Annual Report 2010 (PDF) - USB Bank

Annual Report 2010 (PDF) - USB Bank

Annual Report 2010 (PDF) - USB Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

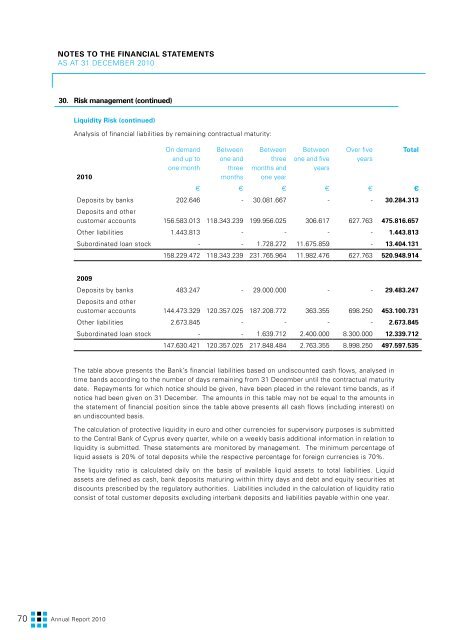

Notes to the Financial Statements<br />

as at 31 December <strong>2010</strong><br />

30. Risk management (continued)<br />

Liquidity Risk (continued)<br />

Analysis of financial liabilities by remaining contractual maturity:<br />

<strong>2010</strong><br />

On demand<br />

and up to<br />

one month<br />

Between<br />

one and<br />

three<br />

months<br />

Between<br />

three<br />

months and<br />

one year<br />

Between<br />

one and five<br />

years<br />

Over five<br />

years<br />

Total<br />

€ € € € € €<br />

Deposits by banks 202.646 - 30.081.667 - - 30.284.313<br />

Deposits and other<br />

customer accounts 156.583.013 118.343.239 199.956.025 306.617 627.763 475.816.657<br />

Other liabilities 1.443.813 - - - - 1.443.813<br />

Subordinated loan stock - - 1.728.272 11.675.859 - 13.404.131<br />

158.229.472 118.343.239 231.765.964 11.982.476 627.763 520.948.914<br />

2009<br />

Deposits by banks 483.247 - 29.000.000 - - 29.483.247<br />

Deposits and other<br />

customer accounts 144.473.329 120.357.025 187.208.772 363.355 698.250 453.100.731<br />

Other liabilities 2.673.845 - - - - 2.673.845<br />

Subordinated loan stock - - 1.639.712 2.400.000 8.300.000 12.339.712<br />

147.630.421 120.357.025 217.848.484 2.763.355 8.998.250 497.597.535<br />

The table above presents the <strong>Bank</strong>’s financial liabilities based on undiscounted cash flows, analysed in<br />

time bands according to the number of days remaining from 31 December until the contractual maturity<br />

date. Repayments for which notice should be given, have been placed in the relevant time bands, as if<br />

notice had been given on 31 December. The amounts in this table may not be equal to the amounts in<br />

the statement of financial position since the table above presents all cash flows (including interest) on<br />

an undiscounted basis.<br />

The calculation of protective liquidity in euro and other currencies for supervisory purposes is submitted<br />

to the Central <strong>Bank</strong> of Cyprus every quarter, while on a weekly basis additional information in relation to<br />

liquidity is submitted. These statements are monitored by management. The minimum percentage of<br />

liquid assets is 20% of total deposits while the respective percentage for foreign currencies is 70%.<br />

The liquidity ratio is calculated daily on the basis of available liquid assets to total liabilities. Liquid<br />

assets are defined as cash, bank deposits maturing within thirty days and debt and equity securities at<br />

discounts prescribed by the regulatory authorities. Liabilities included in the calculation of liquidity ratio<br />

consist of total customer deposits excluding interbank deposits and liabilities payable within one year.<br />

70<br />

Αnnual <strong>Report</strong> <strong>2010</strong>