CovEr STory - Mjunction

CovEr STory - Mjunction

CovEr STory - Mjunction

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

coal market fundamentals<br />

Thermal coal import prices subdued in March<br />

The Indian thermal coal market remained subdued<br />

despite some enquiries that took place in March,<br />

according to market participants. Both consumers and<br />

traders are not bullish or ready to take a position in this market<br />

mainly because of financial problems.<br />

The power prices remained low, while coal prices were<br />

high, with the local currency, the Rupee, hovering around 50-<br />

51 to the US dollar, acting as a deterrent to imports.<br />

Australian thermal coal of heating value of 6,300 kcal GAR<br />

is currently being offered at around $106 per ton against $114<br />

per ton quoted at the beginning of March. Offers of South<br />

African thermal coal of heating value of 6,000 kcal NAR fell by<br />

$2 per ton to $103 per ton in March from February end levels.<br />

Offers for Indonesian coal of heating value of 5,900 kcal GAR<br />

is hovering around $92 per ton, while that of heating value of<br />

5,000 kcal GAR is at $72 per ton.<br />

Traders said deals are done only if the coal is required on<br />

an urgent basis. No one is buying to stock the coal, and small<br />

power projects are also buying low grade coal with high ash.<br />

Another reason for the lack of buying interest is that players<br />

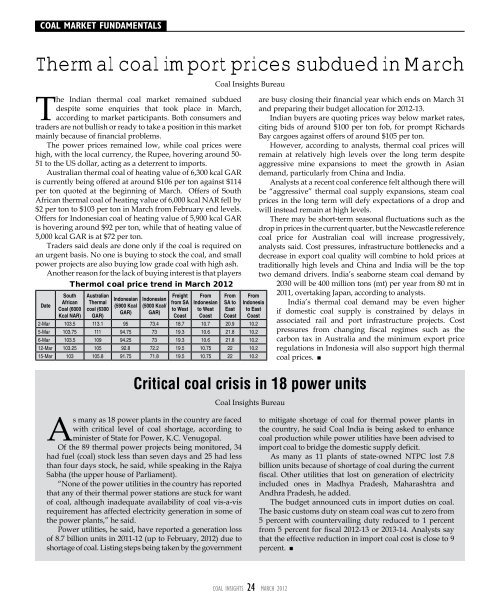

Thermol coal price trend in March 2012<br />

Date<br />

South<br />

African<br />

Coal (6000<br />

Kcal NAR)<br />

Australian<br />

Thermal<br />

coal (6300<br />

GAR)<br />

Indonesian<br />

(5900 Kcal<br />

GAR)<br />

Indonesian<br />

(5000 Kcal/<br />

GAR)<br />

Freight<br />

from SA<br />

to West<br />

Coast<br />

From<br />

Indonesian<br />

to West<br />

Coast<br />

Coal Insights Bureau<br />

From<br />

SA to<br />

East<br />

Coast<br />

From<br />

Indonesia<br />

to East<br />

Coast<br />

2-Mar 103.5 113.1 95 73.4 18.7 10.7 20.9 10.2<br />

5-Mar 103.75 111 94.75 73 19.3 10.6 21.8 10.2<br />

6-Mar 103.5 109 94.25 73 19.3 10.6 21.8 10.2<br />

12-Mar 103.25 105 92.8 72.2 19.5 10.75 22 10.2<br />

15-Mar 103 105.8 91.75 71.8 19.5 10.75 22 10.2<br />

are busy closing their financial year which ends on March 31<br />

and preparing their budget allocation for 2012-13.<br />

Indian buyers are quoting prices way below market rates,<br />

citing bids of around $100 per ton fob, for prompt Richards<br />

Bay cargoes against offers of around $105 per ton.<br />

However, according to analysts, thermal coal prices will<br />

remain at relatively high levels over the long term despite<br />

aggressive mine expansions to meet the growth in Asian<br />

demand, particularly from China and India.<br />

Analysts at a recent coal conference felt although there will<br />

be “aggressive” thermal coal supply expansions, steam coal<br />

prices in the long term will defy expectations of a drop and<br />

will instead remain at high levels.<br />

There may be short-term seasonal fluctuations such as the<br />

drop in prices in the current quarter, but the Newcastle reference<br />

coal price for Australian coal will increase progressively,<br />

analysts said. Cost pressures, infrastructure bottlenecks and a<br />

decrease in export coal quality will combine to hold prices at<br />

traditionally high levels and China and India will be the top<br />

two demand drivers. India’s seaborne steam coal demand by<br />

2030 will be 400 million tons (mt) per year from 80 mt in<br />

Critical coal crisis in 18 power units<br />

Coal Insights Bureau<br />

2011, overtaking Japan, according to analysts.<br />

India’s thermal coal demand may be even higher<br />

if domestic coal supply is constrained by delays in<br />

associated rail and port infrastructure projects. Cost<br />

pressures from changing fiscal regimes such as the<br />

carbon tax in Australia and the minimum export price<br />

regulations in Indonesia will also support high thermal<br />

coal prices.<br />

As many as 18 power plants in the country are faced<br />

with critical level of coal shortage, according to<br />

minister of State for Power, K.C. Venugopal.<br />

Of the 89 thermal power projects being monitored, 34<br />

had fuel (coal) stock less than seven days and 25 had less<br />

than four days stock, he said, while speaking in the Rajya<br />

Sabha (the upper house of Parliament).<br />

“None of the power utilities in the country has reported<br />

that any of their thermal power stations are stuck for want<br />

of coal, although inadequate availability of coal vis-a-vis<br />

requirement has affected electricity generation in some of<br />

the power plants,” he said.<br />

Power utilities, he said, have reported a generation loss<br />

of 8.7 billion units in 2011-12 (up to February, 2012) due to<br />

shortage of coal. Listing steps being taken by the government<br />

to mitigate shortage of coal for thermal power plants in<br />

the country, he said Coal India is being asked to enhance<br />

coal production while power utilities have been advised to<br />

import coal to bridge the domestic supply deficit.<br />

As many as 11 plants of state-owned NTPC lost 7.8<br />

billion units because of shortage of coal during the current<br />

fiscal. Other utilities that lost on generation of electricity<br />

included ones in Madhya Pradesh, Maharashtra and<br />

Andhra Pradesh, he added.<br />

The budget announced cuts in import duties on coal.<br />

The basic customs duty on steam coal was cut to zero from<br />

5 percent with countervailing duty reduced to 1 percent<br />

from 5 percent for fiscal 2012-13 or 2013-14. Analysts say<br />

that the effective reduction in import coal cost is close to 9<br />

percent.<br />

COAL INSIGHTS 24 March 2012