Annual Report 2010 (PDF) - USB Bank

Annual Report 2010 (PDF) - USB Bank

Annual Report 2010 (PDF) - USB Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements<br />

as at 31 December <strong>2010</strong><br />

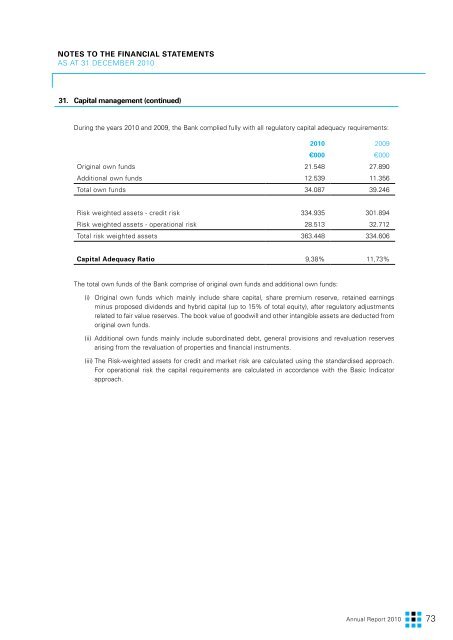

31. Capital management (continued)<br />

During the years <strong>2010</strong> and 2009, the <strong>Bank</strong> complied fully with all regulatory capital adequacy requirements:<br />

<strong>2010</strong> 2009<br />

€000 €000<br />

Original own funds 21.548 27.890<br />

Additional own funds 12.539 11.356<br />

Total own funds 34.087 39.246<br />

Risk weighted assets - credit risk 334.935 301.894<br />

Risk weighted assets - operational risk 28.513 32.712<br />

Total risk weighted assets 363.448 334.606<br />

Capital Adequacy Ratio 9,38% 11,73%<br />

The total own funds of the <strong>Bank</strong> comprise of original own funds and additional own funds:<br />

(i) Original own funds which mainly include share capital, share premium reserve, retained earnings<br />

minus proposed dividends and hybrid capital (up to 15% of total equity), after regulatory adjustments<br />

related to fair value reserves. The book value of goodwill and other intangible assets are deducted from<br />

original own funds.<br />

(ii) Additional own funds mainly include subordinated debt, general provisions and revaluation reserves<br />

arising from the revaluation of properties and financial instruments.<br />

(iii) The Risk-weighted assets for credit and market risk are calculated using the standardised approach.<br />

For operational risk the capital requirements are calculated in accordance with the Basic Indicator<br />

approach.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> 73