AJ Lucas Group annual report 2007-08

AJ Lucas Group annual report 2007-08

AJ Lucas Group annual report 2007-08

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Environmental regulations<br />

and native title<br />

As infrastructure engineers, meeting stringent environmental and land<br />

use regulations, including native title issues, are an important element<br />

of our work. <strong>Lucas</strong> is committed to identifying environmental risks and<br />

engineering solutions to avoid, minimise or mitigate them. We work<br />

closely with all levels of government, landholders, Aboriginal land<br />

councils and other bodies to ensure our activities have minimal or no<br />

effect on land use and areas of environmental, archaeological or cultural<br />

importance. One of the key benefits of directional drilling is its ability to<br />

avoid or substantially mitigate environmental impact.<br />

<strong>Group</strong> policy requires all operations to be conducted in a manner that<br />

will preserve and protect the environment.<br />

At PEL285 in the Gloucester Basin, the <strong>Group</strong> holds together with its<br />

joint venture partner, two bore licence certificates under the Water Act<br />

1912, for the drainage of water from the production wells.<br />

The directors are not aware of any significant environmental incidents, or<br />

breaches of environmental regulations during or since the end of the year.<br />

Events subsequent to <strong>report</strong>ing date<br />

On 23 July 20<strong>08</strong>, the Company purchased the business of Mitchell<br />

Drilling, the largest specialist drilling company for the coal seam gas<br />

industry in Queensland. The purchase price of $150 million was funded<br />

by a $15 million equity placement to the vendor, with the balance out<br />

of an equity placement to institutional shareholders of $29.15 million,<br />

deferred consideration of $15 million and increased borrowing facilities.<br />

At the same time, the <strong>Group</strong>’s bank facilities have been renegotiated and<br />

their terms extended.<br />

Subsequent to year-end, the directors have declared a final ordinary<br />

dividend of 4.5¢ per share, franked to 15%.<br />

Other than these matters, there has not arisen in the interval between<br />

the end of the financial year and the date of this <strong>report</strong> any item,<br />

transaction or event of a material or unusual nature likely, in the opinion<br />

of the directors of the Company, to affect significantly the operations of the<br />

<strong>Group</strong>, the results of those operations, or the state of affairs of the <strong>Group</strong>,<br />

in future financial years.<br />

Likely developments<br />

The <strong>Group</strong> has successfully established itself as the leading service<br />

provider in each of its chosen activities. Its strategy of being an integrated<br />

service provider to the resources water and wastewater, oil and gas<br />

and property sectors presents many opportunities to leverage its service<br />

offering.<br />

The coal seam gas industry is expected to experience significant growth<br />

in preparation for the proposed export of LNG through Gladstone, <strong>AJ</strong> <strong>Lucas</strong><br />

is the only company with the full service capability to provide technical<br />

services, drilling and management services, well head completions,<br />

work overs, well services, gas gathering systems through to pipelines to<br />

market. This gives the <strong>Group</strong> a significant strategic advantage over all its<br />

competitors. The acquisition of Mitchell Drilling strengthens this capability<br />

through adding additional capacity, customer contacts, drilling expertise<br />

and management depth. The <strong>Group</strong> will continue to invest in additional<br />

plant and equipment to provide it with the extra capacity to service the<br />

expected increase in demand from the coal seam gas producers.<br />

The complementary nature of the <strong>Group</strong>’s activities will also be<br />

drawn upon to undertake civil works for the infrastructure works<br />

to be undertaken by the pipeline division. Partnering with selected<br />

entities through joint ventures and alliances, and the development and<br />

application of innovative technology and practices, are expected to create<br />

opportunities to apply the <strong>Group</strong>’s civil works expertise.<br />

The <strong>Group</strong> also intends to restructure its coal seam gas interests to<br />

provide investor transparency to their underlying value. The form of this<br />

restructuring is yet to be determined but will relieve the <strong>Group</strong> of any<br />

direct funding obligation, in particular in respect to Gloucester Basin, as<br />

the investment projects move into their commercialisation stage.<br />

The <strong>Group</strong> will however, continue to investigate direct investment<br />

opportunities in the water and wastewater sectors, initially based on the<br />

water being produced from the dewatering of coal seam gas properties<br />

where the <strong>Group</strong> is drilling. The <strong>Group</strong> will also pursue investment<br />

opportunities in unconventional hydrocarbons (shale gas), sustainable<br />

energies (geothermal and tidal) and other technologies being developed to<br />

reduce green house gas emissions by carbon geosequestration.<br />

Further information about likely developments in the operations of the<br />

<strong>Group</strong> and the expected results of those operations in future financial years<br />

has not been included in this <strong>report</strong> because disclosure of the information<br />

would be likely to result in unreasonable prejudice to the <strong>Group</strong>.<br />

Other Disclosures<br />

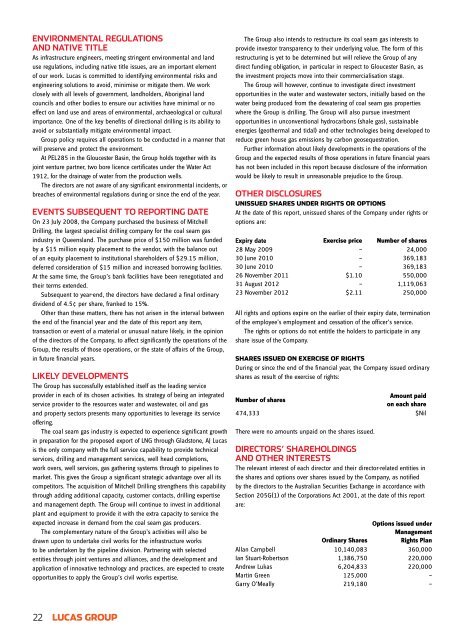

Unissued shares under rights or options<br />

At the date of this <strong>report</strong>, unissued shares of the Company under rights or<br />

options are:<br />

Expiry date Exercise price Number of shares<br />

28 May 2009 — 24,000<br />

30 June 2010 — 369,183<br />

30 June 2010 — 369,183<br />

26 November 2011 $1.10 550,000<br />

31 August 2012 — 1,119,063<br />

23 November 2012 $2.11 250,000<br />

All rights and options expire on the earlier of their expiry date, termination<br />

of the employee’s employment and cessation of the officer’s service.<br />

The rights or options do not entitle the holders to participate in any<br />

share issue of the Company.<br />

Shares issued on exercise of rights<br />

During or since the end of the financial year, the Company issued ordinary<br />

shares as result of the exercise of rights:<br />

Number of shares<br />

Amount paid<br />

on each share<br />

474,333 $Nil<br />

There were no amounts unpaid on the shares issued.<br />

Directors’ shareholdings<br />

and other interests<br />

The relevant interest of each director and their director-related entities in<br />

the shares and options over shares issued by the Company, as notified<br />

by the directors to the Australian Securities Exchange in accordance with<br />

Section 205G(1) of the Corporations Act 2001, at the date of this <strong>report</strong><br />

are:<br />

Options issued under<br />

Management<br />

Ordinary Shares<br />

Rights Plan<br />

Allan Campbell 10,140,<strong>08</strong>3 360,000<br />

Ian Stuart-Robertson 1,386,750 220,000<br />

Andrew Lukas 6,204,833 220,000<br />

Martin Green 125,000 —<br />

Garry O’Meally 219,180 —<br />

22 LUCAS group