Annual Report 2010 (PDF) - USB Bank

Annual Report 2010 (PDF) - USB Bank

Annual Report 2010 (PDF) - USB Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements<br />

as at 31 December <strong>2010</strong><br />

20. Placements by banks, financing from the Central <strong>Bank</strong> and customer deposits (continued)<br />

The book value of deposits repayable on demand represents their fair value. The fair value of deposits with<br />

variable interest rate is equivalent to their book value. The fair value of deposits with fixed interest rate is<br />

based on the present value of future cash flows, using interest rates of new deposits with the same remaining<br />

maturity. The fair value of these deposits does not materially differ from their book value as the majority mature<br />

within one year from the reporting date (Note 30).<br />

Although the <strong>Bank</strong> is entitled to legal protection according to the Debtors Relief (Temporary Provision) Laws of<br />

1979 until 1995, as an affected and displaced legal entity, however, on 15 December 1998 the bank released<br />

all frozen deposits amounting to €719.058 in favour of the <strong>Bank</strong>’s depositors. The equivalent balance as at 31<br />

December <strong>2010</strong> was €156.105 (2009: €156.226).<br />

Due to the fact that the amount above consists of a large number of small deposit accounts and the likelihood<br />

of repayment is minimal, on 24 May 2000 the Board of Directors decided to transfer the amount of €234.301 to<br />

the income statement and in case of repayment of these deposits to debit the income statement accordingly.<br />

During the year <strong>2010</strong>, the <strong>Bank</strong> repaid deposits amounting to €121 (2009: €393) by debiting the income<br />

statement.<br />

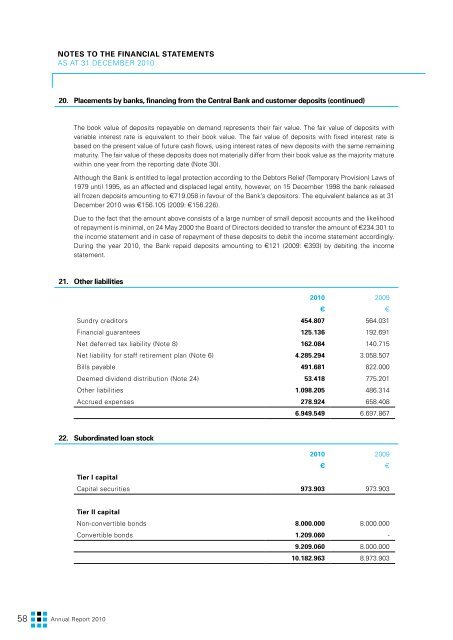

21. Other liabilities<br />

<strong>2010</strong> 2009<br />

€ €<br />

Sundry creditors 454.807 564.031<br />

Financial guarantees 125.136 192.691<br />

Net deferred tax liability (Note 8) 162.084 140.715<br />

Net liability for staff retirement plan (Note 6) 4.285.294 3.058.507<br />

Bills payable 491.681 822.000<br />

Deemed dividend distribution (Note 24) 53.418 775.201<br />

Other liabilities 1.098.205 486.314<br />

Accrued expenses 278.924 658.408<br />

6.949.549 6.697.867<br />

22. Subordinated loan stock<br />

<strong>2010</strong> 2009<br />

€ €<br />

Tier I capital<br />

Capital securities 973.903 973.903<br />

Tier II capital<br />

Non-convertible bonds 8.000.000 8.000.000<br />

Convertible bonds 1.209.060 -<br />

9.209.060 8.000.000<br />

10.182.963 8.973.903<br />

58<br />

Αnnual <strong>Report</strong> <strong>2010</strong>