AJ Lucas Group annual report 2007-08

AJ Lucas Group annual report 2007-08

AJ Lucas Group annual report 2007-08

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

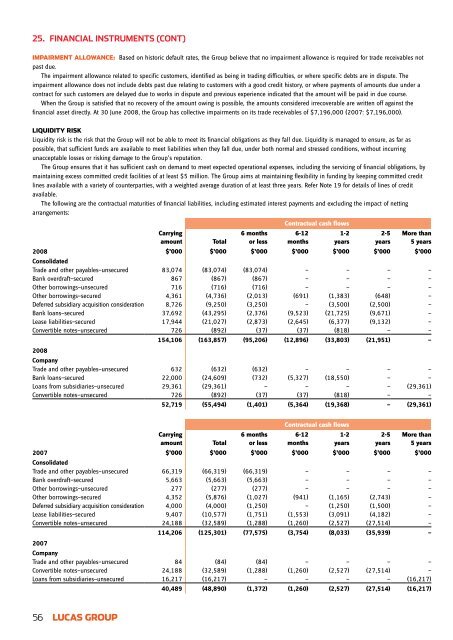

25. FINANCIAL INSTRUMENTs (cont)<br />

Impairment allowance: Based on historic default rates, the <strong>Group</strong> believe that no impairment allowance is required for trade receivables not<br />

past due.<br />

The impairment allowance related to specific customers, identified as being in trading difficulties, or where specific debts are in dispute. The<br />

impairment allowance does not include debts past due relating to customers with a good credit history, or where payments of amounts due under a<br />

contract for such customers are delayed due to works in dispute and previous experience indicated that the amount will be paid in due course.<br />

When the <strong>Group</strong> is satisfied that no recovery of the amount owing is possible, the amounts considered irrecoverable are written off against the<br />

financial asset directly. At 30 June 20<strong>08</strong>, the <strong>Group</strong> has collective impairments on its trade receivables of $7,196,000 (<strong>2007</strong>: $7,196,000).<br />

Liquidity risk<br />

Liquidity risk is the risk that the <strong>Group</strong> will not be able to meet its financial obligations as they fall due. Liquidity is managed to ensure, as far as<br />

possible, that sufficient funds are available to meet liabilities when they fall due, under both normal and stressed conditions, without incurring<br />

unacceptable losses or risking damage to the <strong>Group</strong>’s reputation.<br />

The <strong>Group</strong> ensures that it has sufficient cash on demand to meet expected operational expenses, including the servicing of financial obligations, by<br />

maintaining excess committed credit facilities of at least $5 million. The <strong>Group</strong> aims at maintaining flexibility in funding by keeping committed credit<br />

lines available with a variety of counterparties, with a weighted average duration of at least three years. Refer Note 19 for details of lines of credit<br />

available.<br />

The following are the contractual maturities of financial liabilities, including estimated interest payments and excluding the impact of netting<br />

arrangements:<br />

Carrying<br />

amount<br />

Total<br />

6 months<br />

or less<br />

Contractual cash flows<br />

6-12<br />

months<br />

1-2<br />

years<br />

2-5<br />

years<br />

More than<br />

5 years<br />

20<strong>08</strong> $’000 $’000 $’000 $’000 $’000 $’000 $’000<br />

Consolidated<br />

Trade and other payables—unsecured 83,074 (83,074) (83,074) — — — —<br />

Bank overdraft—secured 867 (867) (867) — — — —<br />

Other borrowings—unsecured 716 (716) (716) — — — —<br />

Other borrowings—secured 4,361 (4,736) (2,013) (691) (1,383) (648) —<br />

Deferred subsidiary acquisition consideration 8,726 (9,250) (3,250) — (3,500) (2,500) —<br />

Bank loans—secured 37,692 (43,295) (2,376) (9,523) (21,725) (9,671) —<br />

Lease liabilities—secured 17,944 (21,027) (2,873) (2,645) (6,377) (9,132) —<br />

Convertible notes—unsecured 726 (892) (37) (37) (818) — —<br />

154,106 (163,857) (95,206) (12,896) (33,803) (21,951) —<br />

20<strong>08</strong><br />

Company<br />

Trade and other payables—unsecured 632 (632) (632) — — — —<br />

Bank loans—secured 22,000 (24,609) (732) (5,327) (18,550) — —<br />

Loans from subsidiaries—unsecured 29,361 (29,361) — — — — (29,361)<br />

Convertible notes—unsecured 726 (892) (37) (37) (818) — —<br />

52,719 (55,494) (1,401) (5,364) (19,368) — (29,361)<br />

Carrying<br />

amount<br />

Total<br />

6 months<br />

or less<br />

Contractual cash flows<br />

6-12<br />

months<br />

1-2<br />

years<br />

2-5<br />

years<br />

More than<br />

5 years<br />

<strong>2007</strong> $’000 $’000 $’000 $’000 $’000 $’000 $’000<br />

Consolidated<br />

Trade and other payables—unsecured 66,319 (66,319) (66,319) — — — —<br />

Bank overdraft—secured 5,663 (5,663) (5,663) — — — —<br />

Other borrowings—unsecured 277 (277) (277) — — — —<br />

Other borrowings—secured 4,352 (5,876) (1,027) (941) (1,165) (2,743) —<br />

Deferred subsidiary acquisition consideration 4,000 (4,000) (1,250) — (1,250) (1,500) —<br />

Lease liabilities—secured 9,407 (10,577) (1,751) (1,553) (3,091) (4,182) —<br />

Convertible notes—unsecured 24,188 (32,589) (1,288) (1,260) (2,527) (27,514) —<br />

114,206 (125,301) (77,575) (3,754) (8,033) (35,939) —<br />

<strong>2007</strong><br />

Company<br />

Trade and other payables—unsecured 84 (84) (84) — — — —<br />

Convertible notes—unsecured 24,188 (32,589) (1,288) (1,260) (2,527) (27,514) —<br />

Loans from subsidiaries—unsecured 16,217 (16,217) — — — — (16,217)<br />

40,489 (48,890) (1,372) (1,260) (2,527) (27,514) (16,217)<br />

56 LUCAS group