AJ Lucas Group annual report 2007-08

AJ Lucas Group annual report 2007-08

AJ Lucas Group annual report 2007-08

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

notes to the<br />

financial statements<br />

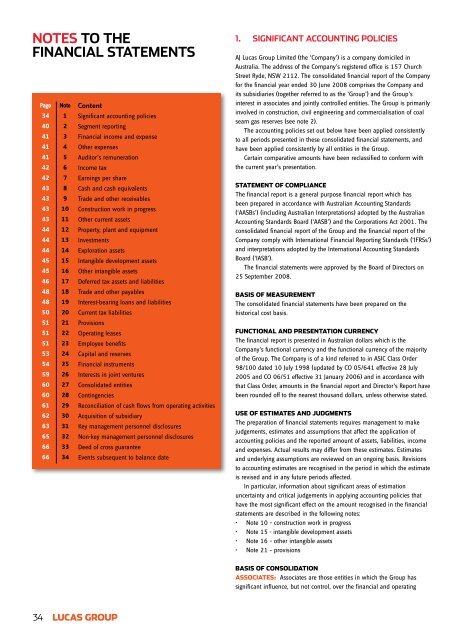

Page Note Content<br />

34 1 Significant accounting policies<br />

40 2 Segment <strong>report</strong>ing<br />

41 3 Financial income and expense<br />

41 4 Other expenses<br />

41 5 Auditor’s remuneration<br />

42 6 Income tax<br />

42 7 Earnings per share<br />

43 8 Cash and cash equivalents<br />

43 9 Trade and other receivables<br />

43 10 Construction work in progress<br />

43 11 Other current assets<br />

44 12 Property, plant and equipment<br />

44 13 Investments<br />

44 14 Exploration assets<br />

45 15 Intangible development assets<br />

45 16 Other intangible assets<br />

46 17 Deferred tax assets and liabilities<br />

48 18 Trade and other payables<br />

48 19 Interest-bearing loans and liabilities<br />

50 20 Current tax liabilities<br />

51 21 Provisions<br />

51 22 Operating leases<br />

51 23 Employee benefits<br />

53 24 Capital and reserves<br />

54 25 Financial instruments<br />

59 26 Interests in joint ventures<br />

60 27 Consolidated entities<br />

60 28 Contingencies<br />

61 29 Reconciliation of cash flows from operating activities<br />

62 30 Acquisition of subsidiary<br />

63 31 Key management personnel disclosures<br />

65 32 Non-key management personnel disclosures<br />

66 33 Deed of cross guarantee<br />

66 34 Events subsequent to balance date<br />

1. SIGNIFICANT ACCOUNTING POLICIES<br />

<strong>AJ</strong> <strong>Lucas</strong> <strong>Group</strong> Limited (the ‘Company’) is a company domiciled in<br />

Australia. The address of the Company’s registered office is 157 Church<br />

Street Ryde, NSW 2112. The consolidated financial <strong>report</strong> of the Company<br />

for the financial year ended 30 June 20<strong>08</strong> comprises the Company and<br />

its subsidiaries (together referred to as the ‘<strong>Group</strong>’) and the <strong>Group</strong>’s<br />

interest in associates and jointly controlled entities. The <strong>Group</strong> is primarily<br />

involved in construction, civil engineering and commercialisation of coal<br />

seam gas reserves (see note 2).<br />

The accounting policies set out below have been applied consistently<br />

to all periods presented in these consolidated financial statements, and<br />

have been applied consistently by all entities in the <strong>Group</strong>.<br />

Certain comparative amounts have been reclassified to conform with<br />

the current year’s presentation.<br />

Statement of compliance<br />

The financial <strong>report</strong> is a general purpose financial <strong>report</strong> which has<br />

been prepared in accordance with Australian Accounting Standards<br />

(‘AASBs’) (including Australian Interpretations) adopted by the Australian<br />

Accounting Standards Board (‘AASB’) and the Corporations Act 2001. The<br />

consolidated financial <strong>report</strong> of the <strong>Group</strong> and the financial <strong>report</strong> of the<br />

Company comply with International Financial Reporting Standards (‘IFRSs’)<br />

and interpretations adopted by the International Accounting Standards<br />

Board (‘IASB’).<br />

The financial statements were approved by the Board of Directors on<br />

25 September 20<strong>08</strong>.<br />

Basis of measurement<br />

The consolidated financial statements have been prepared on the<br />

historical cost basis.<br />

Functional and presentation currency<br />

The financial <strong>report</strong> is presented in Australian dollars which is the<br />

Company’s functional currency and the functional currency of the majority<br />

of the <strong>Group</strong>. The Company is of a kind referred to in ASIC Class Order<br />

98/100 dated 10 July 1998 (updated by CO 05/641 effective 28 July<br />

2005 and CO 06/51 effective 31 January 2006) and in accordance with<br />

that Class Order, amounts in the financial <strong>report</strong> and Director’s Report have<br />

been rounded off to the nearest thousand dollars, unless otherwise stated.<br />

Use of estimates and judgments<br />

The preparation of financial statements requires management to make<br />

judgements, estimates and assumptions that affect the application of<br />

accounting policies and the <strong>report</strong>ed amount of assets, liabilities, income<br />

and expenses. Actual results may differ from these estimates. Estimates<br />

and underlying assumptions are reviewed on an ongoing basis. Revisions<br />

to accounting estimates are recognised in the period in which the estimate<br />

is revised and in any future periods affected.<br />

In particular, information about significant areas of estimation<br />

uncertainty and critical judgements in applying accounting policies that<br />

have the most significant effect on the amount recognised in the financial<br />

statements are described in the following notes:<br />

• Note 10 – construction work in progress<br />

• Note 15 - intangible development assets<br />

• Note 16 – other intangible assets<br />

• Note 21 – provisions<br />

Basis of consolidation<br />

Associates: Associates are those entities in which the <strong>Group</strong> has<br />

significant influence, but not control, over the financial and operating<br />

34 LUCAS group