Annual Report 2010 (PDF) - USB Bank

Annual Report 2010 (PDF) - USB Bank

Annual Report 2010 (PDF) - USB Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

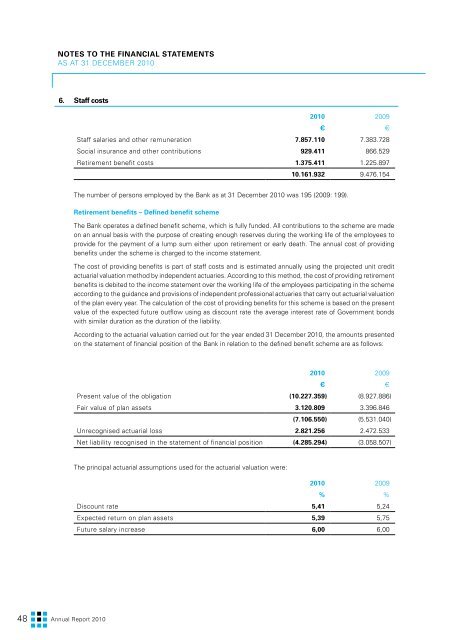

Notes to the Financial Statements<br />

as at 31 December <strong>2010</strong><br />

6. Staff costs<br />

<strong>2010</strong> 2009<br />

€ €<br />

Staff salaries and other remuneration 7.857.110 7.383.728<br />

Social insurance and other contributions 929.411 866.529<br />

Retirement benefit costs 1.375.411 1.225.897<br />

10.161.932 9.476.154<br />

The number of persons employed by the <strong>Bank</strong> as at 31 December <strong>2010</strong> was 195 (2009: 199).<br />

Retirement benefits – Defined benefit scheme<br />

The <strong>Bank</strong> operates a defined benefit scheme, which is fully funded. All contributions to the scheme are made<br />

on an annual basis with the purpose of creating enough reserves during the working life of the employees to<br />

provide for the payment of a lump sum either upon retirement or early death. The annual cost of providing<br />

benefits under the scheme is charged to the income statement.<br />

The cost of providing benefits is part of staff costs and is estimated annually using the projected unit credit<br />

actuarial valuation method by independent actuaries. According to this method, the cost of providing retirement<br />

benefits is debited to the income statement over the working life of the employees participating in the scheme<br />

according to the guidance and provisions of independent professional actuaries that carry out actuarial valuation<br />

of the plan every year. The calculation of the cost of providing benefits for this scheme is based on the present<br />

value of the expected future outflow using as discount rate the average interest rate of Government bonds<br />

with similar duration as the duration of the liability.<br />

According to the actuarial valuation carried out for the year ended 31 December <strong>2010</strong>, the amounts presented<br />

on the statement of financial position of the <strong>Bank</strong> in relation to the defined benefit scheme are as follows:<br />

<strong>2010</strong> 2009<br />

€ €<br />

Present value of the obligation (10.227.359) (8.927.886)<br />

Fair value of plan assets 3.120.809 3.396.846<br />

(7.106.550) (5.531.040)<br />

Unrecognised actuarial loss 2.821.256 2.472.533<br />

Net liability recognised in the statement of financial position (4.285.294) (3.058.507)<br />

The principal actuarial assumptions used for the actuarial valuation were:<br />

<strong>2010</strong> 2009<br />

% %<br />

Discount rate 5,41 5,24<br />

Expected return on plan assets 5,39 5,75<br />

Future salary increase 6,00 6,00<br />

48<br />

Αnnual <strong>Report</strong> <strong>2010</strong>