related to the consolidated market risk<br />

Whether the group within the financial risk management objectives hedges itself against market risk, the precautions taken by the Board of<br />

Directors for market risk, the methods used for measuring market risk and time intervals for measurement of market risk<br />

The Parent Bank has defined its risk management procedures and has taken necessary precautions in order to avoid market risks, in<br />

compliance with “Regulation on Bank’s Internal Control and Risk Management Systems” and “Regulation on Measurement and Assessment<br />

of Capital Adequacy Ratio of Banks”. As the main precaution against being exposed to market risk, the Parent Bank’s Board of Directors<br />

identifies risk limits determined in the context of economic capital.<br />

Standard method and the internal risk measurement model are used in calculating the market risk. The criteria for the standard method<br />

have been set by the BRSA and are reported on a monthly basis. Internal risk measurement model is applied on a daily basis.<br />

112<br />

«« CONTENTS