AJ Lucas Group annual report 2007-08

AJ Lucas Group annual report 2007-08

AJ Lucas Group annual report 2007-08

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

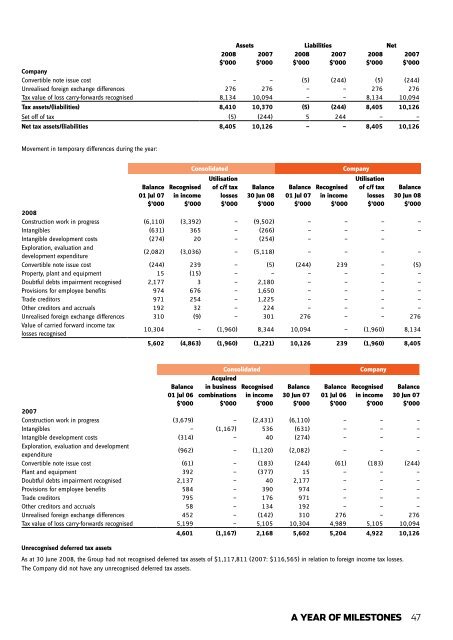

Assets Liabilities Net<br />

20<strong>08</strong><br />

$’000<br />

<strong>2007</strong><br />

$’000<br />

20<strong>08</strong><br />

$’000<br />

<strong>2007</strong><br />

$’000<br />

20<strong>08</strong><br />

$’000<br />

Company<br />

Convertible note issue cost — — (5) (244) (5) (244)<br />

Unrealised foreign exchange differences 276 276 — — 276 276<br />

Tax value of loss carry-forwards recognised 8,134 10,094 — — 8,134 10,094<br />

Tax assets/(liabilities) 8,410 10,370 (5) (244) 8,405 10,126<br />

Set off of tax (5) (244) 5 244 — —<br />

Net tax assets/(liabilities 8,405 10,126 — — 8,405 10,126<br />

<strong>2007</strong><br />

$’000<br />

Movement in temporary differences during the year:<br />

Balance<br />

01 Jul 07<br />

$’000<br />

Recognised<br />

in income<br />

$’000<br />

Consolidated<br />

Utilisation<br />

of c/f tax<br />

losses<br />

$’000<br />

Balance<br />

30 Jun <strong>08</strong><br />

$’000<br />

Balance<br />

01 Jul 07<br />

$’000<br />

Recognised<br />

in income<br />

$’000<br />

Company<br />

Utilisation<br />

of c/f tax<br />

losses<br />

$’000<br />

Balance<br />

30 Jun <strong>08</strong><br />

$’000<br />

20<strong>08</strong><br />

Construction work in progress (6,110) (3,392) — (9,502) — — — —<br />

Intangibles (631) 365 — (266) — — — —<br />

Intangible development costs (274) 20 — (254) — — —<br />

Exploration, evaluation and<br />

development expenditure<br />

(2,<strong>08</strong>2) (3,036) — (5,118) — — — —<br />

Convertible note issue cost (244) 239 — (5) (244) 239 — (5)<br />

Property, plant and equipment 15 (15) — — — — — —<br />

Doubtful debts impairment recognised 2,177 3 — 2,180 — — — —<br />

Provisions for employee benefits 974 676 — 1,650 — — — —<br />

Trade creditors 971 254 — 1,225 — — — —<br />

Other creditors and accruals 192 32 — 224 — — — —<br />

Unrealised foreign exchange differences 310 (9) — 301 276 — — 276<br />

Value of carried forward income tax<br />

losses recognised<br />

10,304 — (1,960) 8,344 10,094 — (1,960) 8,134<br />

5,602 (4,863) (1,960) (1,221) 10,126 239 (1,960) 8,405<br />

Balance<br />

01 Jul 06<br />

$’000<br />

Acquired<br />

in business<br />

combinations<br />

$’000<br />

Consolidated<br />

Recognised<br />

in income<br />

$’000<br />

Balance<br />

30 Jun 07<br />

$’000<br />

Balance<br />

01 Jul 06<br />

$’000<br />

Company<br />

Recognised<br />

in income<br />

$’000<br />

Balance<br />

30 Jun 07<br />

$’000<br />

<strong>2007</strong><br />

Construction work in progress (3,679) — (2,431) (6,110) — — —<br />

Intangibles — (1,167) 536 (631) — — —<br />

Intangible development costs (314) — 40 (274) — — —<br />

Exploration, evaluation and development<br />

(962) — (1,120) (2,<strong>08</strong>2) — — —<br />

expenditure<br />

Convertible note issue cost (61) — (183) (244) (61) (183) (244)<br />

Plant and equipment 392 — (377) 15 — — —<br />

Doubtful debts impairment recognised 2,137 — 40 2,177 — — —<br />

Provisions for employee benefits 584 — 390 974 — — —<br />

Trade creditors 795 — 176 971 — — —<br />

Other creditors and accruals 58 — 134 192 — — —<br />

Unrealised foreign exchange differences 452 — (142) 310 276 — 276<br />

Tax value of loss carry-forwards recognised 5,199 — 5,105 10,304 4,989 5,105 10,094<br />

4,601 (1,167) 2,168 5,602 5,204 4,922 10,126<br />

Unrecognised deferred tax assets<br />

As at 30 June 20<strong>08</strong>, the <strong>Group</strong> had not recognised deferred tax assets of $1,117,811 (<strong>2007</strong>: $116,565) in relation to foreign income tax losses.<br />

The Company did not have any unrecognised deferred tax assets.<br />

a year of milestones 47