Annual Report 2010 (PDF) - USB Bank

Annual Report 2010 (PDF) - USB Bank

Annual Report 2010 (PDF) - USB Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

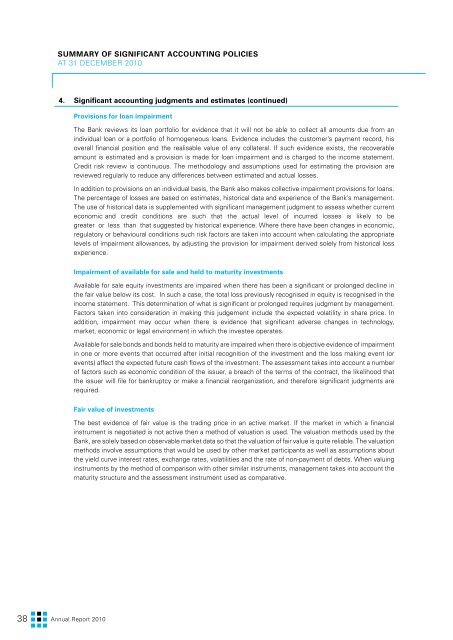

Summary of Significant Accounting Policies<br />

at 31 December <strong>2010</strong><br />

4. Significant accounting judgments and estimates (continued)<br />

Provisions for loan impairment<br />

The <strong>Bank</strong> reviews its loan portfolio for evidence that it will not be able to collect all amounts due from an<br />

individual loan or a portfolio of homogeneous loans. Evidence includes the customer’s payment record, his<br />

overall financial position and the realisable value of any collateral. If such evidence exists, the recoverable<br />

amount is estimated and a provision is made for loan impairment and is charged to the income statement.<br />

Credit risk review is continuous. The methodology and assumptions used for estimating the provision are<br />

reviewed regularly to reduce any differences between estimated and actual losses.<br />

In addition to provisions on an individual basis, the <strong>Bank</strong> also makes collective impairment provisions for loans.<br />

The percentage of losses are based on estimates, historical data and experience of the <strong>Bank</strong>’s management.<br />

The use of historical data is supplemented with significant management judgment to assess whether current<br />

economic and credit conditions are such that the actual level of incurred losses is likely to be<br />

greater or less than that suggested by historical experience. Where there have been changes in economic,<br />

regulatory or behavioural conditions such risk factors are taken into account when calculating the appropriate<br />

levels of impairment allowances, by adjusting the provision for impairment derived solely from historical loss<br />

experience.<br />

Impairment of available for sale and held to maturity investments<br />

Available for sale equity investments are impaired when there has been a significant or prolonged decline in<br />

the fair value below its cost. In such a case, the total loss previously recognised in equity is recognised in the<br />

income statement. This determination of what is significant or prolonged requires judgment by management.<br />

Factors taken into consideration in making this judgement include the expected volatility in share price. In<br />

addition, impairment may occur when there is evidence that significant adverse changes in technology,<br />

market, economic or legal environment in which the investee operates.<br />

Available for sale bonds and bonds held to maturity are impaired when there is objective evidence of impairment<br />

in one or more events that occurred after initial recognition of the investment and the loss making event (or<br />

events) affect the expected future cash flows of the investment. The assessment takes into account a number<br />

of factors such as economic condition of the issuer, a breach of the terms of the contract, the likelihood that<br />

the issuer will file for bankruptcy or make a financial reorganization, and therefore significant judgments are<br />

required.<br />

Fair value of investments<br />

The best evidence of fair value is the trading price in an active market. If the market in which a financial<br />

instrument is negotiated is not active then a method of valuation is used. The valuation methods used by the<br />

<strong>Bank</strong>, are solely based on observable market data so that the valuation of fair value is quite reliable. The valuation<br />

methods involve assumptions that would be used by other market participants as well as assumptions about<br />

the yield curve interest rates, exchange rates, volatilities and the rate of non-payment of debts. When valuing<br />

instruments by the method of comparison with other similar instruments, management takes into account the<br />

maturity structure and the assessment instrument used as comparative.<br />

38<br />

Αnnual <strong>Report</strong> <strong>2010</strong>