Annual Report 2010 (PDF) - USB Bank

Annual Report 2010 (PDF) - USB Bank

Annual Report 2010 (PDF) - USB Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

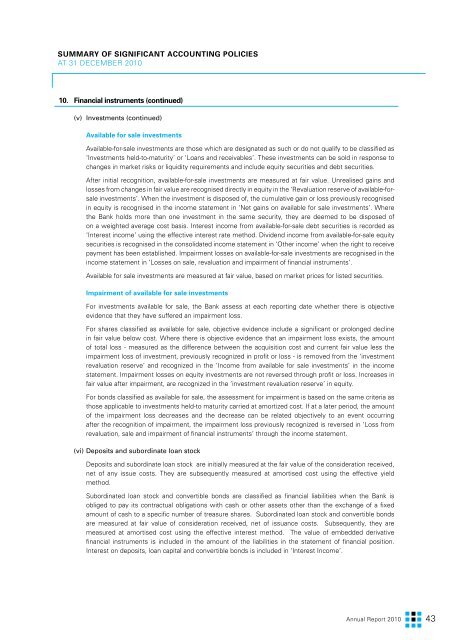

Summary of Significant Accounting Policies<br />

at 31 December <strong>2010</strong><br />

10. Financial instruments (continued)<br />

(v) Investments (continued)<br />

Available for sale investments<br />

Available-for-sale investments are those which are designated as such or do not qualify to be classified as<br />

‘Investments held-to-maturity’ or ‘Loans and receivables’. These investments can be sold in response to<br />

changes in market risks or liquidity requirements and include equity securities and debt securities.<br />

After initial recognition, available-for-sale investments are measured at fair value. Unrealised gains and<br />

losses from changes in fair value are recognised directly in equity in the ‘Revaluation reserve of available-forsale<br />

investments’. When the investment is disposed of, the cumulative gain or loss previously recognised<br />

in equity is recognised in the income statement in ‘Net gains on available for sale investments’. Where<br />

the <strong>Bank</strong> holds more than one investment in the same security, they are deemed to be disposed of<br />

on a weighted average cost basis. Interest income from available-for-sale debt securities is recorded as<br />

‘Interest income’ using the effective interest rate method. Dividend income from available-for-sale equity<br />

securities is recognised in the consolidated income statement in ‘Other income’ when the right to receive<br />

payment has been established. Impairment losses on available-for-sale investments are recognised in the<br />

income statement in ‘Losses on sale, revaluation and impairment of financial instruments’.<br />

Available for sale investments are measured at fair value, based on market prices for listed securities.<br />

Impairment of available for sale investments<br />

For investments available for sale, the <strong>Bank</strong> assess at each reporting date whether there is objective<br />

evidence that they have suffered an impairment loss.<br />

For shares classified as available for sale, objective evidence include a significant or prolonged decline<br />

in fair value below cost. Where there is objective evidence that an impairment loss exists, the amount<br />

of total loss - measured as the difference between the acquisition cost and current fair value less the<br />

impairment loss of investment, previously recognized in profit or loss - is removed from the ‘investment<br />

revaluation reserve’ and recognized in the ‘Income from available for sale investments’ in the income<br />

statement. Impairment losses on equity investments are not reversed through profit or loss. Increases in<br />

fair value after impairment, are recognized in the ‘investment revaluation reserve’ in equity.<br />

For bonds classified as available for sale, the assessment for impairment is based on the same criteria as<br />

those applicable to investments held-to maturity carried at amortized cost. If at a later period, the amount<br />

of the impairment loss decreases and the decrease can be related objectively to an event occurring<br />

after the recognition of impairment, the impairment loss previously recognized is reversed in ‘Loss from<br />

revaluation, sale and impairment of financial instruments’ through the income statement.<br />

(vi) Deposits and subordinate loan stock<br />

Deposits and subordinate loan stock are initially measured at the fair value of the consideration received,<br />

net of any issue costs. They are subsequently measured at amortised cost using the effective yield<br />

method.<br />

subordinated loan stock and convertible bonds are classified as financial liabilities when the <strong>Bank</strong> is<br />

obliged to pay its contractual obligations with cash or other assets other than the exchange of a fixed<br />

amount of cash to a specific number of treasure shares. Subordinated loan stock and convertible bonds<br />

are measured at fair value of consideration received, net of issuance costs. Subsequently, they are<br />

measured at amortised cost using the effective interest method. The value of embedded derivative<br />

financial instruments is included in the amount of the liabilities in the statement of financial position.<br />

Interest on deposits, loan capital and convertible bonds is included in ‘Interest Income’.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> 43