Annual Report 2010 (PDF) - USB Bank

Annual Report 2010 (PDF) - USB Bank

Annual Report 2010 (PDF) - USB Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements<br />

as at 31 December <strong>2010</strong><br />

30. Risk management (continued)<br />

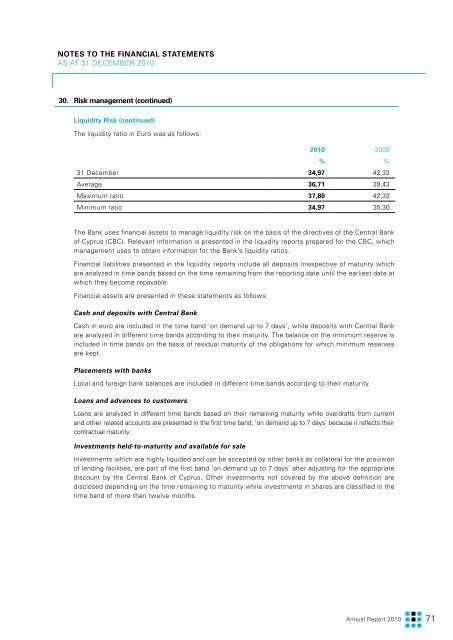

Liquidity Risk (continued)<br />

The liquidity ratio in Euro was as follows:<br />

<strong>2010</strong> 2009<br />

% %<br />

31 December 34,97 42,33<br />

Average 36,71 39,43<br />

Maximum ratio 37,80 42,33<br />

Minimum ratio 34,97 35,30<br />

The <strong>Bank</strong> uses financial assets to manage liquidity risk on the basis of the directives of the Central <strong>Bank</strong><br />

of Cyprus (CBC). Relevant information is presented in the liquidity reports prepared for the CBC, which<br />

management uses to obtain information for the <strong>Bank</strong>’s liquidity ratios.<br />

Financial liabilities presented in the liquidity reports include all deposits irrespective of maturity which<br />

are analyzed in time bands based on the time remaining from the reporting date until the earliest date at<br />

which they become repayable.<br />

Financial assets are presented in these statements as follows:<br />

Cash and deposits with Central <strong>Bank</strong><br />

Cash in euro are included in the time band ‘on demand up to 7 days’, while deposits with Central <strong>Bank</strong><br />

are analyzed in different time bands according to their maturity. The balance on the minimum reserve is<br />

included in time bands on the basis of residual maturity of the obligations for which minimum reserves<br />

are kept.<br />

Placements with banks<br />

Local and foreign bank balances are included in different time bands according to their maturity.<br />

Loans and advances to customers<br />

Loans are analyzed in different time bands based on their remaining maturity while overdrafts from current<br />

and other related accounts are presented in the first time band, ‘on demand up to 7 days’ because it reflects their<br />

contractual maturity.<br />

Investments held-to-maturity and available for sale<br />

Investments which are highly liquided and can be accepted by other banks as collateral for the provision<br />

of lending facilities, are part of the first band ‘on demand up to 7 days’ after adjusting for the appropriate<br />

discount by the Central <strong>Bank</strong> of Cyprus. Other investments not covered by the above definition are<br />

disclosed depending on the time remaining to maturity while investments in shares are classified in the<br />

time band of more than twelve months.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> 71