Annual Report 2010 (PDF) - USB Bank

Annual Report 2010 (PDF) - USB Bank

Annual Report 2010 (PDF) - USB Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements<br />

as at 31 December <strong>2010</strong><br />

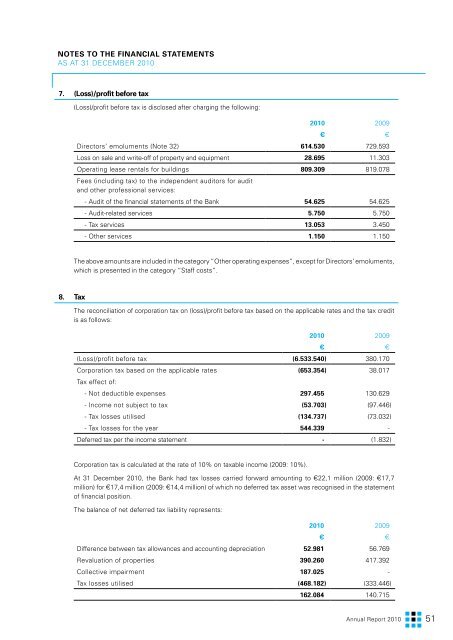

7. (Loss)/profit before tax<br />

(Loss)/profit before tax is disclosed after charging the following:<br />

<strong>2010</strong> 2009<br />

€ €<br />

Directors’ emoluments (Note 32) 614.530 729.593<br />

Loss on sale and write-off of property and equipment 28.695 11.303<br />

Operating lease rentals for buildings 809.309 819.078<br />

Fees (including tax) to the independent auditors for audit<br />

and other professional services:<br />

- Audit of the financial statements of the <strong>Bank</strong> 54.625 54.625<br />

- Audit-related services 5.750 5.750<br />

- Tax services 13.053 3.450<br />

- Other services 1.150 1.150<br />

The above amounts are included in the category “Other operating expenses”, except for Directors’ emoluments,<br />

which is presented in the category “Staff costs”.<br />

8. Tax<br />

The reconciliation of corporation tax on (loss)/profit before tax based on the applicable rates and the tax credit<br />

is as follows:<br />

<strong>2010</strong> 2009<br />

€ €<br />

(Loss)/profit before tax (6.533.540) 380.170<br />

Corporation tax based on the applicable rates (653.354) 38.017<br />

Tax effect of:<br />

- Not deductible expenses 297.455 130.629<br />

- Income not subject to tax (53.703) (97.446)<br />

- Tax losses utilised (134.737) (73.032)<br />

- Tax losses for the year 544.339 -<br />

Deferred tax per the income statement - (1.832)<br />

Corporation tax is calculated at the rate of 10% on taxable income (2009: 10%).<br />

At 31 December <strong>2010</strong>, the <strong>Bank</strong> had tax losses carried forward amounting to €22,1 million (2009: €17,7<br />

million) for €17,4 million (2009: €14,4 million) of which no deferred tax asset was recognised in the statement<br />

of financial position.<br />

The balance of net deferred tax liability represents:<br />

<strong>2010</strong> 2009<br />

€ €<br />

Difference between tax allowances and accounting depreciation 52.981 56.769<br />

Revaluation of properties 390.260 417.392<br />

Collective impairment 187.025 -<br />

Tax losses utilised (468.182) (333.446)<br />

162.084 140.715<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> 51